- July 29, 2024

Nuclear Renaissance: Getting Serious about Fusion (Part III)

This piece is part of a series. Click to read Part 1 and Part 2.

Nuclear fusion, or replicating the atomic reactions in our sun, has long been touted as the “holy grail” of energy solutions. Solving fusion would finally lead to an age of energy abundance as it will deliver nearly limitless carbon-free energy with minimal radioactive waste. Every major economy with the scientific and engineering wherewithal has been chasing fusion breakthroughs for many decades.

But creating “mini suns” on earth has turned out to be exceptionally difficult, even if the actual physics of fusion have been well known for a century. Meaningful progress on commercializing fusion seemed to be always “30 years away” as the joke goes. In addition to the technical challenges of producing sustained net positive energy from fusion, building actual fusion plants is another level of engineering complexity.

On both of those fronts, however, recent breakthroughs and investments have moved the needle on fusion that merit serious attention. For one, net positive fusion energy was produced at the US Lawrence Livermore National Lab. Two, the technology choice for getting to a commercial plant seems to be leaning toward the magnet-based Tokamak design at the moment. Finally, the number of startups and funding for fusion appear more vibrant than it had been for decades.

None of this means that commercialization is within grasp, however. But it may also mean that the reality of fusion is no longer perpetually 30 years away. In this final installment of the nuclear renaissance series, we examine both the renewed dynamism in fusion as well as its real, near-term constraints.

Fusion Industry Blossoming

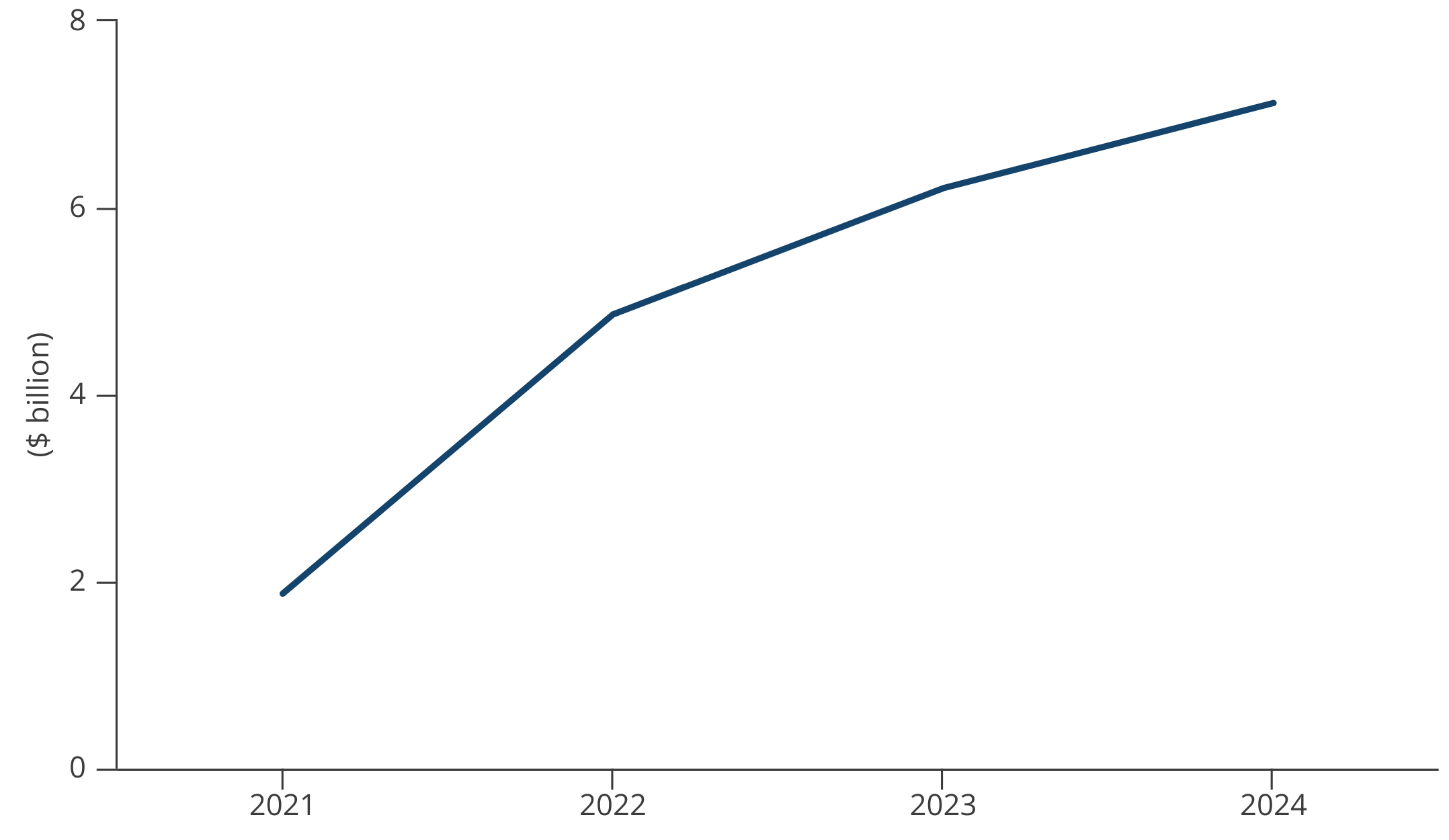

On the dynamism side of the ledger, the fusion industry has experienced an unprecedented boom over the last few years—one that is predominantly private-sector driven. Since 2021, the number of fusion companies worldwide almost doubled from 24 to 45, more than half of which are headquartered in the United States. Funding for the industry has almost quintupled in a matter of three years, reaching over $7 billion so far in 2024 (see Figure 2).

Figure 2. Fusion Industry Funding Has Grown Exponentially since 2021  Source: Fusion Industry Association (FIA).

Source: Fusion Industry Association (FIA).

If this level of funding can be sustained, it will foster a quicker innovation cycle, allowing startups to iterate on different technological choices and experiment with engineering solutions. This level of activity in a frontier industry like fusion simply wasn’t feasible until around 2020.

Investor optimism has certainly been influenced by the technological breakthrough at the National Ignition Facility (NIF) at Lawrence Livermore National Laboratory in December 2022. The NIF achieved a milestone that has eluded scientists for the better part of a century: producing net positive energy from fusion with its laser system. While the net gain of about one megajoule (MJ) of energy is just enough to power a 100-watt light bulb for two hours, the demonstration was an important proof-of-concept that controllable thermal fusion isn’t just theory but a potential reality.

From Ignition to Commercialization

On the constraint side of the ledger is the gulf between proof-of-concept and commercialization. Indeed, achieving ignition is simply a first step, and some experts have questioned whether NIF’s demonstration had reached true breakeven on energy input versus energy output. Nevertheless, that positive energy production needs to be much higher than a few MJs and be sustained for much longer for a fusion plant to actually work. Any power plant, fission or fusion, needs to operate 24/7 and supply sufficient power for communities.

What’s more, the economics of magnetically powered fusion reactors based on Tokamak designs remain murky. A hint of the unit economics of fusion plants comes from International Thermonuclear Experimental Reactor (ITER), the world’s largest collaborative magnetic fusion project involving seven member countries. The project has pushed back its operations for a decade until 2034, citing first-of-its-kind project challenges and critical supply chain issues. It has also already tallied up over $16 billion in cost overruns.

Even with concentrated private investment, Tokamak reactors have yet to demonstrate positive energy from fusion (see Figure 3). For instance, while investors seem enthusiastic about Helion Energy’s claim to deploy its first power plant by 2028, whether fusion can become truly commercially viable by 2035 remains to be seen.

Figure 3. Tokamak Confines Plasma Using Magnetic Fields

Note: Tokamak (an acronym from the Russian words for toroidal magnetic confinement) actually emerged in Russia as far back as 1958. Continued innovation and breakthroughs in superconducting magnets will be key as the strength of the Tokamak’s magnetic field is crucial for containing and stabilizing the plasma that produces the fusion reaction.

Source: International Thermonuclear Experimental Reactor (ITER).

Like all frontier industries, fusion will need much more push to get it over the “valley of death” to put it on a path toward commercialization. That push likely can’t be left to the private sector alone and will require extensive government support, both in terms of clearing regulatory hurdles and providing significant funding.

In the United States, perhaps in recognition of the highest concentration of fusion startups to date, the US Congress has already passed legislation in 2023 (ADVANCE Act) on nuclear energy. Part of the legislation seeks to simplify the regulatory pathway for fusion technology given the different technological and safety standards of fusion reactors, potentially speeding up their licensing process and subsequent deployment. This appears to mark a rare instance of regulation getting a bit ahead of a nascent industry to support it.

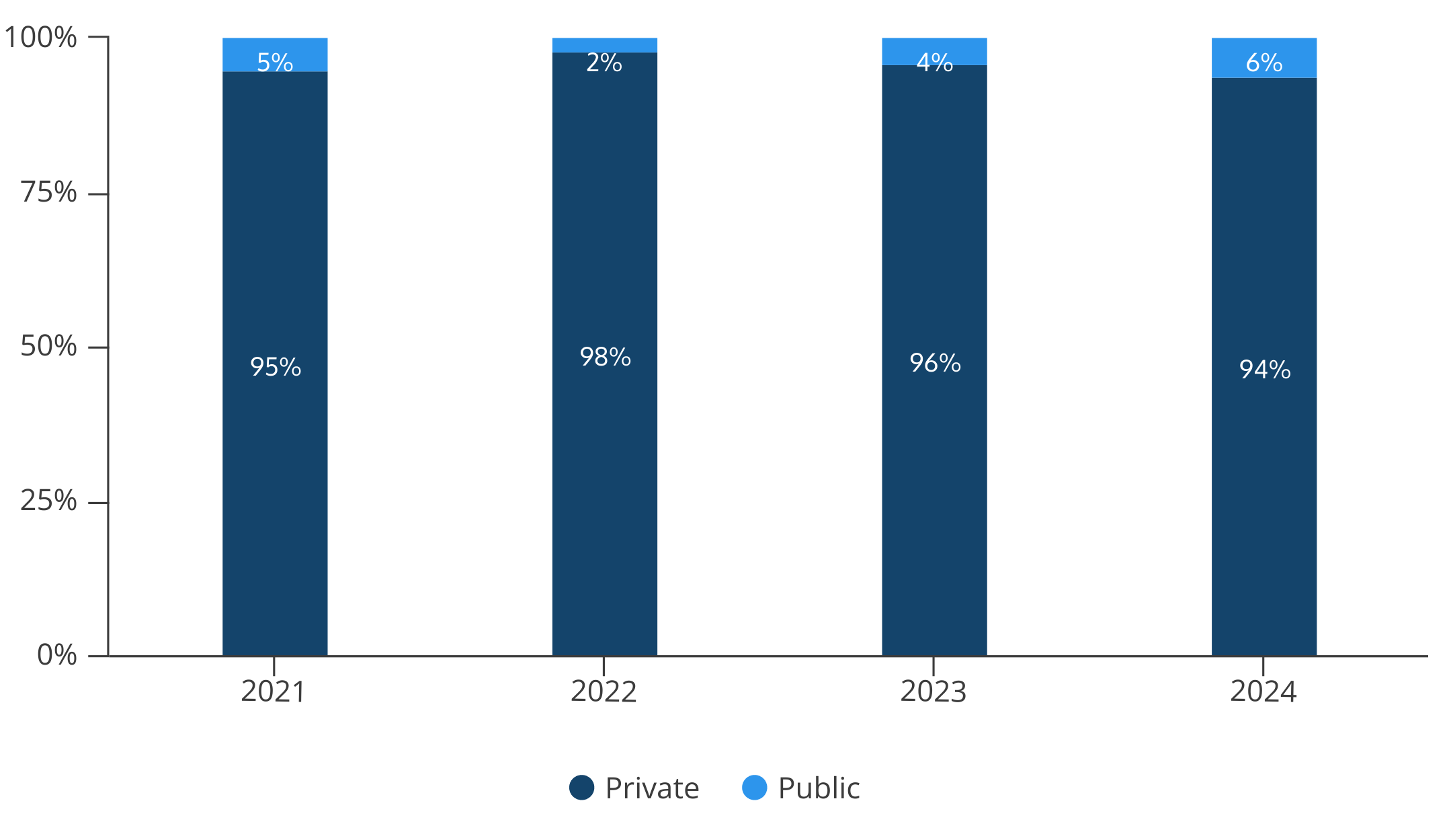

But when it comes to funding support for fusion, the public sector has been punching substantially below its weight. In fact, public spending to support private fusion companies has been minimal, totaling <$500 million as of 2024 (see Figure 4).

Figure 4. Public Funding To Support Private Sector Has Been Miniscule

Source: FIA Annual Industry Reports.

While many private sector startups are preoccupied with the design and engineering of Tokamaks, for example, the capital expenditure for an actual plant is unclear. Public spending can help defray what will certainly be significant capex on a functional pilot plant, which would constitute a major milestone in proving the commercial viability of fusion. For example, the US Department of Energy has recently moved in that direction by awarding $46 million to eight private companies. In short, a more robust public-private partnership will be necessary to accelerate meaningful progress in fusion.

If there is such a thing as a “silver bullet” in tackling climate change, commercial fusion arguably comes the closest. That’s because it can reconcile the longstanding energy trilemma of “secure, affordable, and clean”. That potential of a fusion revolution, which now seems closer than it has been in decades, has probably brought as much enthusiasm to the energy technology world as Silicon Valley has lavished on the transformative potential of artificial intelligence. Commercialization won’t happen next year, but it isn’t a pipe dream either.

Ultimately, whether it is conventional fission, small modular reactors, or fusion, there appears to be a global reawakening over the necessity of nuclear power in achieving Net Zero Emissions goals by the middle of this century. We will continue to analyze and monitor various facets of the nuclear renaissance—from market and industry developments to funding and regulations.

Amy Ouyang is a research associate at MacroPolo. You can find her work on the global energy transition and its intersection with the economy, technology and industrial policy here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe