- August 12, 2024

2H2024: More Continuity, No Major Course Correction

2H2024 Key Takeaways:

- Although Beijing set a higher 2024 growth target than the 4.5% we predicted, reality in 2H2024 will likely bring growth closer to that lower bound, as achieving 5% growth in 2024 now looks very difficult. All told, China could well end the year with nominal growth of ~4%.

- For one, existing headwinds such as property sector woes and local government debt will continue to be drags on growth in the second half.

- Recent signals from the Third Plenum and Politburo meetings strongly suggest continuity with the current “supply-side first” approach while minimally addressing demand-side weakness.

- That means any central government fiscal stimulus will be modest and will be offset by covering for its revenue shortfall this year. Nor will there be sufficient stimulus at the local level, as local governments are once again preoccupied with servicing their debt.

1H2024 Growth Weaker Than It Looks

The first half’s headline growth of 5% year-on-year belies softness in the Chinese economy. First, 1Q2024 had a “leap year effect” (extra day in February) that bumped up growth a bit for the first two months of 2024. Second, the first half also benefited from the low base effect, as early 2023 growth was still shaking off the residual effects of the long pandemic. As a result, China saw stronger-than-expected 1Q growth of 5.3% and subsequent slowdown to 4.7% in 2Q.

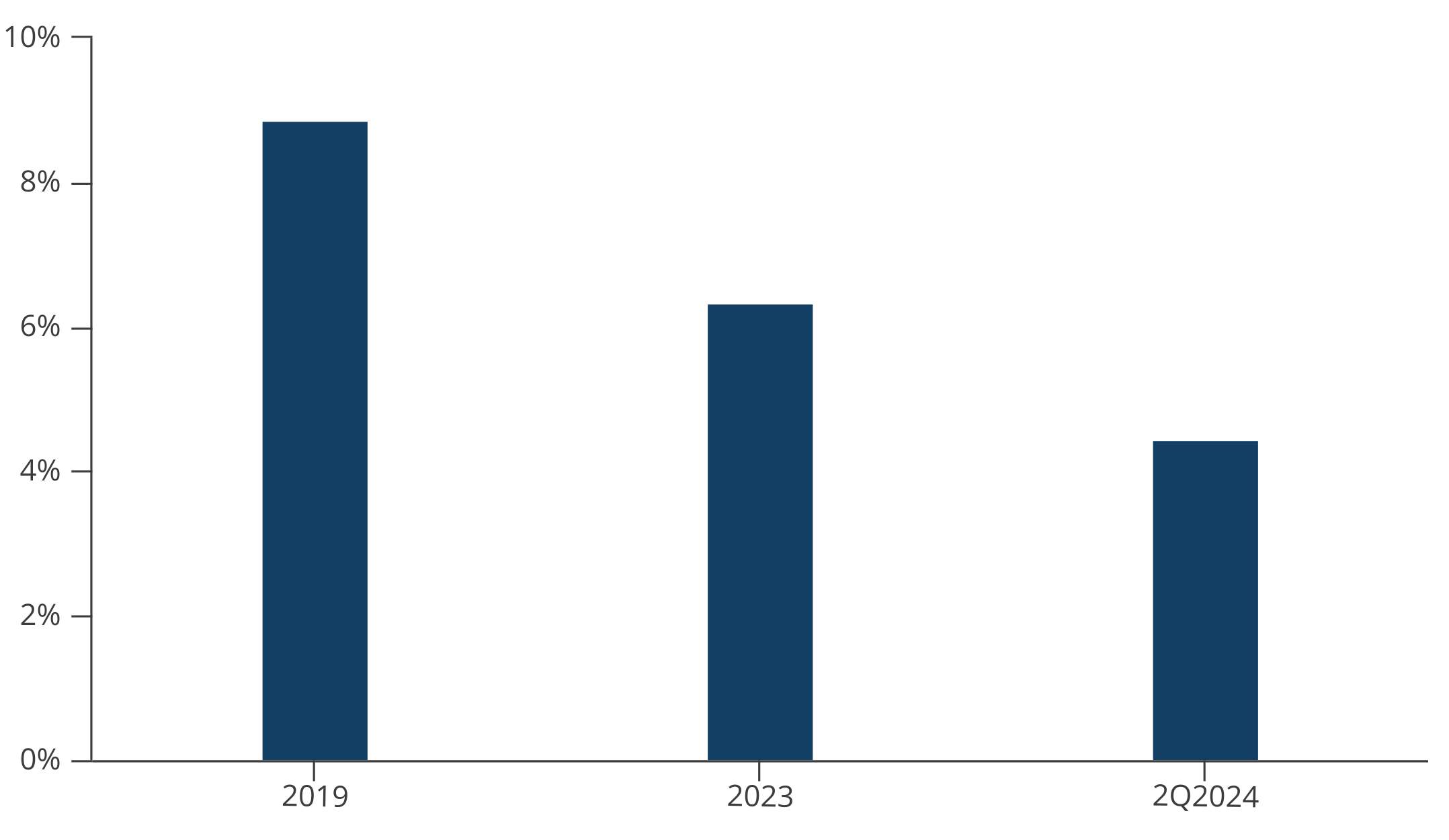

Figure 1. Household Income Growth Continued To Slow

Source: Wind and MacroPolo.

That 1H weakness showed up in several recent economic indicators. Household income growth continued to slow from around 6% in 2023 to 4.5% in 2Q2024, roughly half of the pre-pandemic household income growth rate (see Figure 1). Retail sales, which already saw zero growth month-on-month for the first two months of 2024, haven’t gotten better since then either. Retail sales growth is only 3.7% to date and actually contracted month-on-month in June. At the same time, fixed-asset investment only grew at an annualized ~2%, while June’s manufacturing PMI came in at 49.5 (contractionary) and the services PMI came in at 50.2 (barely expansionary)—both indicating growth challenges ahead.

Property and Local Government Debt Will Continue To Be Growth Headwinds

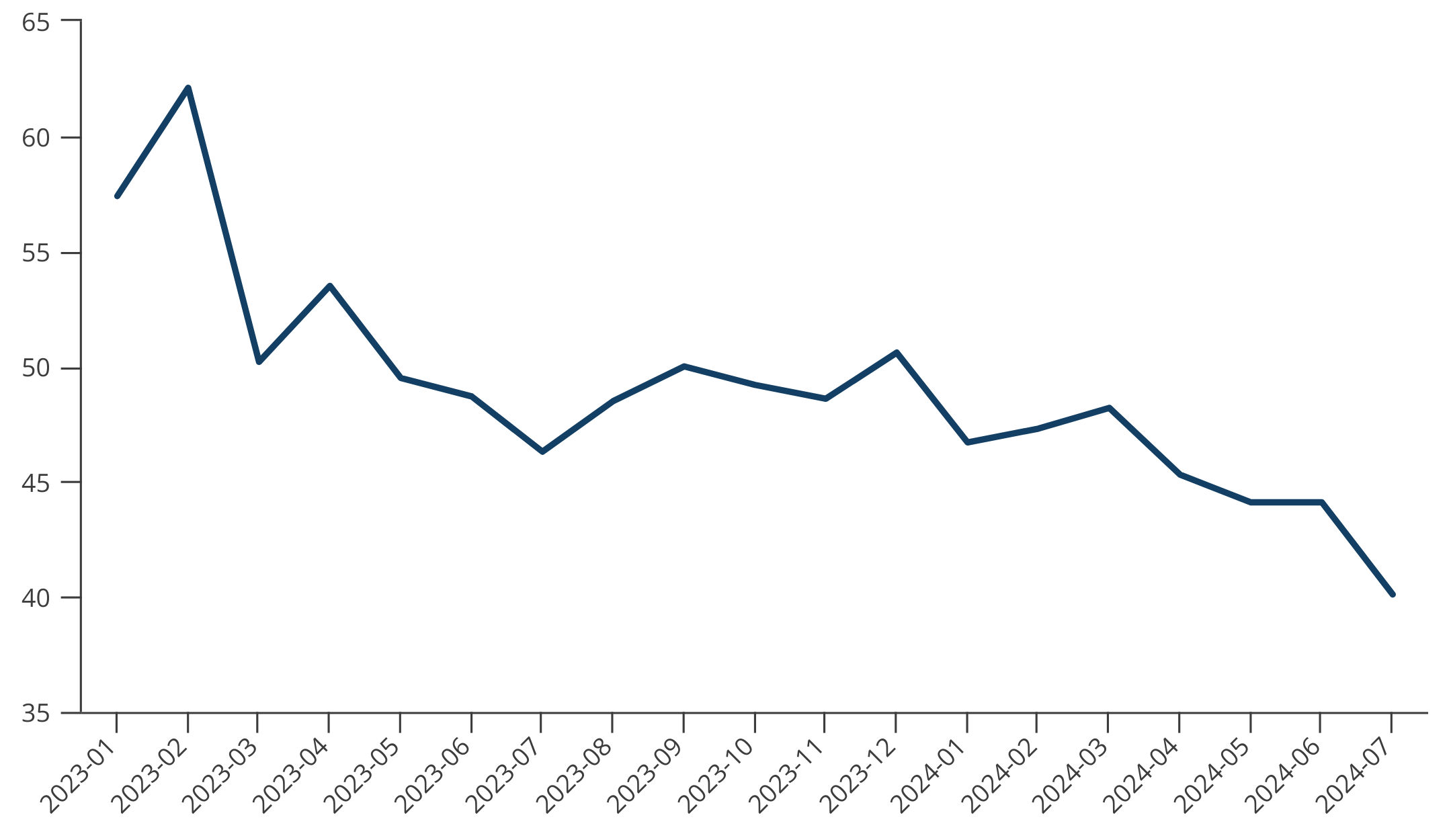

Although property sales have shown recent signs of stabilizing, property investment has taken a big hit. On balance, property construction—accounting for 8% of GDP—is a bigger contributor to growth than property sales, so the former is more important for stabilizing growth. Yet 1H property construction was down 11.3% y-o-y, while new project starts declined by 23.7%. What is more, the latest construction PMI indicates accelerating decline of new construction orders, pointing to further slowdown in construction activity (see Figure 2).

Figure 2. Sharp Drop in New Construction Orders (below 50 indicates contraction)

Source: Wind and MacroPolo.

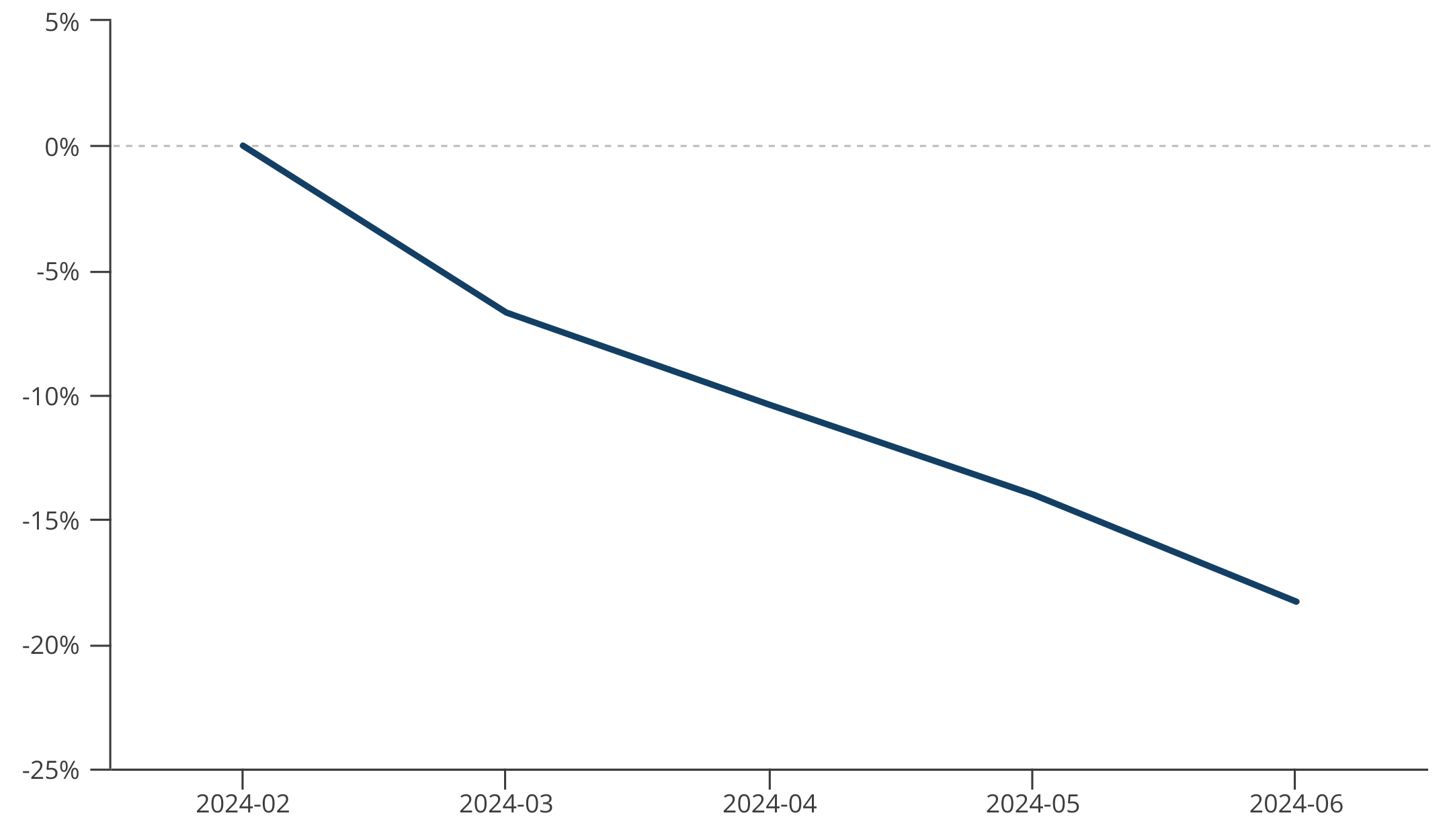

Weaker construction activity of course also drags down local government investment through reduced land sales revenue, which has already fallen 18.3% year-to-date (see Figure 3). This means total land sales revenue for 2024 will likely be more than 1 trillion yuan (~$130 billion) less than Beijing’s budget forecast.

Figure 3. Land Sales Revenue Decline Getting Worse

Source: Wind and MacroPolo.

Second Half Stimulus Outlook Not Encouraging

Troubles in the property sector and constraints on local government spending will persist into 2H, in large part because there does not appear to be strong signals of support for either from Beijing. While there were some expectations of a course correction at the July Third Plenum, the outcome was largely one of broad continuity instead of a pivot.

While bolstering consumption through services and lifting household income through better social safety nets received some mention, supporting the property sector did not get attention at the Plenum. Instead, much of the full decision was devoted to longer-term objectives such as sustaining manufacturing prowess and advancing technological leadership. On balance, the Third Plenum should be interpreted as a doubling down on Beijing’s existing “supply-side first” strategy.

As such, the Plenum decision, and the subsequent Politburo meeting, won’t matter much for near-term growth nor do they imply significant stimulus is on the table. So we do not anticipate either fiscal or monetary policy to significantly support the economy in 2H.

On the fiscal side, two key constraints will tie Beijing’s hands: central revenue shortfall and local government deleveraging.

Central government revenue was forecast to see 3%+ growth this year, yet to date revenue has instead contracted by 3%. That will create a 500 billion yuan ($70 billion) hole in the budget in 2H, implying that Beijing will have to increase the central budget deficit by ~$70 billion to avoid the budget shortfall from handicapping growth even more. To the extent Beijing increases the budget deficit in 2H, it will do so conservatively to cover the revenue shortfall but fall far short of being stimulative.

Stimulus also won’t come from local governments as they are once again struggling with deleveraging. Not only are local governments facing a broad revenue crunch from continued decline in land sales, part of their dwindling revenue also needs to be used for debt servicing. In fact, Beijing has shown its preference in recent weeks by letting local governments use bond borrowing to refinance existing debt instead of financing new projects. In other words, it appears Beijing has already decided to not rely on local governments to stimulate the economy, instead redirecting them to focus on de-risking.

Finally, the People’s Bank of China (PBOC) isn’t likely to be much more accommodative either in 2H. Just as we predicted, credit growth has declined significantly this year, with total social financing growing only 8.1% to date, which is significantly lower than 2023 growth of 9.5%. Credit growth will likely continue to slow in 2H because Beijing now has a different attitude toward monetary stimulus: it believes that risks to banks from increased lending outweigh the benefit of a minor growth boost. For example, despite worsening growth, the PBOC was deliberately trying to slow credit growth in 2Q.

Without meaningfully addressing property sector and local government revenue woes, the Chinese economy isn’t likely to outperform in 2H. Absent more demand-side stimulus, growth will descend further toward the end of the year. As such, the 5% growth target set in March was overly ambitious, and the reality of persistent challenges in the economy means that our relatively bearish outlook on growth this year is merited.

Houze Song is a fellow at MacroPolo. You can find his work on the economy, local finance, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe