- October 26, 2020

China Politics 2025: Stronger as Xi Goes

This chapter is part of the China Forecast 2025 report – read the Foreword and download the PDF here.

Our call:

- By 2025, Xi Jinping will remain General Secretary of the Chinese Communist Party (CCP), Chair of the Central Military Commission, and President of the People’s Republic of China. He will likely emerge the strongest he has ever been after the 20th Party Congress in 2022.

- It’s unlikely that a clear successor will emerge from this political transition, to avoid diluting Xi’s authority as the CCP focuses on executing its domestic reform agenda.

- Xi will likely focus his power on “the politics of execution” in his third term, as the 14th Five-Year Plan (FYP) begins his strategy to transform China into a superpower by 2035. This program will strengthen governance, discipline, and ideology to enhance Beijing’s ability to transmit policy through central agencies and local governments.

- A strengthening focus on domestic priorities will involve some trade-offs, so Xi is unlikely to announce hugely ambitious new foreign policy initiatives in the next five years.

Key assumptions:

- Xi avoids the kind of ruinous policy mistakes that could trigger widespread and coordinated elite resistance to his continued rule.

- Power in central-local dynamics tilts further in Beijing’s favor as costs are raised and possibilities are narrowed for local noncompliance with central directives.

- The economic and security costs of potential conflict mean Beijing does not escalate tensions around regional hotspots into kinetic hostilities.

Leading indicators:

- Xi is formally elevated to Mao’s former position of CCP “Chairman” at the 20th Party Congress.

- Xi’s associates who enjoyed skip-level promotions to the 19th Politburo are elevated to the 20th Politburo Standing Committee (PBSC), as their lack of personal power bases make them less credible challengers for the leadership.

- Party-State disciplinary bodies notch a record number of investigations and punishments—the most measurable manifestations of the “politics of execution”—in the five-year period between the 19th and 20th Party congresses.

Base Case (65%)

The significant shift from “collective leadership” under Hu Jintao to the “core leadership” of Xi Jinping in the last decade has created a more top-down and controlled political system. Many doubt the effectiveness and resilience of a system that concentrates power, stifles policy debate, and limits public expression. Moreover, the leadership adjustment that occurs in 2022 will be a key test of Xi’s enduring position, creating uncertainty about China’s future direction.

Our base case is that, at least through 2025, Xi will likely beat expectations and achieve many of his political goals, chief among them securing a third term as paramount leader. After the 2022 Party Congress, Xi will sit atop an organization largely purged of alternate power centers and stacked with loyal supporters in crucial Party, state, and military bodies. At the start of this third term, Xi will likely be the strongest he has ever been politically.

That strength, however, will not be channeled exclusively toward wrangling internal power. Even in the Chinese political system, performance and outcomes are important, especially for a leader who has defined his platform as delivering “the great rejuvenation of the Chinese nation” in exchange for exceptional personal authority.

Therefore, to realize his vision for China, and maintain his position with Party elites and the general public, Xi will likely channel a considerable portion of his power toward improving the effectiveness of Chinese governance. For Xi, a more effective political system is the surest way to advance the country’s progress toward “national rejuvenation,” particularly amid the dual challenges of a slowing economy and a less conducive external environment.

Xi’s third term will likely see greater emphasis on upgrading the Party-State’s regulatory, disciplinary, and ideological capabilities, toward the intended effect of “comprehensively deepening reform” in the economy, energy sector, and innovation system. In other words, Xi will likely direct his political capital at the “higher-hanging fruits” of governance changes seen as necessary to escape the middle-income trap and achieve comprehensive national power.

This “politics of execution” assessment centers on three major judgments: 1) Xi’s hold on power will solidify further; 2) Xi’s political focus will be on improving policy execution; and 3) These governance reforms will help deliver higher living standards for most Chinese people and thereby consolidate elite and public support for Xi’s rule. These developments will ensure his ideas influence or even permeate Chinese policymaking for decades.

Analysis:

1. Xi Consolidates Political Power in 2022

Perhaps the defining theme of Xi’s first two terms has been his contravention of Chinese political norms. He remade the Party in his image, declined to promote a leader-in-waiting, and abolished presidential term limits. These actions all but assure Xi a third term, and could enable a much longer reign, perhaps until around 2035. That’s the year Xi identified in his authoritative 19th Party Congress Report as an accelerated target for the Party to “basically realize” its aim to make China a modernized great power. At that point, Xi would be 82, still three years younger than Deng Xiaoping when the latter left formal office in 1989.

To do this, Xi would have to exempt himself from the age eligibility norm for top leaders that was introduced in 1992. That norm, known as “seven up, eight down”, stipulated that leaders aged 68 or older in the year of a Party Congress must retire from the PBSC. Xi can ignore this norm because he has spent the better part of the last decade consolidating his hold over the three pillars of political power: the Party, the state, and the military.

In the Party, his fierce anti-corruption campaign crippled rival power centers, like the Communist Youth League and the “Petroleum Gang,” by sidelining numerous followers and imprisoning their patrons. Such moves allowed Xi to stack the CCP Central Committee and its 25-member Politburo with more personal allies than former leaders Hu Jintao or Jiang Zemin managed to install while in office.

Xi’s position within the Party became more salient as he progressively sidelined the parallel power structure of the State Council and its government bureaucracy. Decision-making and policy coordination are now centralized in Party “leading small groups” or commissions headed by Xi. A trend toward separating Party and state was decisively reversed, as reflected by the Party constitution being amended to leave no doubt that “the Party leads everything.”

Importantly, Xi appears to enjoy unparalleled authority over the armed forces and the security services, after orchestrating radical reorganizations of the People’s Liberation Army (PLA) and the People’s Armed Police. Propaganda and education campaigns have made Xi virtually synonymous with the CCP regime to both popular and elite constituencies.

Of course, Xi’s bold moves have faced resistance. High-profile dissidents and disillusioned cadres feed reports of burgeoning opposition in Beijing, which could compound if China’s growth is imperiled by Xi’s policies. But there is little evidence of a “backlash” against Xi in the ~370-member Central Committee that forms the main “selectorate” of Chinese politics.

Someone in Xi’s position is well aware of such risks, which is why he has worked assiduously to build public support, in part by projecting China’s power abroad and by increasing the public costs of any move against him by elites. But this is also why Xi is unlikely to push much further on foreign policy issues like Taiwan, the South China Sea, and the Belt and Road Initiative—because he needs to keep China stable to sustain his legitimacy and achieve domestic goals.

A large decline in disciplinary investigations of high-level cadres suggests that Xi believes his position in the Party is increasingly secure—otherwise a rising or at least steady number of top-level purges would be expected (see Figure 1).

Figure 1. Investigations of Central Party-State-Military Cadres Spiked Then Declined

Note: Data shows the year of investigation announcements from November 2012 to October 2020. Central Party-State cadres are deputy ministerial level or above. Central military cadres are deputy army level or above.

Over the next two years Xi will focus on shaping the 20th Party Congress in late 2022. He will likely reinstate the title of Party “Chairman,” which is most associated with Mao Zedong and was abolished in 1982, six years after Mao’s death. Xi will cement his organizational hold by engineering personnel changes that stack the Central Committee, Politburo, and PBSC with an unprecedented proportion of loyalists who will be reliable executors of Xi’s political and economic programs.

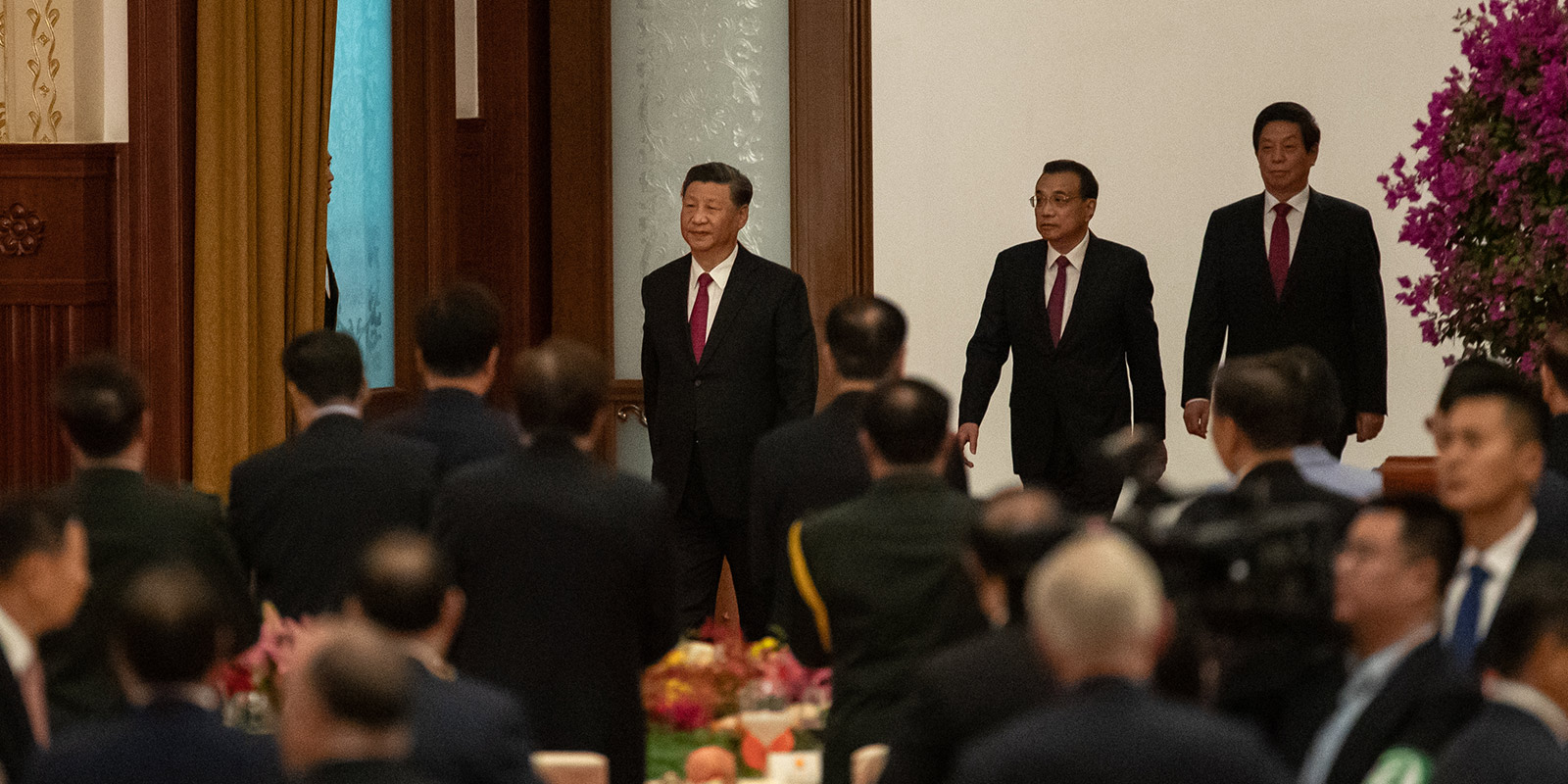

To avoid becoming a lame duck or empowering a potential usurper, Xi will likely avoid anointing an obvious heir apparent on the PBSC, while other PBSC members will still have to abide by the “seven up, eight down” norm. Given that assumption, and the retirement of term-limited Premier Li Keqiang, a new PBSC in 2022 could retain the age-eligible Zhao Leji, Wang Yang, and Wang Huning, and add three allies that Xi parachuted into the 19th Politburo. (MacroPolo’s The Committee will publish more in-depth analysis of the 2022 political transition in the coming year.)

2. Government Will Become a Better Means to Xi’s Ends

Xi’s extraordinary power stems partly from the extraordinary circumstances he faced on entering office. In 2012, following a “lost decade” of weak leadership that fueled corruption, indiscipline, and public cynicism, the CCP faced its biggest existential crisis in a generation. Xi seemed to have won an elite mandate to exert authority and restore the Party’s standing.

Thus, for Xi, political power has a policy purpose. He wants to improve the Party’s ability to “concentrate power to do big things.” He believes the Party needs to “comprehensively deepen reforms” that “modernize China’s system and capacity for governance.” The bottom line is that Xi believes he needs to build a more effective Party to address the challenges facing China’s rise. That’s why his focus will be on the “politics of execution” and the confluence of strengthened Party regulation, discipline, and ideology.

Even Xi’s desire to centralize power in the Party has a policy rationale—to clearly divide the labor of governance at every level between deciders and implementers. At the top, Xi will likely use the 2023 National People’s Congress to pass “institutional reforms” that transfer more responsibilities in key policy areas, such as innovation and science, from state bodies to Party agencies.

Execution is vital for Xi’s ambitious governance agenda because he cannot announce policy into reality. Central directives can be circumvented or distorted in their implementation by state agencies or by provincial governments down through the counties, townships, and villages. The Party-State is more “fragmented” than often assumed, and Xi wants to ensure that his blueprints actually play out across the country.

A perennial challenge for execution is the fact that fiscal activity is rather decentralized. Localities are responsible for ~85% of public spending yet collect just ~53% of public revenues, a trend that has persisted for some two decades. The proportion of local-level spending rose dramatically under the Hu administration, from ~70% to 85%, giving local officials broader scope to direct resources toward ends that are at odds with central priorities.

Xi wants to remedy this intransigence and noncompliance, both in local governments and in the agencies that implement central policies. But rather than exerting control through more central spending, Xi seeks to improve execution by strengthening the Party’s monitoring and control of its agents, including how they can spend money. This priority is shown by greater emphasis on “evaluation work” and “inspection work” in Party discourse, and by Xi’s revived campaign against “formalism” (shallow implementation) and “bureaucratism” (inefficient implementation) (see Figure 2).

Figure 2. Party Media Focus on Policy Implementation Issues Rose Since 2012

Note: Graph shows number of People’s Daily articles in each year that mention each term.

To improve political performance, Xi will likely prefer to empower internal disciplinary organs, namely the Central Commission for Discipline Inspection (CCDI) and the new National Supervision Commission (NSC), to inspect and evaluate more cadre behavior. Xi’s first term already saw record numbers of investigations and prosecutions, which will likely reach new heights by the end of his second term. The CCDI and NSC’s main focus will likely continue to shift from higher level cadres to lower level policy noncompliance, so these figures are likely to keep climbing over the next few years (see Figure 3).

Figure 3. Record Number of CCP Cadres Under Scrutiny (1000s)

Note: Due to missing data, investigations and prosecutions data for 2018 are interpolated, and the prosecutions data point for 2007 is inferred as the mean of annual prosecutions from 2003-2006.

Beyond disciplinary tools, instilling belief in the Party and in Xi’s leadership will be another focus to generate more fealty on policy execution. Xi believes a major cause of the Soviet collapse was that ideological laxity “rendered its Party organizations practically ineffective” and so he will likely intensify both ideological study and ideological repression.

Bolstering control of execution will also involve increasing the Party-State’s use of legal instruments to govern. More laws and regulations will delimit the powers of officials, citizens, and firms throughout the country and establish clearer procedures for governing in all spheres. Xi’s affinity for “law-based governance” is evident in the unparalleled additions and revisions he has made to the corpus of Party regulations (see Figure 4). The passage of China’s first Civil Code in May 2020 shows a similar commitment to the formalization of state governance.

Figure 4. Xi Passed More Party Regulations than Predecessors

Note: Number of operative Central CCP Regulations (zhongyang dangnei fagui) that were passed (introduced or most recently amended) by each paramount leader, listed by regulation type in decreasing order of authority. These data exclude the CCP Constitution, amended by every reform-era Party Congress.

Valid concerns exist that Xi’s accumulation of personalized power means he will be surrounded by “yes men,” leading to more rigid and less innovative governance. The risk is real, yet Xi does encourage “activism, initiative, and creativity” in local governance and says the Party will “distinguish unintentional errors made to promote development from disobedient and illegal behavior to seek personal gain.” Put simply, Xi demands absolute loyalty to his overarching policy agendas, but encourages policy innovation within defined parameters.

3. Xi’s Party-State Will Deliver More for Most Chinese Citizens

Xi’s muscular leadership and governance reforms will combine to deliver better living standards for most Chinese, not just in terms of income but also on “quality of life” concerns like health, education, and the environment. China will be able to do more with less because its political system—leveraging new technologies for educating, monitoring, and evaluating cadres and citizens—will more efficiently allocate social resources to its desired ends. Success on this front, predicated on a post-growth “new deal” to refocus policy on “better life,” will create ideological support for Xi’s continued rule and further buttress his politics of execution.

There is some evidence that, after eight years of reshaping Chinese politics, Xi’s system of centralization and control may be delivering better outcomes. Measures of government effectiveness, regulatory quality, and rule of law in China have increased notably after 2012, all of which now sit well above the medians for upper-middle-income countries (see Figure 5).

Figure 5. China’s Scores on Practical Governance Indicators Are Increasing

Note: Scores range from -2.5 to +2.5.

Central policymaking means little without changing local performance, but progress seems to have occurred on even this thorniest of problems, likely due in part to greater public consultation in the policy process. Surveys show rising satisfaction with local officials, who are viewed as more law-abiding, more receptive to public opinion, and less abusive of their fiscal powers (see Figure 6). Such developments will help sustain strong public support for Xi’s continued tenure as paramount leader.

Figure 6. Chinese Perceptions of Local Officials Are Improving (% Survey Respondents)

More effective action to address poverty, pollution, and potential financial crises should also help improve living standards. From 2009-2018, the share of pro-social spending in China’s budget trended upward, including for health (5.2% to 7.1%), education (13.7% to 14.6%), communities (6.7% to 9.5%), welfare and employment (10.0% to 12.2%), and agriculture, forestry, and water (8.8% to 9.5%). However, quality of life improvements will not be equally distributed, as the forced assimilation of ethnic and religious minorities in regions like Xinjiang, Tibet, and Inner Mongolia will likely continue.

A growing China will keep expanding its global footprint, but Beijing is unlikely to pursue ambitious new foreign policy agendas on the scale of the unwieldy Belt and Road Initiative in the next five years. Managing the domestic economy will require China to maintain a significant degree of access to foreign markets, investment, and technology, even as it pursues a “dual circulation” strategy that reemphasizes internal drivers of economic development (see economy base case). Beijing will also look to stabilize relations with the West—at least those that don’t impinge on what it considers to be “core interests”—as Xi works to reduce China’s reliance on foreign inputs (see technology base case).

To be sure, Beijing will still face thorny political problems in 2025, with policy execution remaining far from perfect and many policy challenges lingering as long-term concerns. But Xi’s governance reforms will improve overall performance in the sense that more of what Beijing wants done around China will actually happen. Practical difficulties and bureaucratic hindrances will persist, but the Party-state’s ability to overcome these obstacles will also rise. Together with a nationalist recoil to anti-Beijing sentiment abroad, meaningful policy achievements will buttress public and elite support of Xi’s rule.

Secondary Scenario (35%)

A less likely secondary scenario centers on a considerable increase in elite dissension to Xi’s continued accumulation of power, which would most likely arise from a sharp downturn in economic growth and social stability.

This scenario would follow a series of unexpected shocks or major unforced errors, which go unchecked due to Xi’s growing reluctance to adjust policy trajectories or pull back from risky situations. For instance, one such misstep could be a Chinese decision to massively escalate security tensions in Asia that prompts major multilateral sanctions and military retaliation, especially if the ultimate outcome is not a ready success for Beijing.

A growing sense of regime insecurity would build within the CCP and PLA, leading to serious opposition to Xi’s leadership. A range of outcomes could flow from a weakened Xi, including a quiet retirement after his third term, or a more dramatic factional split within the Party. Whatever the specifics, a less united CCP would be less effective at reforming its governance to deal with looming economic challenges and would be a less stable actor on the global stage.

This scenario is less likely to occur because, as the base case stipulated, Xi also came to power in a moment of internal political crisis. Doing what is necessary to adjust course and keep the CCP united to advance China’s development will remain his administration’s underlying priority.

Neil Thomas is a Senior Research Associate at MacroPolo. You can follow him on Twitter here and read more of his work on politics, political economy, and US-China relations here. The author would like to thank Yimin Li for excellent research assistance. This article has been updated slightly from the PDF report.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe