- July 31, 2023

3Q2023: Growth Bottoms Out, Stimulus Insufficient

3Q2023 Key Takeaways:

- Quarterly growth will likely bottom out at ~4%, as no “big bang” stimulus is forthcoming.

- Stimulus measures will take the form of modest fiscal spending to stabilize growth, but are insufficient to the task of supporting the private sector and boosting household consumption.

- Anemic property sales are a downside surprise that will magnify risks and weigh on consumption.

- As such, we maintain our view that the big growth spurt already happened in 1Q, suggesting Beijing is content to simply meet its unambitious 5% growth target this year.

We expect China’s economic activity to remain weak before modestly improving towards the end of the year. We were overly optimistic in our interpretation of labor market data in 2Q and expectation of an imminent arrival of stimulus. Instead, stimulus will be delayed and will not pack the kind of powerful punch needed to meaningfully buoy growth. This means the Chinese economy is expected to hit its cyclical bottom in 3Q, with growth likely to come in ~4% (q-o-q annualized).

In addition to insufficient stimulus, Beijing is also behind the curve in dealing with property risk, evidenced by the surprising contraction in property sales in 3Q. On top of the property sales indicator, mediocre wage growth will lead to weaker-than-expected household consumption. Much of the recent data further reinforce our view set out at the beginning of the year that China’s post-Covid rebound is less than meets the eye.

Downside Surprise: Property Sales Bust

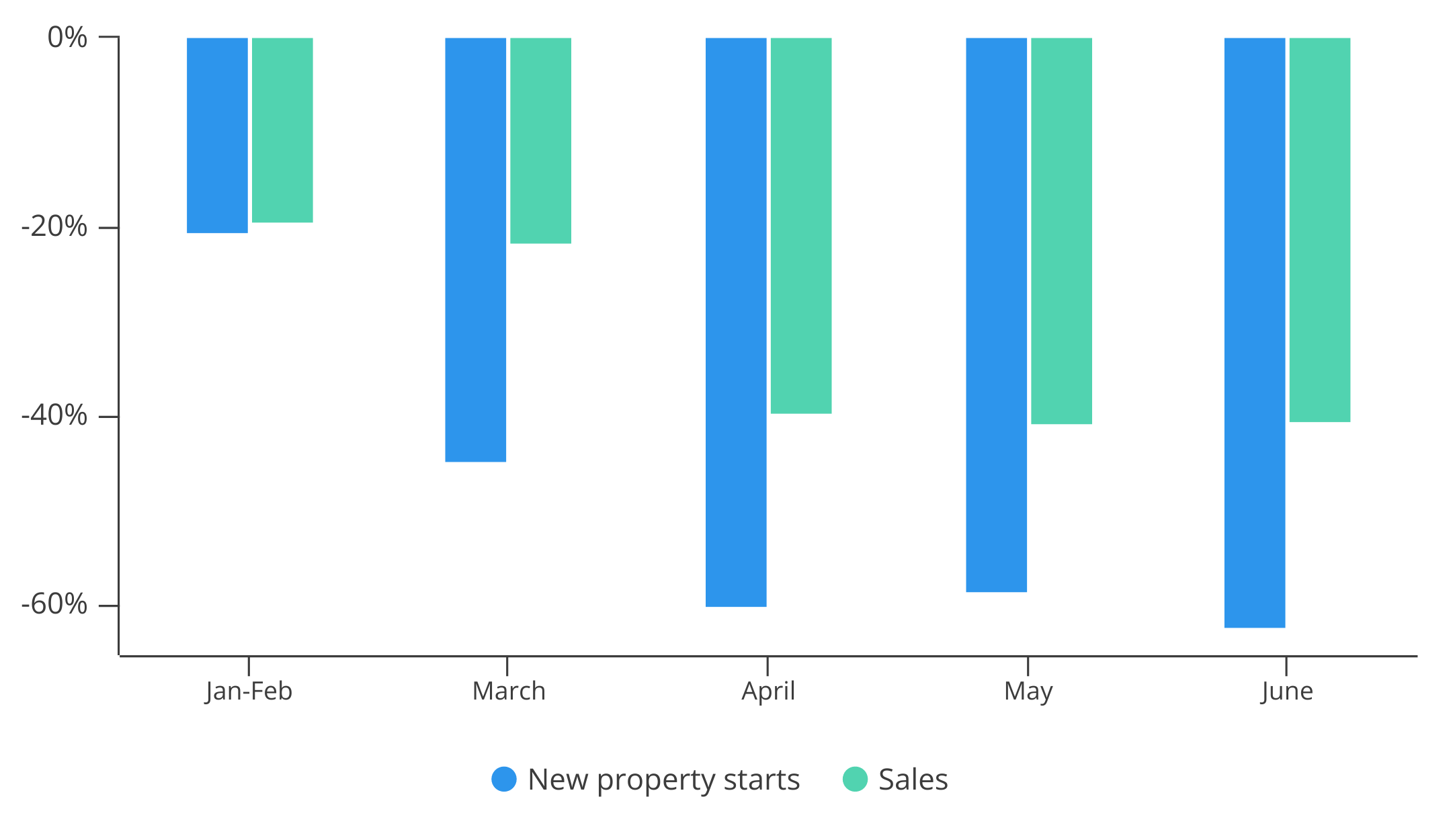

The Chinese economy expanded by just 0.8% in 2Q, which is the weakest quarterly growth in the past decade, not accounting for Covid lockdowns. What’s concerning about the weak headline growth is that an unexpected property sales contraction appears to have contributed to it. After returning to positive growth during the early months of the post-Covid reopening, property sales in June 2023 were 40% below the June 2021 level (we use 2021 because 2022 data is unreliable). Given such poor sales performance, it is not a surprise that new property construction starts fell off a cliff (see Figure 1).

Figure 1. New Property Starts Plummeted 60% Compared to June 2021 Source: National Bureau of Statistics (NBS) and MacroPolo.

Source: National Bureau of Statistics (NBS) and MacroPolo.

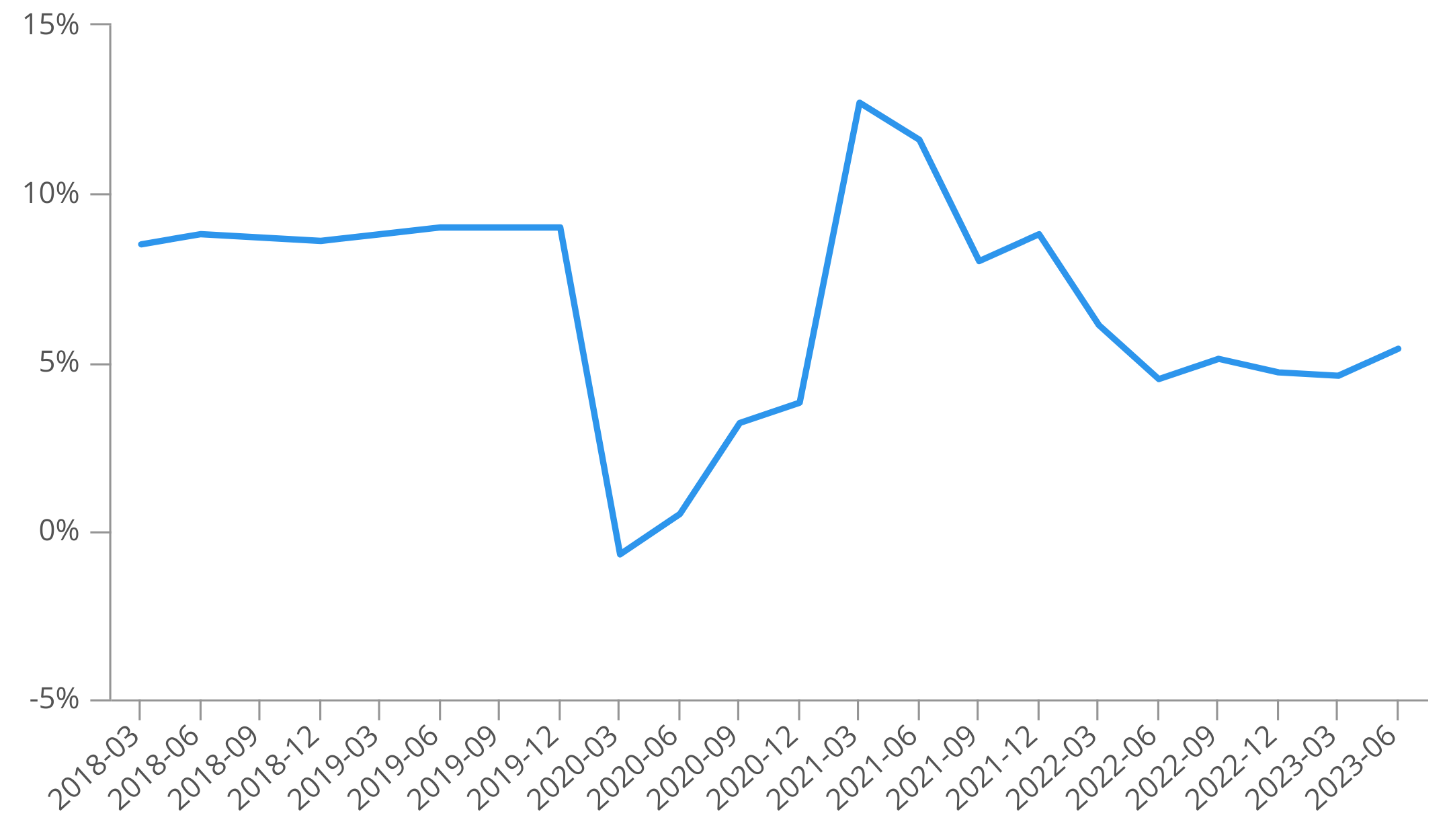

Poor property sales is not the only indicator of continued sluggishness in household consumption. Chinese imports in the first half registered negative year-on-year growth, though that’s partly attributable to a slowdown in construction activity tied to property. Moreover, despite seemingly positive recovery in services jobs, wage growth has slowed down dramatically. Personal income growth has nearly halved to just 5.4% compared to pre-pandemic levels (see Figure 2).

Figure 2. Personal Income Growth Fails to Rebound Despite Reopening Source: NBS.

Source: NBS.

Finally, Chinese households’ inability to refinance mortgages with high interest rates is resulting in higher savings in order to pay down their mortgages much faster. Our estimate indicates that during the first half, Chinese households repaid some ~2.5 trillion yuan ($350 billion) of mortgages ahead of schedule (see endnote). As Beijing continues to prohibit households from refinancing their mortgages, the trend of early mortgage repayment will continue.

All these factors weigh on consumption, which grew at a sluggish 0.3% month-on-month in 2Q. That translates into a roughly 4.5% annualized growth in consumption, or about half the pre-pandemic pace. We have been skeptical of the idea of “revenge spending” coming to the rescue this year, and the 2Q data should finally put to rest the notion that Chinese households are ready to open their wallets.

Beijing’s Actions Evince Lackadaisical Approach to Growth

While the July Politburo meeting announced new stimulus measures, it won’t be particularly effective at revving up 3Q growth because it is coming too late and it is not aimed at the most pressing need: supporting the private sector.

The announced stimulus again relies heavily on fiscal spending rather than supporting the private sector and households. Illustrative of this divergence is the fact that infrastructure investment grew at a solid 7.8% in the first half, while private investment growth was negative.

Beijing has already done a “soft” bailout of debt-laden local government financing vehicles (LGFVs), but what needs a bailout are private firms and households that continue to face difficulties. For instance, LGFVs in 24 regions were able to borrow more through bond issuance in the first half, indicating that creditors are still willing to lend. In contrast, the private sector continues to have difficulty borrowing in the bond market, as net borrowing was negative in the first half.

Although Beijing doesn’t want private sector conditions to deteriorate further, it has shown little impetus in ameliorating the situation. While the latest policy to support the private sector is a decent sign, it is quite similar to the 2019 policy document that had little effect in turning around the private sector. The substance of the latest document, too, devotes about as much to how the private sector can align with Beijing’s industrial policy objectives as it does to how the government can help the private sector.

In terms of concrete measures, the latest document is not a major departure from what Beijing has already done. And now that the economy appears to have bottomed out, there’s even less urgency to roll out dramatic measures to rescue the private sector.

Property Sector Continues to Sputter

A key leading indicator of Beijing’s earnestness in supporting the private sector and household confidence is whether it will meaningfully revive the flagging property sector. Here the latest 2Q data clearly show that current actions are both insufficient and have not been well implemented, even if Beijing believes that it has done enough to stabilize the property sector.

For example, despite Beijing’s encouragement to extend lending to troubled property developers, banks are not enthusiastic, with lending to property developers down more than 10% y-o-y. That’s because the risk and reward for bailing out property developers is very asymmetric—banks enjoy very little upside if a property developer manages to turn itself around because the benefits will go to shareholders, while they will bear all the downside if the struggling developer goes bankrupt and defaults. Unless Beijing pledges to socialize the cost of bailing out bad developers, which essentially means the central government needs to share the losses, banks will remain quite reluctant in lending to struggling developers.

Moreover, Beijing has continued to marginalize the suspended property projects problem. While it’s clear that suspended projects are concentrated in fiscally weaker regions, Beijing has not come to these regions’ rescue to help with the completion of suspended projects. As a result, consumers are still very sensitive to the risk of incomplete projects and are averse to buying property from financially weak developers. This induces a vicious cycle—perceived developer risks → no sales → no revenue → developers’ conditions worsen—that can bring more developers to their knees.

Persistent turmoil in the property sector and the lack of a big bang stimulus mean that 3Q growth won’t be rosy. Rather than stimulating its way out, the Chinese government appears willing to grind it out and content with so-so growth for 2023. A saving grace is that the anticipated US recession may not materialize, lifting some of the external pressure on the Chinese economy. But so long as Chinese household confidence remains deflated, the economy will remain in the doldrums.

Endnote:

About 3.5 trillion yuan (~$490 billion) of new mortgages were issued in 1H, but total outstanding mortgages have been flat over the same period, implying that a similar amount has been repaid. Assuming ~1 trillion yuan (~$140 billion) in scheduled mortgage repayment, that means early mortgage repayment comes out to roughly ~2.5 trillion yuan (~$350 billion).

Houze Song is a fellow at MacroPolo. You can find his work on the economy, local finance, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe