- August 31, 2023

Reordering the Global Order: A World of “Nodes and Acquends”

Roughly three generations after World War II, an interregnum has arrived again between the existing paradigm and the one that’s yet to fully take shape. While the global order has never been static, a profound shift that was marked by gradualism has now been turbocharged by two superpowers rapidly redefining the nature of their relationship and their orbit of influence.

The unraveling of the US-China rivalry is already stress testing the prevailing global order. It is a process that will be as confounding as it is polarizing. All paradigm shifts scramble our mental models, where long-held assumptions are regularly humbled by unanticipated realities. While clarity is possible, certainty is not, because we must accept that fluid dynamics will lead to a wider range of probable outcomes than we would prefer.

In service of that clarity, analysts and observers in recent months have valiantly offered a slew of ideas. From “geopolitical swing states” to the “a la carte world,” these attempt to articulate the main features of, or define an organizing concept for, this transitional period. They fundamentally rest on the premise that third countries will variously hedge or capitalize on US-China tussles. In other words, countries want the flexibility to opt in and opt out and not get handcuffed to either side of the rivalry.

Avoidance of hardened “bloc geopolitics” or non-alignment may indeed be on the menu. But the main course that will define this transitional order, in my view, is the tension between “nodes and acquends” (acquaintance/friend). That is, the two competing dynamics that will shape an eventual outcome are how third countries align to benefit from participating in economic production nodes and/or benefit from geopolitical alliances.

China tends to be weak on alliances but is central to production nodes. As supply-side thinking rises in prominence globally, the “producer of last resort” will matter as much as the consumer of last resort. The United States, on the other hand, is at the center of geopolitical alliances but plays less of a central role in production nodes. Look no further than the adoption of muscular industrial policies across advanced economies as acknowledgment of weakness in production.

The ostensible strength of the US alliance system obscures a significant wrinkle, however. For many US allies, it is virtually impossible to extricate themselves from China-centric production nodes, particularly across a range of technology products. Unless substitutes can be found quickly, allies have few options to turn to. But their geopolitical alliances with the United States risk their ability to access and benefit from these production networks in the form of lower-cost imports, a large export market, and economies of scale efficiencies.

Even as Washington has dramatically enhanced its alliances from NATO to the Indo-Pacific, the divergence among allies between economic interests and political values will create cleavages, likely producing more “acquends” than steadfast friends. In fact, this transitional order will see a proliferation of acquends and a paucity of true friends for both Beijing and Washington. In life as it is in geopolitics, all of us have many more acquaintances casually labeled as “friends” than we’d care to admit.

Now, let me elaborate on this first draft idea with a bit more detail and data. What follows is entirely my interpretation, so I would welcome suggestions and modifications.

“I wouldn’t want to belong to a club that would have me as a member”

The global order isn’t nearly as iconoclastic as Groucho Marx, as clubbiness has been one of its defining features. For the better part of 50 years, countries relished sorting themselves into status-based clubs. There’s the rich countries club G7 + 1 (Australia) that still commands 46% of global GDP with just 10% of the global population. Then there’s the poor countries club (G77), which has long evolved as previous members pulled away and became “emerging markets.” (The IMF has a useful guide on the permutations of G-based clubs.)

Yet if today’s $100 trillion global economy were equally distributed among its 8 billion humans, the global per capita GDP would be ~$12,500, on par with China’s per capita GDP today. So while it’s theoretically possible that every country could become high-income, reality doesn’t work as ideally as in theory. Fewer than 10 countries are responsible for nearly half of the world’s economic output.

What happens when the once poorer emerging markets graduate to “emerged”? There’s a club for that too (G20), which is essentially the G7 + BRICS + regional powerhouses. While the inclusive spirit of G20 is commendable, it is beset by coordination problems and trust issues. More important, the BRICS now seem to be actively breaking off from G20 to create its own “we don’t like American hegemony” club. With the United States and China locked in head-to-head competition, any club that includes friends and acquends on both sides will be dysfunctional.

Instead, what is more useful in grappling with this emerging order is the little known G33. That’s because it was originally born under the G77 to convene finance ministers and was eventually superseded by the G20. But for my purposes, the G33 deserves another look. It doesn’t contain any G7 country, but includes most if not all the developing countries and Gulf states that China has been coaxing to become friends, such as members of the BRICS expansion team (Saudi Arabia, Iran, UAE, Egypt, Ethiopia, and Argentina).

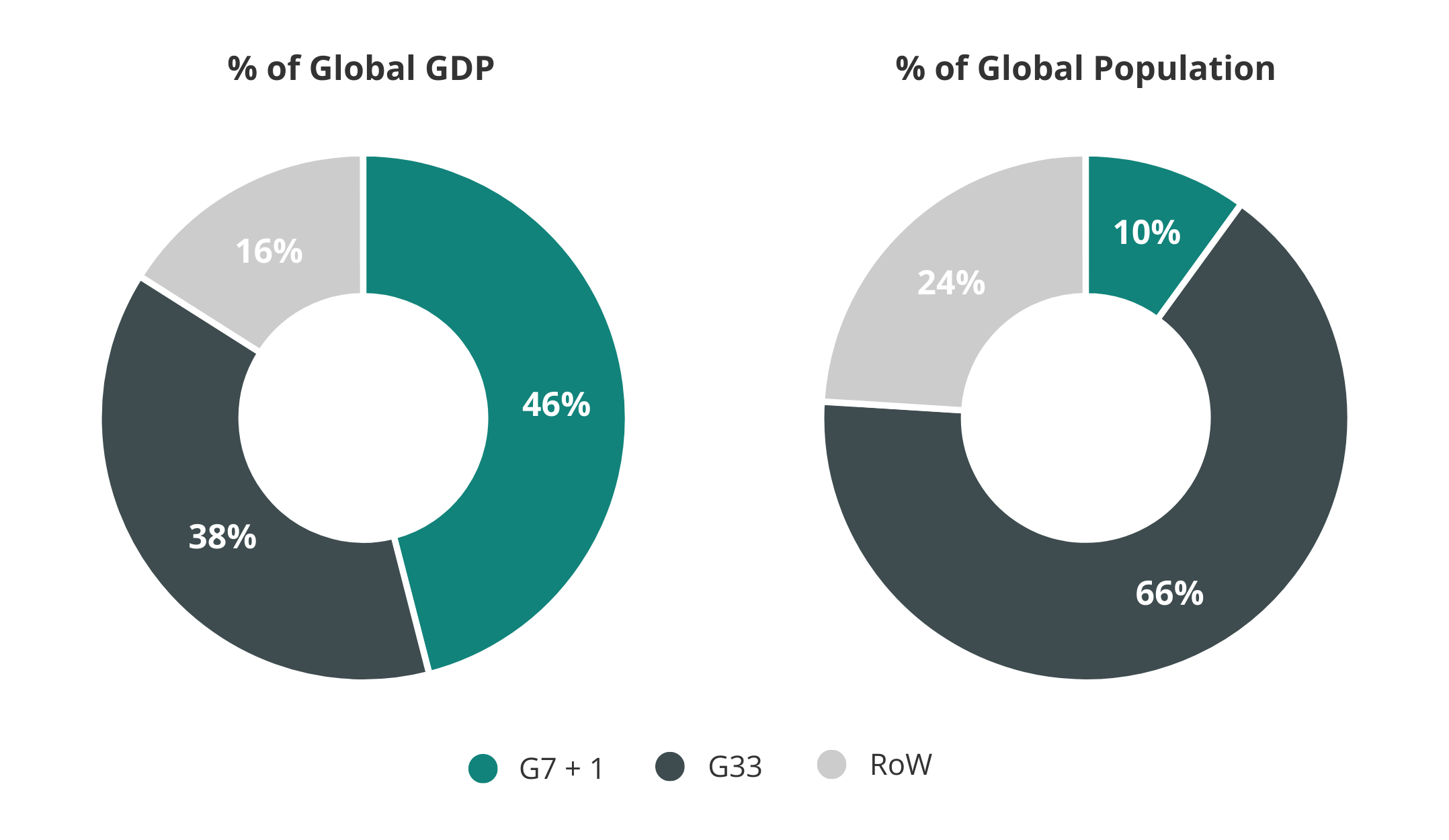

Like the G7, the G33 is also top-heavy, with the Chinese economy constituting half of the G33 GDP (United States is similarly dominant at more than half of the G7 club’s GDP). Combined, the G7 + G33 make up some 84% of global GDP and 76% of the global population (see Figure 1).

Figure 1. Order of the Day: $100 trillion GDP and 8 billion people Notes: The G7 is really G7+1 = US, Japan, Germany, France, UK, Italy, Canada, Australia; the G33 is technically the now-defunct G24 club that actually had 29 members plus four observers. See Map notes below for further explanation of G33 countries.

Notes: The G7 is really G7+1 = US, Japan, Germany, France, UK, Italy, Canada, Australia; the G33 is technically the now-defunct G24 club that actually had 29 members plus four observers. See Map notes below for further explanation of G33 countries.

RoW = rest of world.

Source: Author; World Bank.

These are the ~40 countries of consequence where the tension between nodes and acquends will manifest. But that collision is also the very process that will mold the emerging order (see Map).

Friends and Acquends in the G7 and G33

Notes: As the IMF attests, G-based clubs change regularly, and the number affixed after the G is basically meaningless because these clubs add members all the time. So I took the liberty of swapping out a few countries in the G33 list for others because it wasn’t entirely clear they would be meaningful players in the geopolitical game (e.g. instead of Venezuela, Vietnam is included in the G33). As a first cut, 46% of the 41 countries are labeled “acquends.” The categorization of each country strikes me as reasonable and defensible, though far from perfect and subject to modifications. For instance, some countries (Syria, Algeria, Cote d’Ivoire, Gabon, Morocco, Peru) have not been categorized because their importance to either production nodes or allies is unclear or minimal. Zoom in and out of the map using your touchpad or mouse.

Source: Author.

Production Nodes

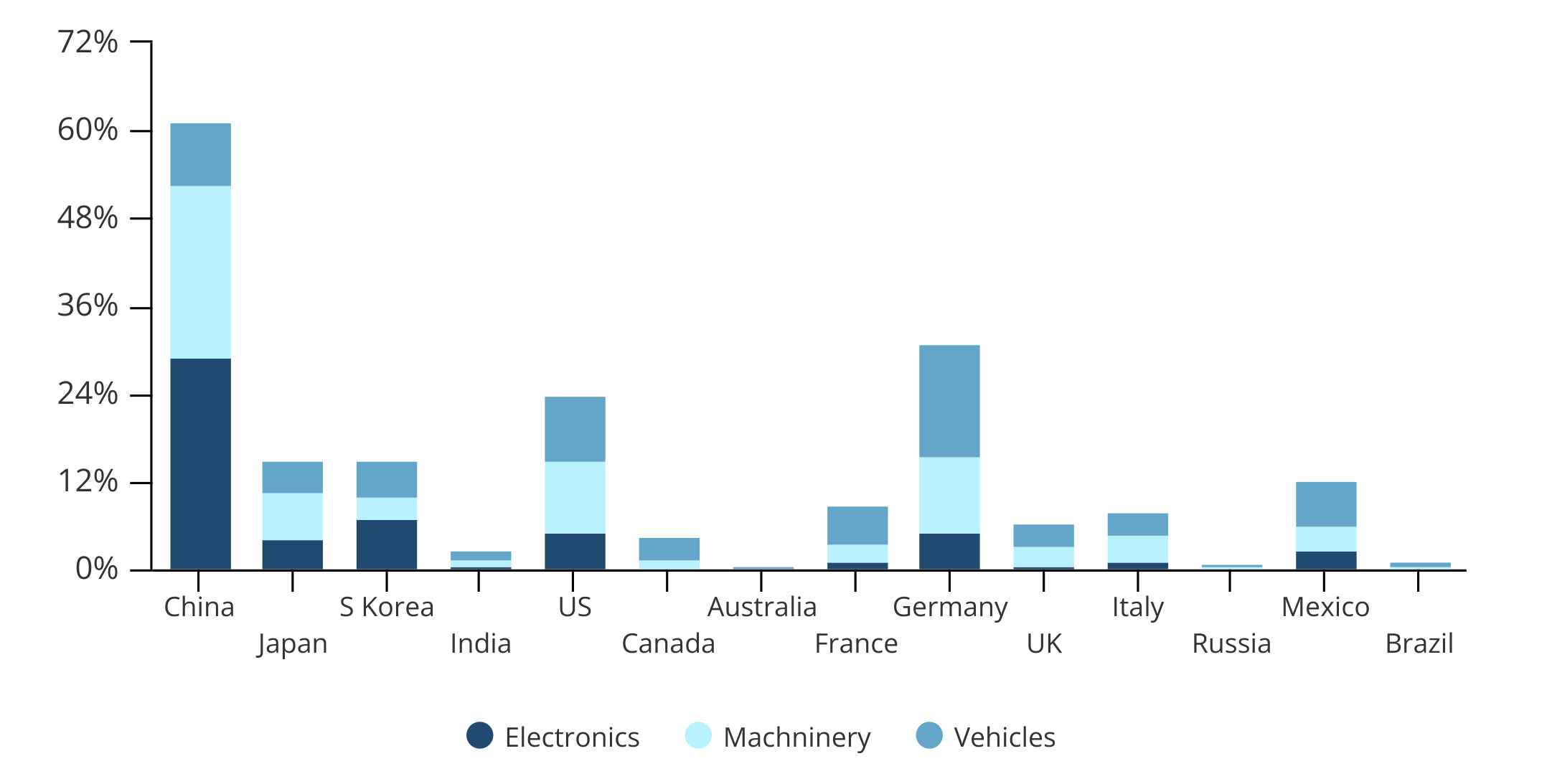

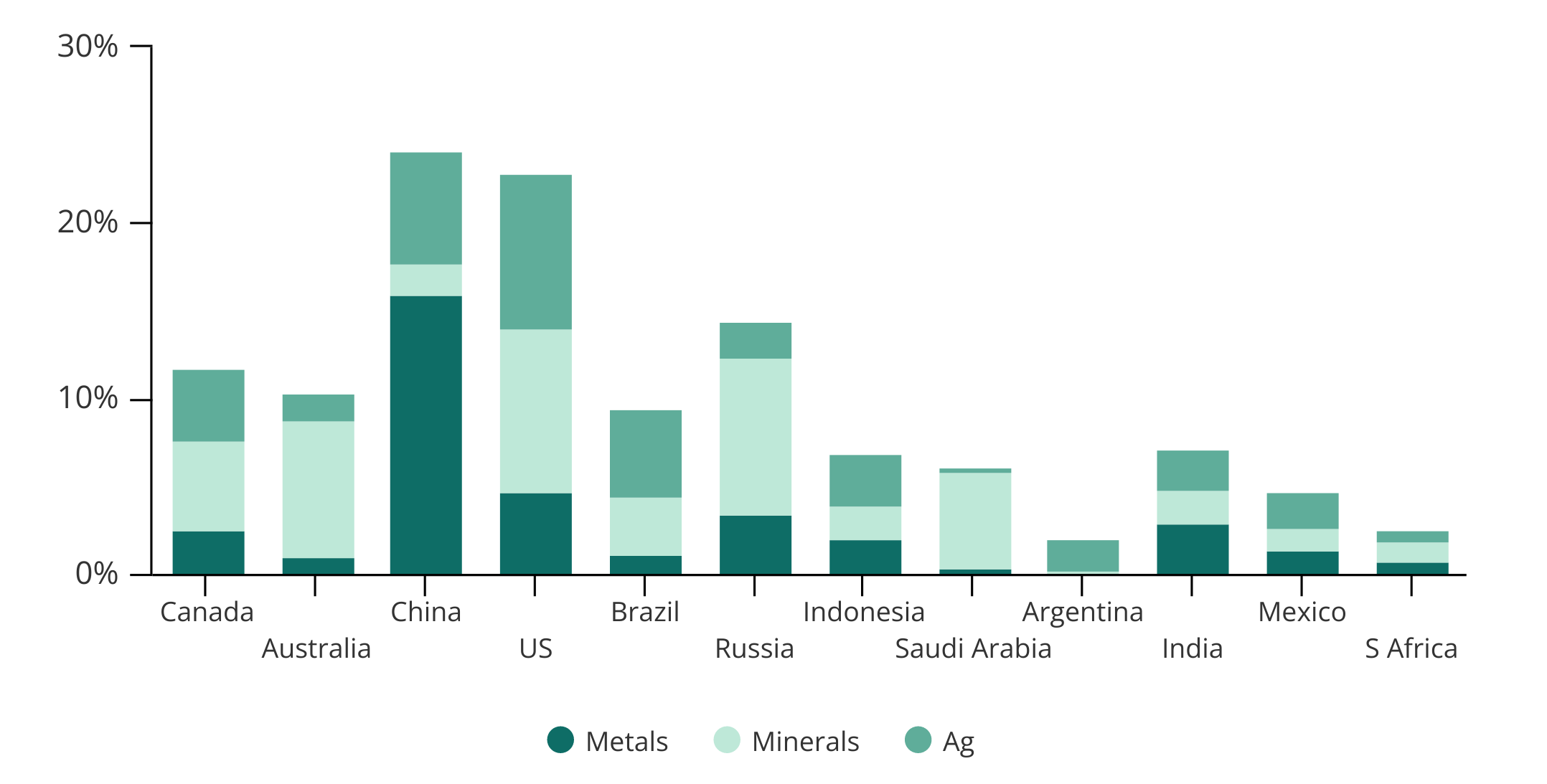

With this initial sorting of the G7 and G33 countries, I’ll now drill down a bit into their roles in production nodes. A country’s export mix is a decent proxy for their relative strength in production or domestic manufacturing prowess. Rather than exhaustively cover several hundred export categories, I focused on a few proxies for technology exports and commodities crucial to the global economy (see Figures 2a & 2b).

Figure 2a. China Is Dominant on Technology Products Figure 2b. More Substitutes for China on Commodities

Figure 2b. More Substitutes for China on Commodities Notes: The stacked columns show market shares of three different technology product and commodity categories for each country. This is not meant to suggest aggregate market share that a particular country commands. All countries belong to either the G7+1 or G33.

Notes: The stacked columns show market shares of three different technology product and commodity categories for each country. This is not meant to suggest aggregate market share that a particular country commands. All countries belong to either the G7+1 or G33.

Source: Author; Atlas of Economic Complexity; Observatory of Economic Complexity.

As is clear from Figure 2a, China dominates the export market share of technology products, particularly when it comes to electronics and machinery. Even when it comes to vehicles, China is virtually tied with the United States on market share, and it is a figure that will rise to converge with that of Germany’s on the back of China’s electric vehicle boom.

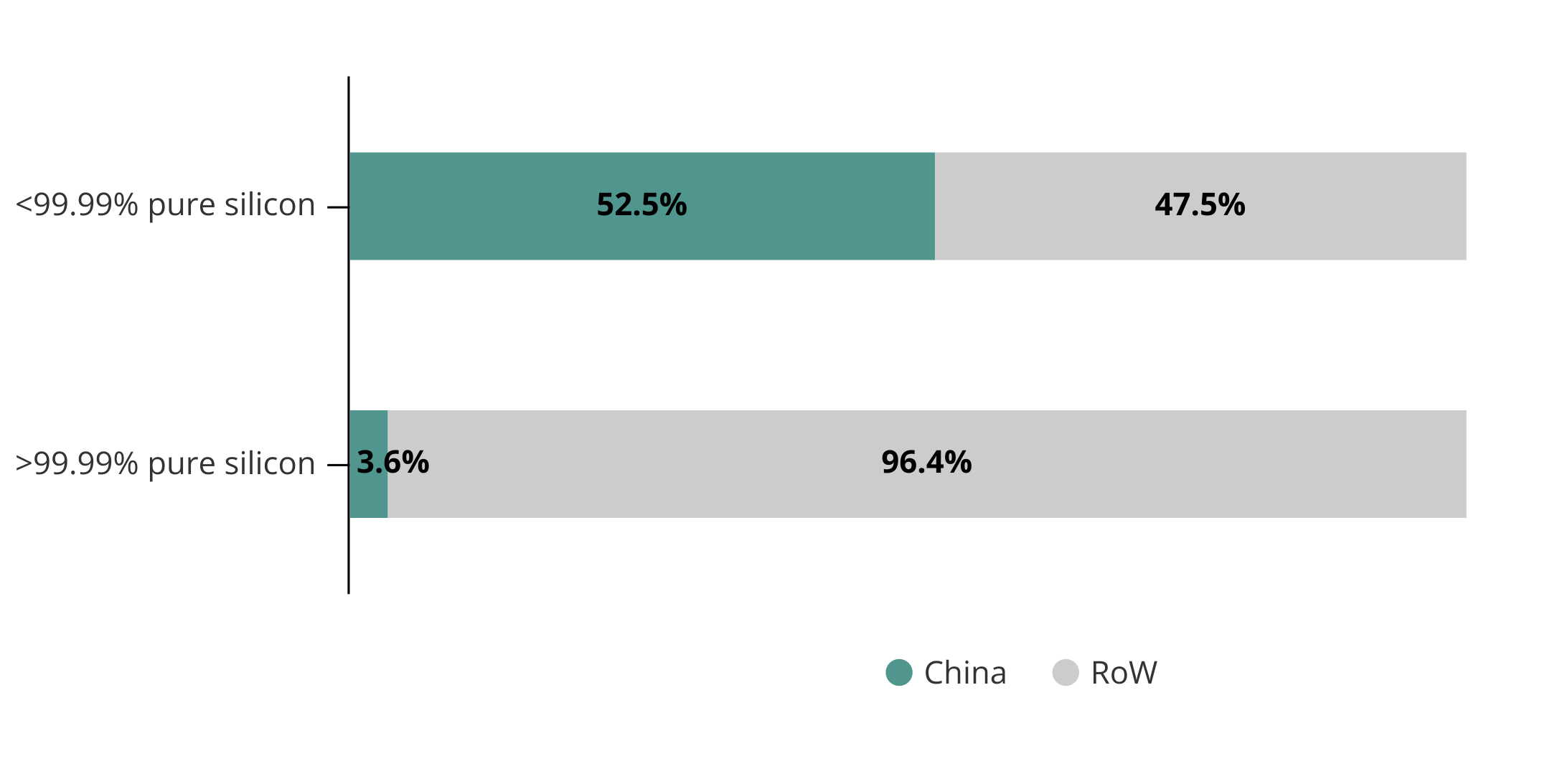

While China is no slouch when it comes to commodities production (Figure 2b), it is less obviously dominant, especially when it comes to minerals (incl. petrochemicals) and agriculture. Although not included in the above, one commodity in which China isn’t particularly dominant is ultra-high purity silicon, primarily used in advanced chips. But China still commands half the global export market share on less pure silicon used mainly in typical solar panels or lower end semiconductors (see Figure 3).

Figure 3. China vs. Rest of World on Silicon Market Share Source: Author; AEC.

Source: Author; AEC.

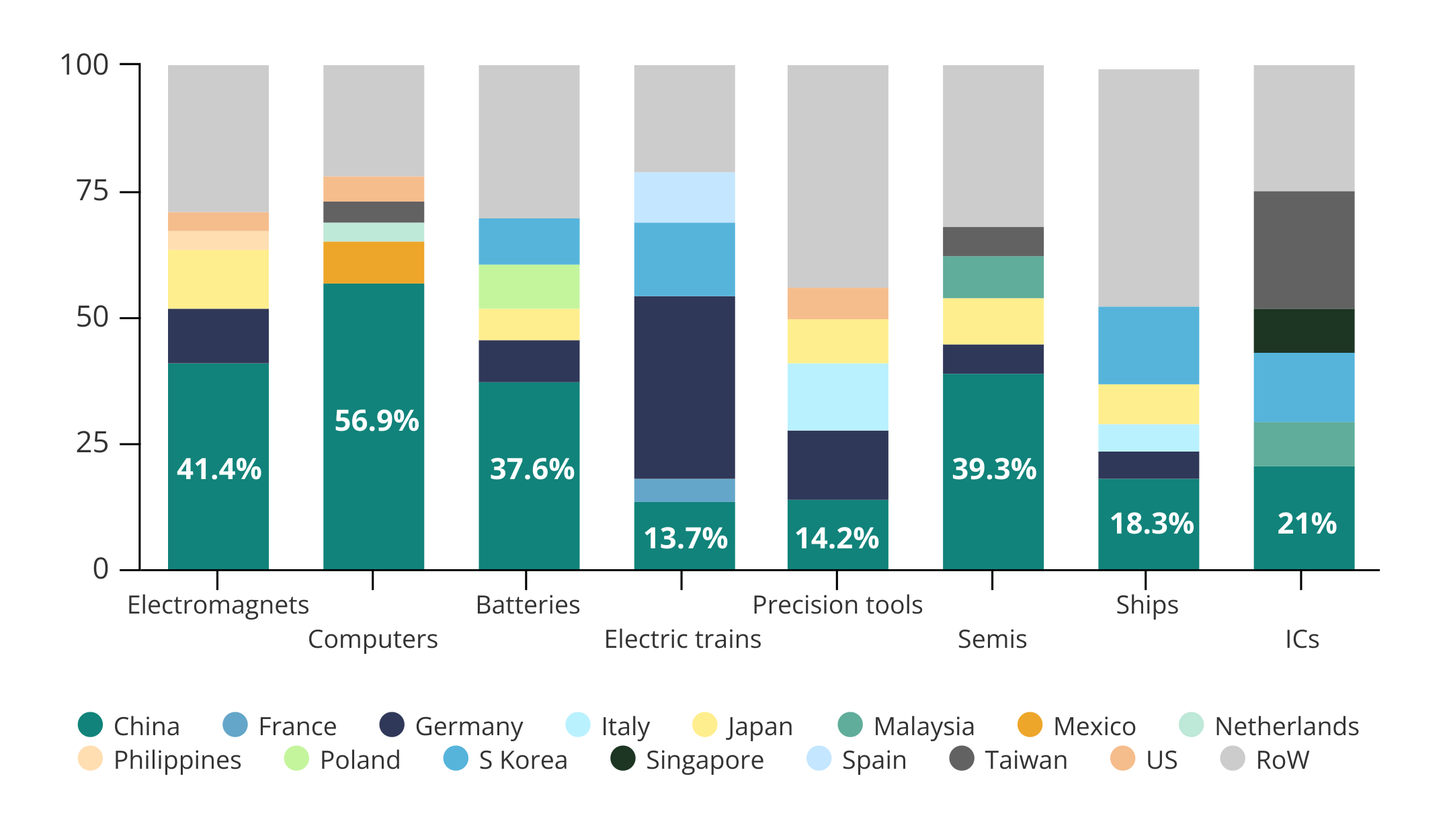

But where China has deficiencies in upstream inputs it makes up for in the midstream and downstream across a range of intermediate and end products (see Figure 4). Looking across specific products, particularly those that are of crucial importance to today’s global economy, China either holds a significant lead or is at least on par with the global leader. In precision machine tools and integrated circuits China is still playing catch up—and it’s not a coincidence that those continue to be key areas that Beijing’s industrial policy targets.

Far from a comprehensive assessment, this is meant to provide indicators of the depth of China’s manufacturing capabilities, which underpin the China-centric production node. Yes, we all know China’s weakness in chips, but it’s doing pretty well on ships.

Figure 4. China’s Grip on Numerous Intermediate and End Products Notes: The legend includes every country that’s shown in the chart, but each stacked column shows only the countries in that product category by market share. Due to space limitations, we only show the top five countries vs. the rest of world. If this list were extended to, say, the top dozen countries, most of them would be in either the G7+1 or G33 club, with a few exceptions. In addition, this looks only at the exports’ country of origin, not the firms’ country of origin. For instance, those exports from Southeast Asian countries could very well be Chinese- or Japanese- or Korean-owned firms. If using firm ownership rather than location as criteria, that will likely make China’s market share even larger.

Notes: The legend includes every country that’s shown in the chart, but each stacked column shows only the countries in that product category by market share. Due to space limitations, we only show the top five countries vs. the rest of world. If this list were extended to, say, the top dozen countries, most of them would be in either the G7+1 or G33 club, with a few exceptions. In addition, this looks only at the exports’ country of origin, not the firms’ country of origin. For instance, those exports from Southeast Asian countries could very well be Chinese- or Japanese- or Korean-owned firms. If using firm ownership rather than location as criteria, that will likely make China’s market share even larger.

Source: Author; AEC; OEC.

Chinese technology exports of course also require numerous inputs, many of which come from Japan, South Korea, and Taiwan. Indeed, throwing all of them into the mix makes East Asia the world’s most formidable integrated production node with scale, speed, and efficiency.

No one else comes close. Europe can no longer be considered a legitimate production node since it’s mainly Germany flying solo as the production machine of Europe, with France and Italy devolving into marginal players. India and Southeast Asia, despite breathless media coverage, simply aren’t meaningful substitutes for the East Asian production node. That may change in a decade, but at the moment they are immaterial.

Whither Substitutes?

From the United States’ vantage point, there are two options to contest China’s production node supremacy: 1) create the production nodes on its own; 2) create production nodes through a network of substitutes for China. Many would argue that industrial policy is the answer to option 1 and allies is the answer to option 2.

Washington appears to be pursuing both simultaneously, but each option comes with its own risks. Let’s put industrial policy aside for the time being, in part because it is a slow-burn process. Then on the latter option, the question is “will there be sufficient substitutes among US allies (G7+1) to seriously displace China?”

On some things like upstream metals, the United States could count on some of its friends or potentially persuade a few acquends to help weaken China’s grip. This is in large part because China is already relatively weaker on commodities. But when it comes to technology products crucial to the global economy, China’s prowess across so many different categories makes it very difficult, if not impossible, to have sufficient substitutes.

For instance, South Korea is an able substitute for China on batteries, but its scale still pales in comparison to China’s. In fact, Chinese companies are going to South Korea to be part of the battery supply chain. That doesn’t really weaken the East Asian production node, it just simply means that Chinese companies are producing in another East Asian country. Camp David summit aside, these enduring dynamics will likely make South Korea slide between acquend and friend for both Washington and Beijing.

Even when it comes to staunch allies like the United Kingdom, it likely needs to weigh the benefits from US geopolitical alliance against the potential cost of not having access to the China-centric production node. The UK is basically a services economy that punches way below Germany on production. And given its inflationary environment, accessing Chinese exports and supply chains is important to the UK economy.

If anything, Mexico may be emerging as a winner of the “near-shoring” trophy on production. Mexico isn’t a production node on its own, but it has the potential to rise as a destination for Chinese production moving closer to North America (Vietnam as of now seems to play a similar role in Southeast Asia). While Mexico is obviously closely connected with the United States, if it becomes a major recipient of Chinese-owned production, it will reside in the acquend territory.

—————

China’s economic gravity as a production node is hard to deny and even harder to circumscribe. Irrespective of a weaker economy, China’s investments will likely concentrate in technology products and strengthening supply chains. In fact, Beijing’s strategy appears to be precisely focused on entrenching China as the irreplaceable production node. It is an advantage that took China forty years to build, and it won’t be dislodged in a week or a year.

Similarly, the US alliance system has been nurtured for over half a century, and China’s inducements aren’t likely to move Friends of America toward more convergence with Beijing on non-economic issues. As the United States has outperformed other advanced economies, its title as consumer of last resort will be safe for quite some time.

Put more simply, as America doubles down on being the indispensable ally and security guarantor, China is doubling down on becoming the indispensable producer of last resort. Beijing will try to do its best to ensure that its appeal won’t be undermined by good substitutes.

In this environment, to benefit from both security alliances and production nodes require countries that are not America or China to be more, let’s say, entrepreneurial in their affiliations. That’s why of the G7 + G33 countries, nearly half are designated acquends rather than friends that neither superpower can count on at 3am. Short of a cataclysmic crisis, we’ll have to get accustomed to this transitional order for some time to come.

Damien Ma is the Managing Director of MacroPolo. You can find his work on energy, politics, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe