- August 9, 2021

Powerful Provinces: How Regional Political and Economic Power Correlate in China

States have a lot of power in the US political system. In general, the “big states,” or those with considerable economic heft, also tend to be the most politically powerful states.

California is the quintessential example. It would be the world’s fifth-largest economy if it were its own country, and it has the highest representation in Congress given its population size. Texas and New York aren’t too shabby either when it comes to economic might (each state is about the size of the Brazilian economy) and political representation.

But does such a correlation hold for Chinese provinces?

Like most large, decentralized countries, politics are mainly local in China too, and political power flows through its 31 provinces and regions. But that political power is far from equally distributed and doesn’t always favor provinces with the largest economies.

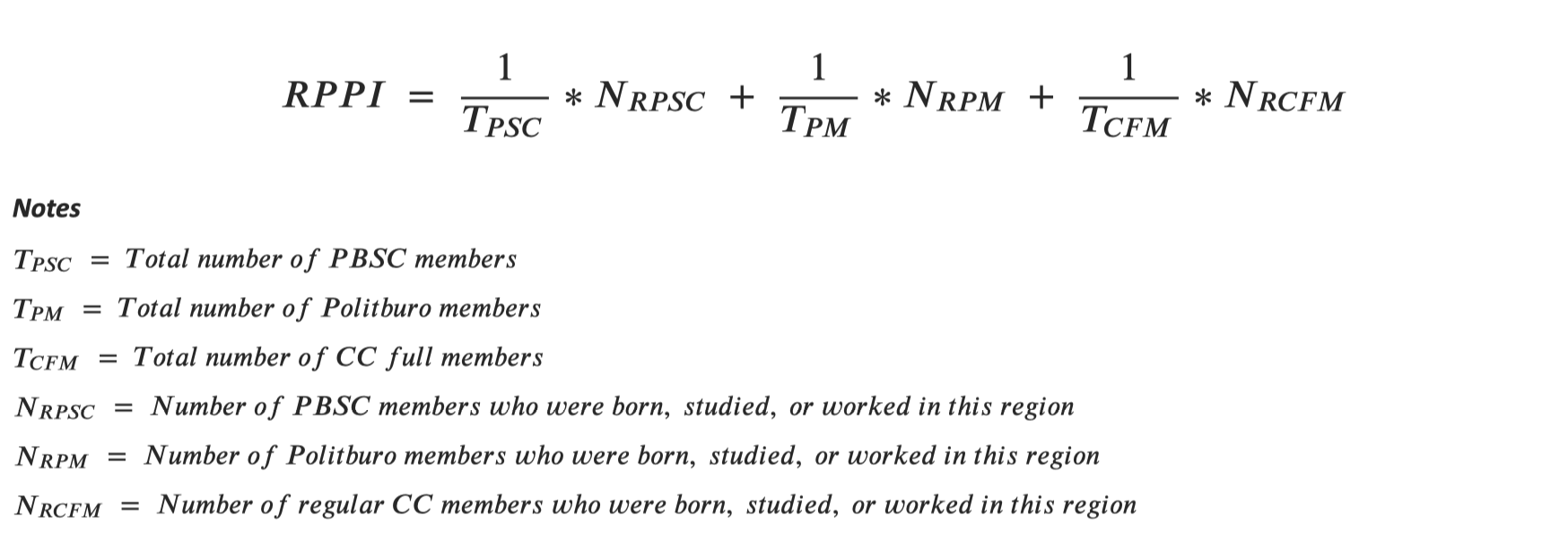

We found the correlation between provinces’ economic strength and political power shifted depending on the leadership that was in power. Based on an original Regional Political Power Index (RPPI), combined with provincial economic indicators, we estimated the correlation between the two from the Jiang Zemin to the Xi Jinping era (see Figure 1).

Covering the 14th to 19th Central Committees (CCs), the RPPI essentially traces the rise and fall of provinces’ political power over 30 years. It provides further quantitative evidence for the regional coalitions that have dominated Chinese elite politics since 1992 (see detailed methodology below).

The main insights from our index are 1) the correlation between economically and politically powerful provinces is strongest under the Hu/Wen administration but weakens under Xi; 2) Shanghai is particularly resilient when it comes to political power; 3) Xi’s power is reflected in the notable changes in provinces’ rankings.

Figure 1. Provincial Power Rankings from 1992 – 2022

Notes: Rankings based on RPPI scores (available upon request). Beijing isn’t counted in the rankings because all regional politicians end up working there as they rise in power. The provinces in which the top leaders worked previously are highlighted to help gauge top leaders’ regional coalitions and their political power. More importantly, the changes in the rankings reflect the ups and downs of their political influence. See methodology below for more details.

Source: Authors.

1. Economic Growth Reigned Supreme under Hu

As Figure 2 below shows, the correlation between provincial political power and economic power peaked during the Hu/Wen decade of rule, nearing 80% in the 17th CC. Not only were Hu/Wen unable to bring many political allies into the top echelons of political power (more details below), they were also particularly focused on economic growth. The famous “Wen Jiabao put” of ensuring 8% GDP growth was a strong political mandate to focus on growth across provinces.

Figure 2. Correlation between Provincial Economic and Political Power from 1992 – 2022Source: Authors.

That correlation was weaker during the Jiang decade, and has also fallen in Xi’s era, particularly after he consolidated power during the 19th CC. What this implies is that economic performance may no longer be grounds for political promotion under Xi, and that he relies on other metrics. This seems to corroborate with observations of his inclination toward personal networks, as well as his deliberate efforts to purge provinces’ GDP worship.

2. Shanghai’s Staying Power

The birthplace of the Chinese Communist Party (CCP), Shanghai, is both one of the most economically important and politically salient. It has ranked at the top of the regional political power pecking order in four of the six CCs since 1992, according to the RPPI (Beijing doesn’t count because all top politicians end up working there, as do American politicians in Washington, DC).

When Jiang was CCP Party Secretary during the 14th and 15th CCs, both Shanghai and Jiangsu—key regions/provinces where he spent most of his time—ranked at the top in the RPPI. Shanghai alone scored much higher than all the other provinces (refer to Figure 1). This isn’t particularly surprising in retrospect, given it has been well known that Jiang’s political coalition was formed in Shanghai, which has exerted significant influence in elite politics.

What’s more surprising is that Shanghai has had a second life under Xi, particularly in the 19th CC. However, this is no longer the Jiang-led “Shanghai clique” but a reconfigured coalition. For example, powerful players like Ding Xuexiang, Yang Xiaodu, Li Qiang, Li Xi, Gong Zheng, and Ying Yong all hail from Shanghai and were promoted under Xi’s aegis. The municipality appears to have become a springboard for Xi allies to get key positions in the CC. It is notable that having spent less than a year as Party Secretary of Shanghai, Xi has been remarkably successful in supplanting Jiang’s Shanghai coalition with new loyal allies.

3. Xi’s Influence Ripples Beyond Beijing

One way to gauge Xi’s political power is to contrast it with the previous Hu/Wen administration. When Xi took power in 2012, Hebei, Shanghai, Zhejiang, and Shaanxi—all provinces where he served political office or had considerable experience—became politically more important.

This was especially notable in the current 19th CC, after the shock and awe of the anticorruption campaign during the 18th CC. For instance, by vigorously promoting allies such as Cai Qi, Li Qiang, and Huang Kunming from 2012 to 2017, Xi was able to significantly increase the political power of the aforementioned four regions plus Fujian, according to the RPPI rankings.

Such dynamics did not hold in the Hu/Wen administration. During the entire decade of 2002-2012, all provinces in which either Hu or Wen had served did not register a high score in the RPPI. Even for Gansu province, where both of them worked previously, its RPPI ranking remained low. This implies that Hu/Wen were not able to bring strong provincial coalitions with them into the highest ranks of political power.

Instead, during Hu/Wen’s first term (the 16th CC), Shanghai remained politically powerful as it still ranked second in the RPPI, far above other regions. This seems to corroborate that the Hu/Wen administration was in many ways flanked in by Jiang’s Shanghai coalition (e.g. Zeng Qinghong and Chen Liangyu).

Although Hu put a dent in the Shanghai coalition with the arrest of Chen Liangyu in the 17th CC, Hu/Wen had to face another regional coalition: Liaoning. Indeed, as exemplified by Bo Xilai, Zhou Yongkang, and Xu Caihou—who more or less controlled national security apparatuses—the Liaoning coalition rose in political power and displaced Shanghai in its ranking.

In many ways, these findings elucidate and reinforce the evolution of powerbases between Jiang and Xi. While Hu/Wen were politically constrained, Xi appears to have been more of a political maestro in not only supplanting previous coalitions but also creating emerging ones.

Take Shandong for example. It has been one of the most politically powerful provinces, rising to the number two position in the 18th CC. It’s a coalition that counts previous Politburo Standing Committee (PBSC) members Zhang Gaoli and Zhou Yongkang as part of it, the former having served as the provincial party secretary and the latter as party secretary of Dongying city where China’s second-largest oil field is located.

By the 19th CC, however, for the first time since the 14th CC no Politburo member had working experience in Shandong , prompting it to fall to fifth place. The main reason that Shandong still remained in the top five was because powerful CC members like Wang Huning and Li Hongzhong were born there.

But the weakened Shandong coalition effect is emblematic of Xi’s relative success in dismantling previous coalitions, such as Shanghai and Liaoning. When it came to Shandong, the Party Secretary and the Mayor of the capital Jinan—Zhang Gaoli’s former allies in Shandong—were swept up and arrested in the fierce anticorruption campaign. Xi then proceeded to install his former Shanghai colleague Wang Wentao as Mayor of Jinan, disrupting the Shandong coalition.

More important, Xi’s increasing political power has had spillover effects in elevating provinces that aren’t the traditionally powerful ones. The making of a new “Guizhou gang” is one such example. The RPPI ranking of Guizhou, where Li Zhanshu (PBSC member), Chen Miner (Politburo member), and Zhao Kezhi (Minister of Public Security) all worked previously, rose from last place in the 17th CC to the top 15 in the 19th CC.

Moreover, current Guizhou Party Secretary Chen Yiqin, who worked with the three politicians above but never directly worked with Xi, appears to have solid prospects for promotion in the upcoming 20th CC. Chen could well replace Sun Chunlan as the only female Politburo member.

The rise of Guizhou politically seems to further validate the divergence between political power and economic power in the Xi era. The province is not an exemplar when it comes to economic performance, being one of the most debt-laden provinces in China. The same goes for Shandong—while it is China’s third-largest provincial economy, its political standing is no longer commensurate with its economic power.

——–

The center of gravity for Chinese politics are the provinces, not bureaucratic politics in Beijing. So regional coalitions have long been a defining feature of Chinese elite politics: they prompt political competition within the CCP and are a useful gauge of the strength of a given Chinese leadership’s political power.

Occasionally, competition between coalitions can get so intense that it becomes a major challenge to maintain political stability. This underlying reason is why top leaders tend to build strong coalitions to head off any potential challenges from other coalitions.

Powerful provinces, in other words, go a long way toward shaping powerful leaders.

Methodology: Quantifying Regional Political Power

1. What is the Regional Political Power Index (RPPI)?

We created the RPPI to estimate the political power of China’s 31 provinces/regions from the 14th to 19th Central Committees (CCs), covering a span of 30 years (1992-2022).

The index is a weighted score of how many CC full members were born, studied, or worked in a particular region—factors we believe that are crucial for gauging coalition formation at the provincial level.

Education and professional networks based on where people went to university and places of work within a province are obvious enough. Birthplace is also important because that can determine personal networks, but also because giving back to their hometowns to improve local conditions is a big part of many Chinese people’s self identity. In short, provinces are where CC members spend most of their time developing various networks, forming personal alliances, and accumulating their political capital.

When CC members are promoted to higher office, they tend to promote officials from their regional political coalitions. Therefore, changes in RPPI rankings can be interpreted as quantifying the rise and fall of regional coalition powerbases over six CCs.

2. Calculating the RPPI

For the purposes of this index, we only looked at full members of each CC and did not include alternate members (average sample size 190 members). This is because full members have the best chances of accruing more political power by being promoted into the Politburo and eventually the Politburo Standing Committee (PBSC).

We then coded full members for each CC since 1992 into the provinces where they were born, studied, or worked in. We also assigned different weights to each full member based on three position tiers: PBSC member, Politburo member, and regular full member, with the PBSC having the highest weight.

For example, a PBSC member in the 19th CC is assigned a weight of 1/7 (PBSC members vacillate between 5 to 9 people). But that weight only applies to five members of the PBSC because the Party Secretary (PS) and Premier are excluded.

We calculated the RPPI as such:

A note on the exclusion of PS and Premier, typically the number 1 and 2 positions on the PBSC for each of the CCs. We made this choice in order to better test the PS and Premier’s political influence and coalitions within a province.

In other words, we wanted to see whether a province/region’s RPPI score stands on its own or is highly skewed by the “top dog” effect. If the former, that means the “top dog” was able to increase the province’s political power by bringing a coalition into the province. If the latter, that means the “top dog” effect disproportionately affects the province’s political power, implying that he or she was not particularly successful in bringing a coalition into the province to sustain its score.

Mathematically speaking, when we assign different weights to the “top dog,” provinces with a notable change in their RPPI ranking fit the “top dog” effect, while provinces with a stable RPPI ranking means the “top dog” succeeded in bringing coalitions along to ensure the province’s staying power.

Take the Hu/Wen-led CC and the current Xi-led CC for example. Hu/Wen fits the “top dog” effect case. In our tests, we assigned multiple weights from 1 to 0 to Hu and Wen and found that the ranking for provinces in which they served previously, such as Anhui, Gansu, Tianjin, Tibet, and Guizhou, all dropped significantly.

This does not hold true for Xi. Excluding him from the scores of Fujian, Hebei, Zhejiang, Shaanxi, and Shanghai—all key regions where he held political office—the regions still perform well on their ranking. This implies Xi fits into the former case above and is politically more powerful.

Another minor caveat is that we excluded regular full members if they had either died or were arrested before the completion of the five-year CC. However, all Politburo members in each CC were counted—such as Chen Liangyu and Bo Xilai—irrespective of whether they were arrested or died. This is because Politburo members tend to have significant political influence within the CC they served, while regular CC members carry very little weight.

2. Regional Economic Power

We used the five-year averages of aggregate GDP and GDP per capita to gauge regional economic power during each CC period. We used both because GDP directly reflects the regional economic weight, while GDP per capita can reduce the impact of the population size on economic output.

More specifically, we wanted to see whether there could be a significant difference in correlating regional political power with aggregate GDP vs. per capita GDP. We found no significant difference, except for a slight divergence between the 17th and 18th CC.

3. Ranking and Correlation Between Regional Political Power and Economic Power

For each CC, we ranked provinces/regions according to their RPPI scores and aggregate GDP and GDP per capita averages in descending order to compare each region’s political power and economic power ranking.

In order to reveal the relationship between regional political and economic power, we calculated the Pearson’s correlation between each region’s political power rank in the current CC with that region’s economic power rank in the previous CC. That is, we computed the correlation between the regional political power rank in the 19th CC and the regional economic power rank in the 18th CC. For simplicity, we use the correlation of only the aggregate GDP with the RPPI.

We do this because the composition of each CC, which determines regional political power, is formed at the start of the five-year period. Meanwhile, the region’s average economic performance can only be determined at the end of the five-year period, which can affect the composition of the next CC but not the current one.

In fact, our calculation also confirms this assumption because the correlation between regional political power rank and economic power rank in the same CC is always lower than the correlation between regional political power rank in current CC vs. the regional economic power rank in the previous CC.

4. Limitations

1. For each CC member, we treat their provincial experiences equally. We fail to estimate each experience’s duration or to evaluate each experience’s importance.

2. We include military personnel who are full members in the RPPI calculation. However, since Chinese military regions are usually concentrated in specific provinces, including military personnel in the calculation may increase the RPPI value for some provinces.

Damien Ma is the Managing Director of MacroPolo. You can find his work on energy, politics, and other topics here.

Ruihan Huang is a summer associate at MacroPolo.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe