- April 24, 2023

2Q2023 Macro Outlook: Steady as She Goes

2Q2023 Key Takeaways:

- The strong rebound in 1Q2023 will spill over into the second quarter, leading to longer-lasting steady growth.

- Several factors inform our modified expectations, chief among them the surprisingly rapid recovery in employment that reflects a resilient private sector and bodes well for consumption.

- In addition, Beijing has tapered stimulus earlier than expected, which means it has reserve fire power to stimulate in the third quarter if growth flags again.

- Although we still believe 2023 growth will resemble a square-root shape (√), the slope’s decline will be shallow, rather than precipitous, as annual growth is likely to overshoot the target of 5%.

As we had expected, the Chinese economy in the first quarter performed strongly, clocking in at 4.5% growth year-on-year. Although second-quarter growth won’t be as robust, the slowdown should be more modest than our previous expectations.

We are more optimistic than some about growth prospects in 2Q2023 because important green shoots have been obscured by mixed signals in the 1Q2023 data. For instance, the deflation in March is likely transitory and does not appear to reflect underlying demand resulting from a robust employment recovery, particularly in the services sector, which will support consumption.

Moreover, Beijing appears to be tapering stimulus earlier than expected, further suggesting that the economic rebound is more resilient. This means Beijing has more policy room to stimulate again down the road to offset weaker growth. Therefore, 2Q growth will remain steady for longer, resulting in a shallower decline of the square root’s slope as growth for the year could well outperform the 5% target Beijing set in March.

Deflation Concerns Obscure Strong Jobs Recovery

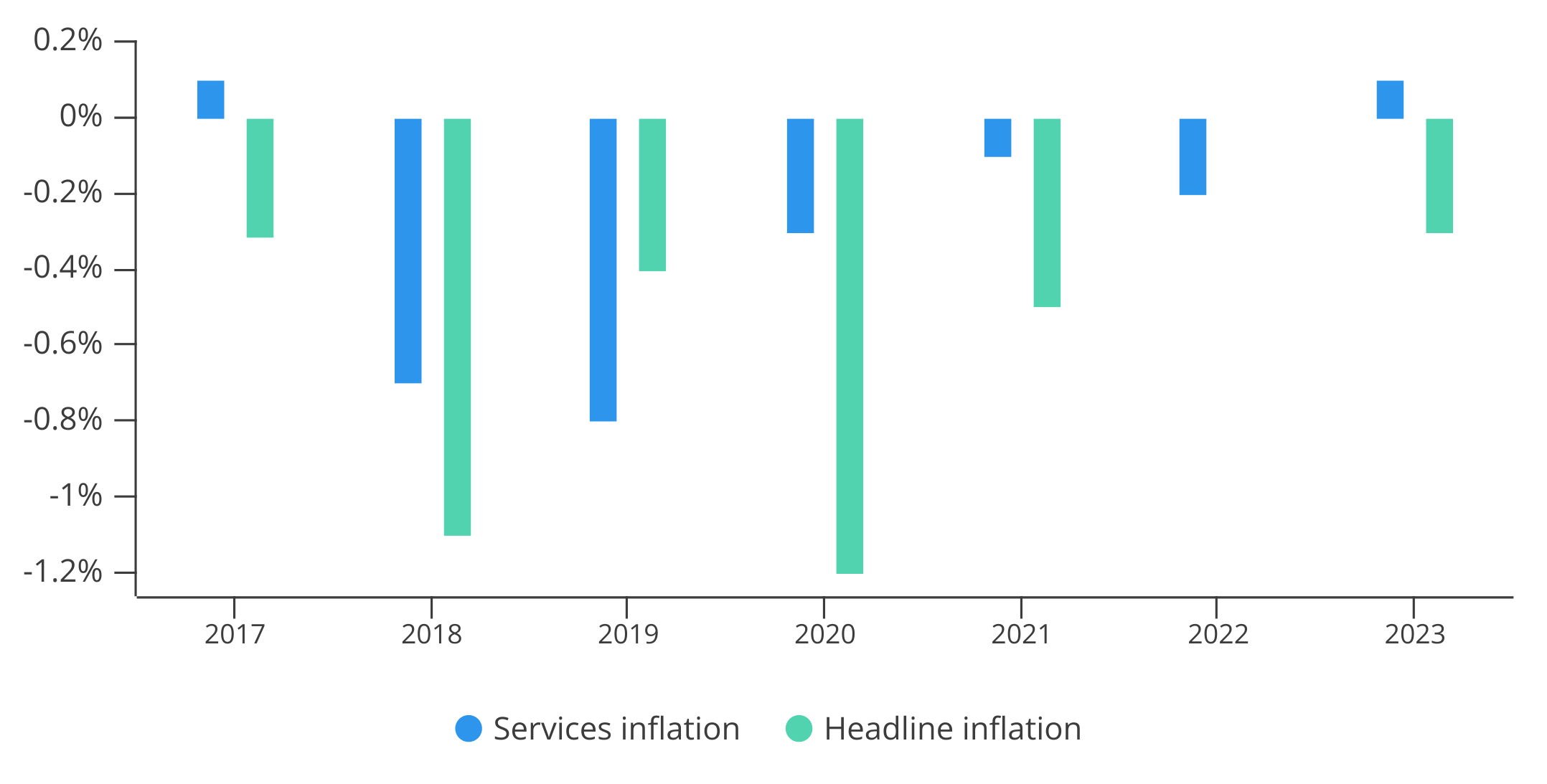

While the -0.3% month-on-month deflation in March seems like a cause for concern, we think that’s mainly due to seasonality factors, as March tends to see deflation (see Figure 1). Disaggregating that inflation shows a more encouraging picture of services inflation remaining in positive territory. That’s important because the services sector is one of the main drivers of employment recovery.

Figure 1. March Inflation Has Been Weak Historically (% m-o-m)

Note: While the National Bureau of Statistics (NBS) claims inflation has been seasonally adjusted, it appears there remains large seasonality factors in the inflation data.

Source: NBS.

Indeed, there are likely 10 million out-of-work migrants over the last few years who have flooded back into cities, with the vast majority finding work in the services sector. This large influx of migrant workers should be driving down wages and therefore weakening inflation. But the fact services inflation remains in positive territory implies that there are plenty of jobs to absorb these migrants.

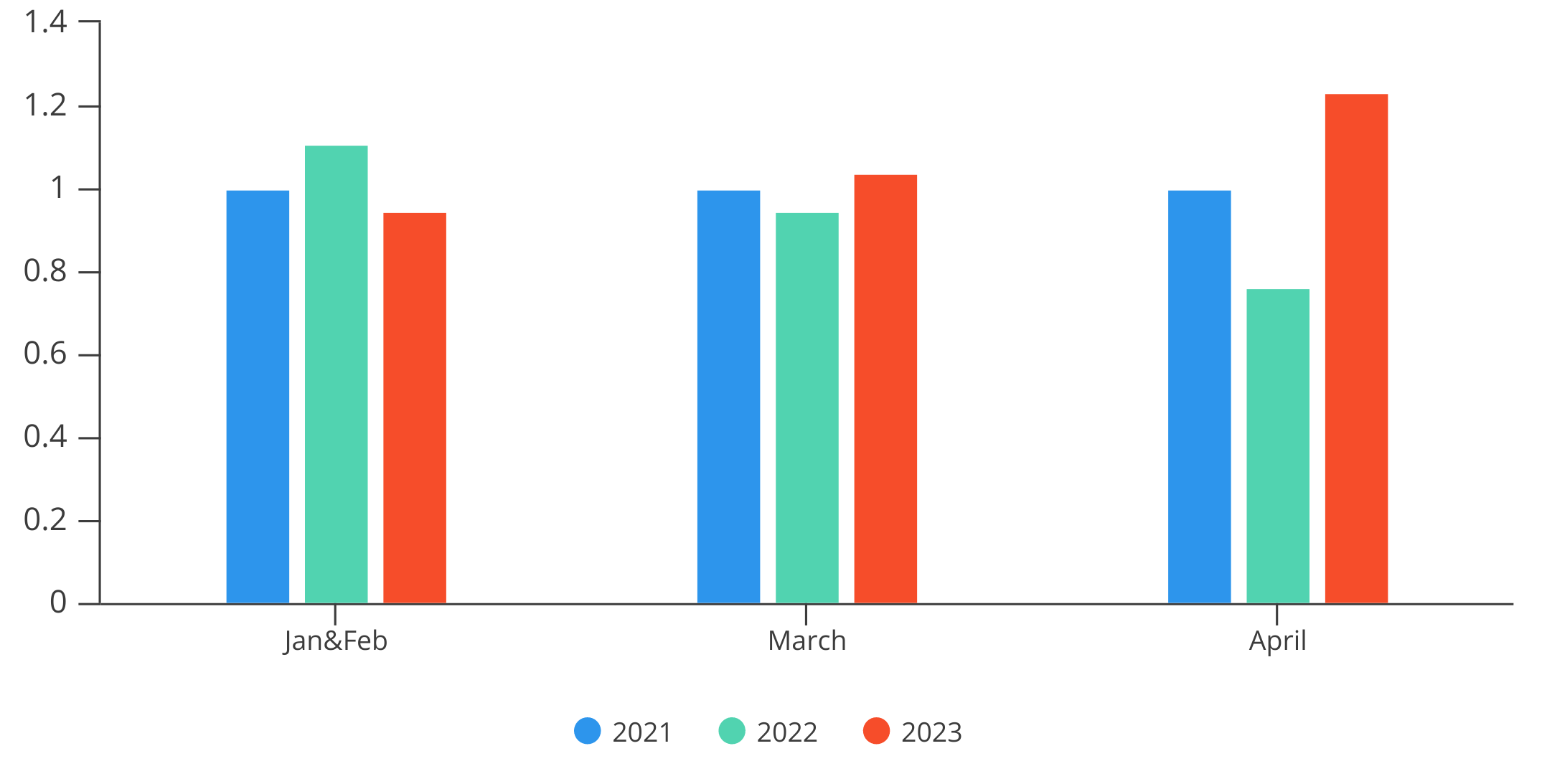

The rapid improvement in services employment will bolster consumer confidence and spending, which have been reinforced by March credit data that showed household deposits growth normalizing to 8% in March from a high of 30% in the first two months of 2023. Some of that spending will likely show up in auto sales, which were quite weak in 1Q2023. But that was largely a policy-driven outcome as consumers rushed to buy cars before tax breaks expired at the end of 2022. There will likely be a turnaround in auto sales going forward, as weekly sales data suggest the worst is already behind (see Figure 2).

Figure 2. After a Weak Start, Auto Sales Have Recovered (2021 sales = 1)

Note: April data is through April 14, 2023.

Source: Wind; MacroPolo.

Slower But Steady Growth

It is clear that as the recovery ages, growth will get progressively slower. Even so, we expect 2Q2023 growth to be more resilient than expected on the back of improved employment and consumer confidence. Chinese policymakers seem to share that assessment, as Beijing appears satisfied with the current growth momentum. In fact, Premier Li Qiang recently echoed just that sentiment.

Moreover, President Xi Jinping has made it a habit of pouring cold water on too much growth. There are few things he dislikes more than a runaway and overheated economy, which he appears to believe is antithetical to the paramount interest of national security. In early March, Xi publicly warned officials to tread carefully and avoid going all out on economic growth.

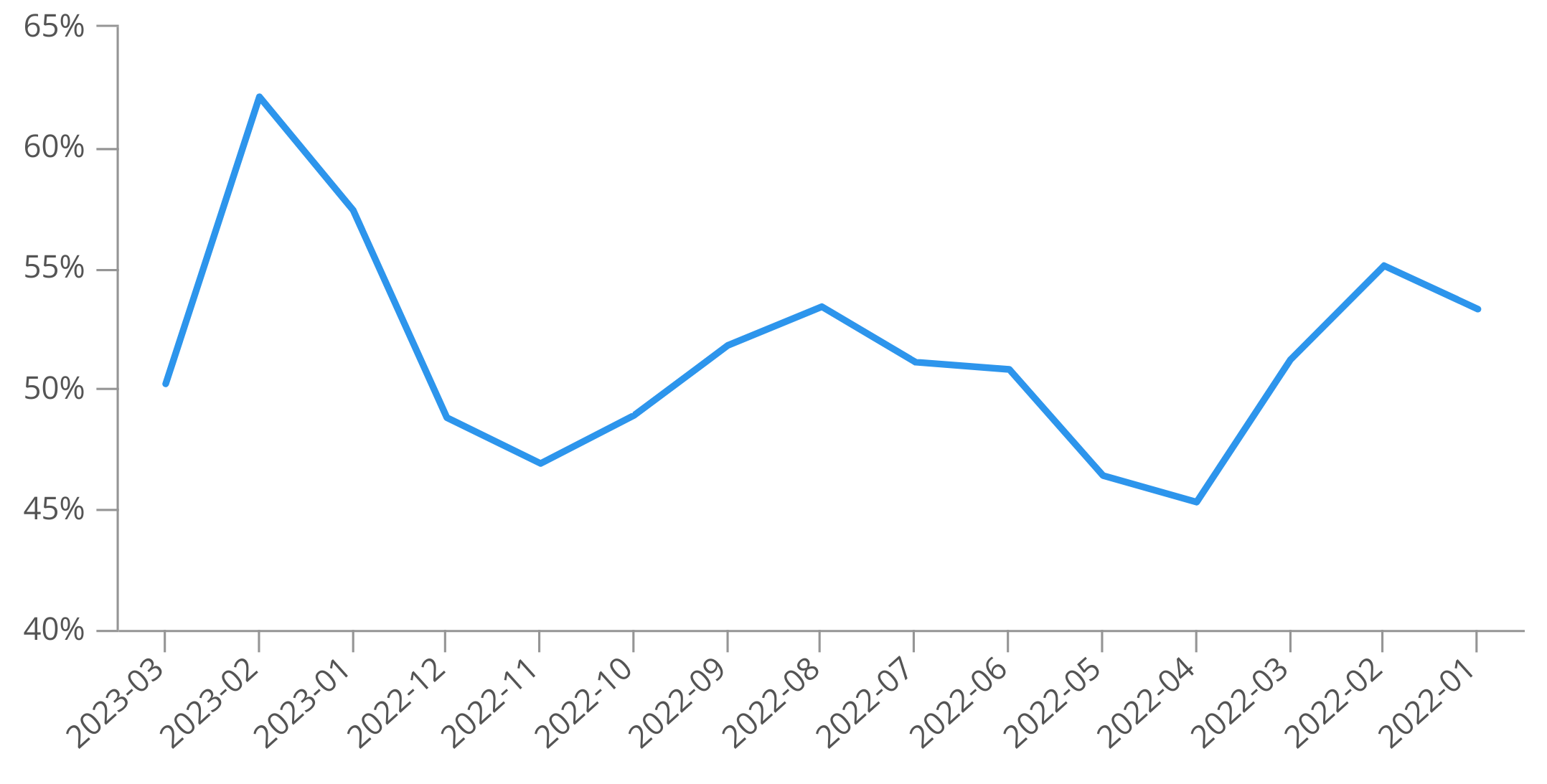

As such, we believe policy will transition from supportive to neutral, which implies the tapering of fiscal stimulus. In fact, the tapering may have already begun, as evidenced by the decline in new orders for construction firms (see Figure 3). That tapering will also affect the strong credit growth that hovered above 10% in the first quarter. By mid-March, the People’s Bank of China had begun to instruct banks to moderate the pace of credit growth.

Figure 3. New Construction Orders Declined Significantly in March

Source: NBS.

So we are already on the other side of peak policy support, but that doesn’t mean Beijing will abruptly tighten policy either. The top leadership has gone the extra mile to reassure its own consumers and global investors that the Chinese economy will be an exemplar of stability this year. The recent financial turbulence in the United States, as we have argued, will only make Beijing double down on stability and not make any drastic moves.

“Steady as she goes” is precisely how Premier Li portrayed China in his first major public speech, pledging that the country will be a contributor to global economic stability while managing and reducing economic uncertainties. As such, major policy shocks or financial disruptions in the coming months are unlikely.

To be sure, the industrial and property sectors will continue to underperform and pose headwinds to growth. While long-term household borrowing (mostly mortgages) and property sales have picked up recently, it won’t contribute much to growth. Property developers are still in deleveraging mode, which means rising sales can help them muddle through debt repayments rather than expand investment.

Weak property investment will of course have knock-on effects on the industrial sector, since it depends so much on property boom cycles. But some of the lackluster in the industrial sector will be offset by the revival of auto sales, which can help sustain industrial output or at a minimum prevent further contraction.

More Firepower Later

Taken holistically, the continued improvement in consumption and employment will enable the economy to recover steadily, even as investment loses steam in 2Q2023. As the recovery becomes more consolidated, policy will become less supportive.

But that actually bodes well for the second half, because Beijing will likely need to tap additional stimulus. Instead of depleting all of its stimulus in the first half, Beijing can now deploy more in the second half when sustaining growth will be even trickier.

The main challenge will be to generate enough jobs to absorb the nearly 12 million college students expected to graduate this year. To prevent yet another spike in unemployment, Beijing likely needs to stimulate the economy. Because of the improved policy outlook, we expect 2H growth (q-o-q) to be only marginally slower than in the first half. In other words, the slope of the (√) will see a shallow, rather than precipitous, decline.

Houze Song is a fellow at MacroPolo. You can find his work on the economy, local finance, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe