- May 27, 2021 Energy, Technology

When Cars Become Computers: The New Data Challenge for EV Companies

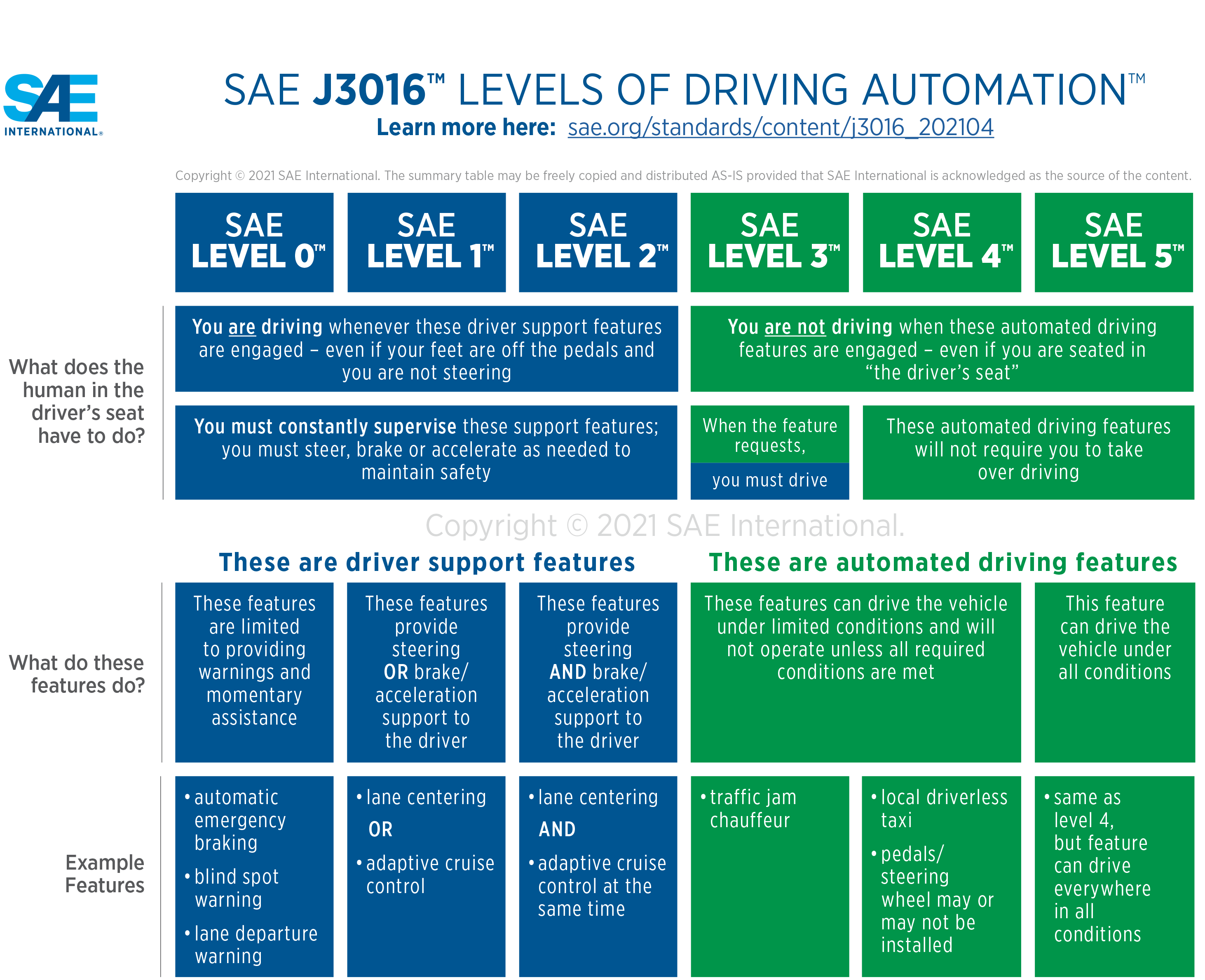

Electric vehicles (EVs) are likely to be the cars of the future. But the battery won’t be the only innovation in cars. An increasing proportion of EVs already boast sophisticated software that include some form of autonomous driving, as well as features like navigation, infotainment, and other safety and sensory diagnostics (see Figure 1).

EVs are not the only vehicles equipped with software, but most new EV models have advanced digital features. One of the reasons for this is that EVs are especially well-suited for integrating autonomous vehicle (AV) features and other software.

In short, EVs will increasingly become data collection and storage platforms. And this will bring to the forefront a new operational challenge for auto manufacturers as they seek to sell EVs into global markets: complying with data privacy regulation in various countries.

Figure 1. Levels of Driving Automation

Note: While most manufacturers have revised previously rosy predictions for advanced automation in private passenger vehicles, there are several Level 4 vehicles already operating in the US market as shuttles and delivery vehicles. Honda in March 2021 launched its passenger vehicle authorized for traffic jam Level 3-use in Japan.

Source: SAE

Data as double-edged sword

Data is necessary for digitally connected and (semi) autonomous EVs to function safely and reliably. The software relies on data generated by the vehicle itself, other vehicles, or third parties, which are collected by original equipment manufacturers to enhance the user experience. This is not dissimilar from how apps and search engines improve over time with more user data.

Although there is little agreement on how much data a connected EV could generate, some estimates have put the upper limit at 32 terabytes of data per day. And with millions of EVs expected to be on the road over the next decade, that will give literal meaning to “highways of data.”

The bulk of that volume will be sensory and diagnostic data for driving, but additional data is increasingly being collected by the car thanks to the integration of more mobility and digital services (see Figure 2). And automakers are now striving to become software companies too in order to generate additional revenue from monetizing the data collected from those services, just as a Google or Facebook does.

These automakers will compete with tech incumbents that have long been developing automobile software, some of which have already entered the AV space. But traditional automakers have an incentive to rely more on revenue from digital services, as the profit margin on an EV is still lower than for a gasoline vehicle, largely because of the high cost of batteries.

Figure 2. Projected Value Shift in The Auto Industry

Source: KPMG.This invariably runs into thorny territory, as questions over who owns the data and what constitutes personal data are far from settled in most countries. In fact, several governments are introducing stricter rules on data privacy, including China’s local storage requirements that would limit transfers of data across borders. This could potentially affect auto companies’ ability to analyze data and complicate how that data are transferred beyond borders.

Barrier for Chinese EVs’ Global Expansion?

EV companies with global aspirations will have to increasingly comply with different national data regulatory regimes. This new source of operational risk may be difficult to avoid. Accessing new markets is necessary for company growth and for collecting diverse data to optimize the software and AV features for different markets. In fact, some governments may increasingly require a certain level of automation to enhance road safety.

Auto manufacturers, in short, will become much more like an Apple, Google, or Huawei when it comes to issues of data access and protection. They will need to balance the need to collect data for their products to function and the need to comply with local regulations to protect drivers’ privacy.

The best present example is the European Union, which has very stringent data protection rules. It also happens to be a market that many high-end Chinese EV makers are eyeing as they aspire to globalize their brand.

As relative newcomers with little international experience, Chinese EV companies must carefully approach data management in the European Union to avoid political and legal repercussions. They will have to ensure that personal data transfers outside of Europe are compliant with regulation and will also need to make assurances that the collected data are being used responsibly.

Navigating this regulatory terrain will be tricky for Chinese EV startups that so far have limited presence in the European market, which means they have minimal exposure and capacity in dealing with data issues. As a consequence, these companies’ EU market entry will likely need to price in the cost of regulatory compliance, as well as building out on-the-ground capacity for handling data-related matters.

Even as Chinese EV makers outfit their cars with “smart” features, they will likely need to become smarter in dealing with the data that those features collect.

Ilaria Mazzocco is a Senior Research Associate at MacroPolo. You can find her work on energy and climate here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe