- March 31, 2022

Supply Chain Diversification in Asia: Quitting China Is Hard

A series of disruptive events over the last few years—from the pandemic to the US-China trade war and traffic jams at ports—have led to many ponderous conclusions that everything about supply chains will change.

Rising concerns about economic security and geopolitical volatility have intensified the unprecedented focus on the origin of products. And of course, China sits at the center of this because it is, after all, where many goods are made.

Judging by endless headlines about supply chain diversification and reshoring, it would appear that much of the Asian supply chain is being refashioned as a result of recent volatility. But is that reality or just a case of the illusory truth effect?

The electronics and machinery sector would be a useful proxy to examine supply chain shifts, as it is the largest category in global trade by value. It also happens to be an industry that China dominates in both production and exports, with established intra-Asian supply chains.

The numbers tell a different story from what the headlines suggest. In fact, when it comes to electronics and machinery, the Asian supply chain remains little changed. While there has been some diversification from China, this “shift” is actually less than meets the eye.

For instance, at first glance China’s electronics exports to the United States dropped 10 percentage points from 2018 to 2021, with much of that slack picked up by Southeast Asia (see Figures 1a & 1b). That may appear as if China has been losing out at the expense of Southeast Asian countries, particularly Vietnam.

Figure 1a. China Declines, Southeast Asia Rises in Electronics Exports to US Source: US Census Bureau; author calculations.

Figure 1b. Vietnam Made Up More Than Half of the Export Decline from China

Notes: Figure 1a shows share of each country in US imports (customs value in US dollar). Figure 1b shows the composition of US imports increase by country of origin from 2018 to 2021. All data for Electrical Machinery and Equipment category only.

Source: US Census Bureau; author calculations.

However, the benefits accrued to Southeast Asia are relatively marginal. It’s true that the “Made in” label has switched from China to Vietnam for some products as the latter took over final assembly, the lowest part of the value chain. But China’s overall manufacturing levels have remained consistently high even during the global recession triggered by the pandemic. Relative to China’s overall production volume, the shift to Southeast Asia is negligible at the global level (see Figure 2).

Figure 2. China’s Manufacturing Weathered the Pandemic Fine

Source: World Bank; author calculations.

The subsequent analysis relies on mini cases of major companies—from Apple to Acer—in the consumer electronics industry to capture a more realistic picture of the recent changes and relative positions that countries take along the “Smile Curve” value chain. Although far from a holistic examination of Asian supply chains, this analysis nonetheless shows just how entrenched supply chain composition can be.

Case 1: Apple (US company)

Apple’s reliance on the Asian manufacturing ecosystem, and specifically China, is well known. Thus, the company’s decisions can serve as a leading indicator of electronics supply chain movements. Between 2019 and 2021, Apple slightly decreased the number of its manufacturing locations in mainland China from 47.9% to 42.4% (see Figure 3).

Figure 3. Apple Has Reduced Its Supplier Sites by 25% Over the Pandemic Years

Notes: The data, which reflects 98% of Apple’s production chain, shows the distribution of supplier sites by physical location, not by the headquarters of the firms. Supplier sites totaled 759, 799, and 611 for the three years shown. Apple’s reduction of its supplier sites has also led to a modest redistribution of suppliers across countries.

Source: Apple; author calculations.

But that reflects less of a significant shift from China than the fact that Apple has been consolidating its supply chain over that period. The company has reduced its total supplier sites by one quarter (from 799 in 2019 to 611 in 2021), and it is but natural that China-based sites account for a large portion of the total cut.

Delving further into these suppliers, many of the sites Apple removed from China were specializing in labor-intensive work such as packaging and metal production. At the same time, Apple added 14 new Chinese suppliers to its roster in 2021, many of which were higher value, knowledge-intensive manufacturers of intermediate goods like optical components, sensors, and connectors.

Much of that labor-intensive work is being relocated to Southeast Asia, which has seen its share of Apple supplier locations rise from 11.6% in 2017 to 15.1% in 2021, to nearly match the second-largest share in Japan.

Within Southeast Asia, Vietnam has been a standout (see Figure 4). This is in part because 11% of Apple’s 200 suppliers—mainly composed of Taiwanese, South Korean, and Japanese firms—already had at least one manufacturing site in Vietnam before the pandemic. Therefore, these suppliers expanded operations in Vietnam with relative ease, capturing the low-end assembly and packaging segments that Apple was shedding from China.

Figure 4. Apple Suppliers Have Eyed Vietnam for Expansion

Notes: The data shows the number of plants opened by Apple’s suppliers in respective countries, not when these suppliers began production for Apple.

Source: Apple; author calculations.

Two other important Southeast Asian countries for Apple’s supply chain are Singapore and Malaysia, where US and EU firms serve as subcontractors for R&D and high-precision manufacturing. This trend, however, is not particularly new, as both countries have occupied this segment since the 1960s.

But Thailand, Indonesia, and the Philippines have not captured much of Apple’s modest diversification into Southeast Asia. So far Thailand and the Philippines have seen just two new sites each, while Indonesia has seen none. Reported concerns over operational, regulatory, and fiscal bottlenecks in some of these countries are apparently holding companies off.

Thus, the composition of Apple’s supply chain remains basically the same as before the trade war and pandemic. That is, R&D and most knowledge-intensive parts of the value chain are done in more advanced economies; end assembly and production of the simplest components are being gradually relocated from China to lower-cost countries such as Vietnam. But China is still home to the bulk of Apple’s supply chain.

Case 2: Samsung Electronics (South Korean Company)

If there’s one company that has diversified significantly into Vietnam, it is South Korea’s Samsung Electronics. Much of this started before the pandemic, and by 2017, Samsung accounted for nearly a quarter of Vietnam’s exports. The company has consistently ranked as a top 10 foreign investor in Vietnam over the past decade.

By the time the US-China trade war hit, Samsung leveraged the concern over having supply chains in China for a media campaign around closing “its last plant” in China in 2020. The company cited the reasons for its move as lost market share in China, political risk exemplified in 2017’s boycott of Korean products, and better investment and labor market conditions in Vietnam.

That publicity belied a more complicated reality. Although the share of Samsung’s China-based suppliers did decline from 2017 to 2021, China still made up nearly 13% of the company’s supply chain, far from having the last plant closed. The company just no longer had final assembly points in China, which allowed it to tout the “Samsung leaves China” story.

Figure 5. Samsung “Leaving” China Is More About a Return to Homebase

Notes: The data, which reflects 80% of Samsung Electronics’ suppliers by value, shows where supplier sites are physically located, not the headquarters of the firms. Total supplier sites were 178 and 189 for 2017 and 2021, respectively.

Source: Samsung Electronics; author calculations.

Moreover, the main beneficiary of Samsung’s move wasn’t Vietnam but South Korea—over 30% of Samsung’s supplier sites are now there, and only 14% in Vietnam (see Figure 5). In terms of supply chain segments, what moved to Vietnam were production of simple components (audio, video, PCBs) and assembly, while the knowledge-intensive segments went back to South Korea.

In this sense, Samsung has taken a similar approach to Apple: moving the lowest segments of production from China to Vietnam and “reshoring” the more complex R&D capacities back home. But when it comes to the middle part of the production chain and intermediate goods, China is still irreplaceable.

Case 3: BBK Electronics Corp (Chinese company)

For being the world’s largest smartphone manufacturer, BBK (步步高 in Chinese) is hardly a household name. As the parent of the brands Oppo, Vivo, OnePlus, Realme, and iQOO, BBK shipped 23.7% of all smartphones globally in 2021, surpassing that of Samsung (19.5%) and Apple (17.1%) (see Figure 6).

Figure 6. BBK Leads the Pack in Smartphone Exports (# of shipped devices)

Note: BBK data includes Oppo, Vivo, OnePlus, iQOO, and Realme shipments.

Source: Counterpoint quarterly market data; author calculations.

Given that the company is headquartered in Guangdong, one of the world’s greatest manufacturing hubs, and relies exclusively on in-house production for all its brands, it may be somewhat surprising that BBK has 25 plants globally (see Figure 7).

Figure 7. BBK’s Supply Chain Is More Diversified Than Expected

Note: Announcement on major expansion in existing plant is counted as one additional facility.

Source: BBK Electronics; author calculations.

But BBK’s strategy for diversification is to be closer to end consumers. The company has established overseas manufacturing capacity in Indonesia, India, Pakistan, and Bangladesh, with an aim to saturate the Southeast and South Asian markets. Recently it has further expanded in Noida, India to be within proximity to new export markets in Africa and the Middle East. It has also set up a plant in Turkey with the intent of making inroads in the European market.

Unlike its erstwhile South Korean and American competitors, BBK has largely bypassed setting up shop in Southeast Asia (Vietnam and Indonesia were considered but turned down). The region didn’t fit the company’s strategy of expanding into developing countries with large underserved markets.

Still, even a Chinese company with “homecourt advantage” in terms of supply chains has followed the diversification pattern seen above. BBK, too, outsourced the simplest production to countries with cheaper labor, while keeping the bulk of production in China.

Case 4: Acer (Taiwanese company)

Although not a smartphone maker, Acer is a top ten Taiwanese consumer electronics manufacturer, particularly of laptops. Since Acer overhauled its business model from in-house to outsourced manufacturing in the early 2000s, its choices on supply chains are worth observing.

All of Acer’s assembly is located in mainland China (14 sites). Of the 169 manufacturing sites that Acer has, including 24 major subcontractors, one-third are located in China, 21.3% in Southeast Asia, 11.2% in Taiwan, and 7.7% in the United States (see Figure 8).

Figure 8. Acer Has Relatively Even Distribution of Supply Chains

Notes: The data shows all 169 suppliers’ manufacturing sites, regardless of whether they are producing specifically for Acer at that location.

Source: Acer; author calculations.

In the wake of the trade war and pandemic, the company’s supply chain barely budged. Only a few supplier sites closed down in China and Southeast Asia, but that was driven by production optimization. Acer maintains its R&D in Taiwan or the United States, contracts Southeast Asian-based factories for simple components, but still keeps an integrated supply chain in China. Even amid rising cross-strait tensions, the economic case for maintaining this status quo is strong.

Say Cheese: The Smile Curve Endures

Acer isn’t just a consumer electronics giant, it is also a pioneer in conceptualizing the global value chain of the industry. The company’s founder Stan Shih developed the now famous “Smile Curve” to represent the value added in each segment of the value chain (see Figure 9).

Figure 9. Manufacturing Sits at the Bottom of the Smile Curve Value Chain

Source: Adapted from Shih, S. (1992). Empowering technology—making your life easier. Acer’s Report, New Taipei.

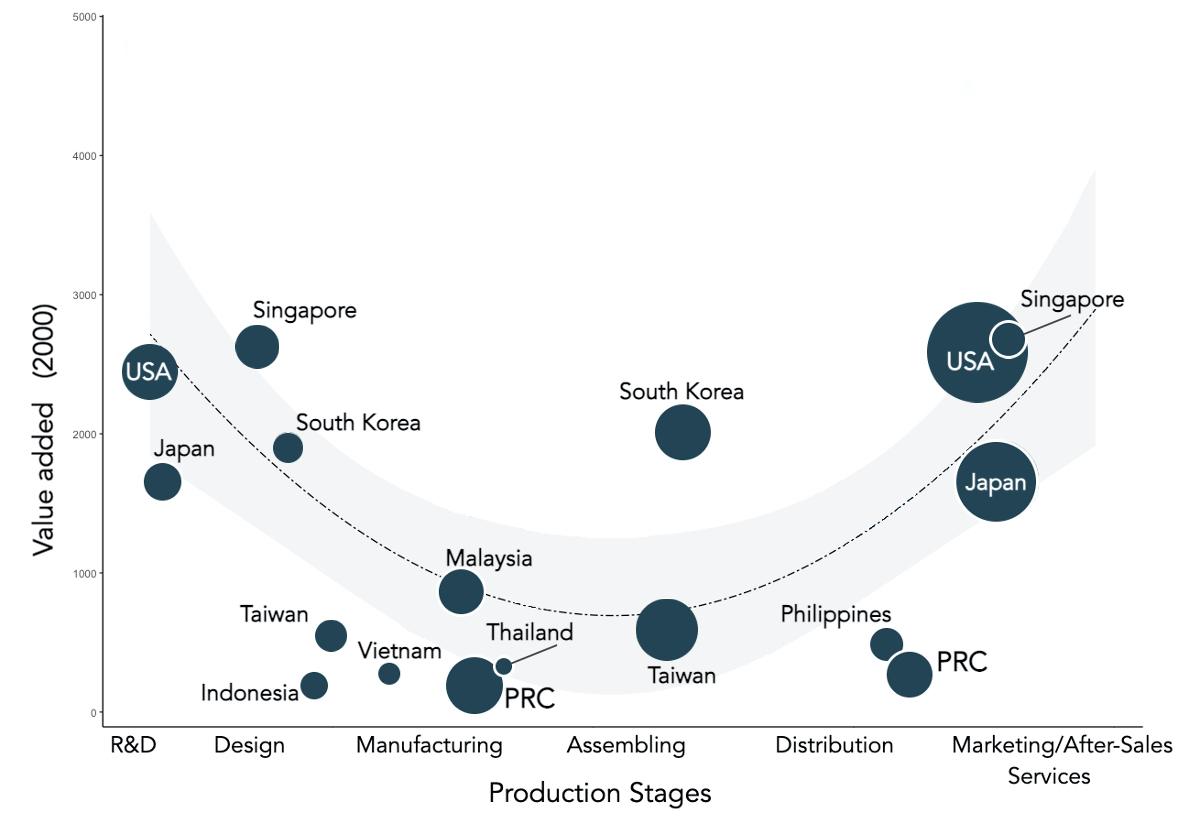

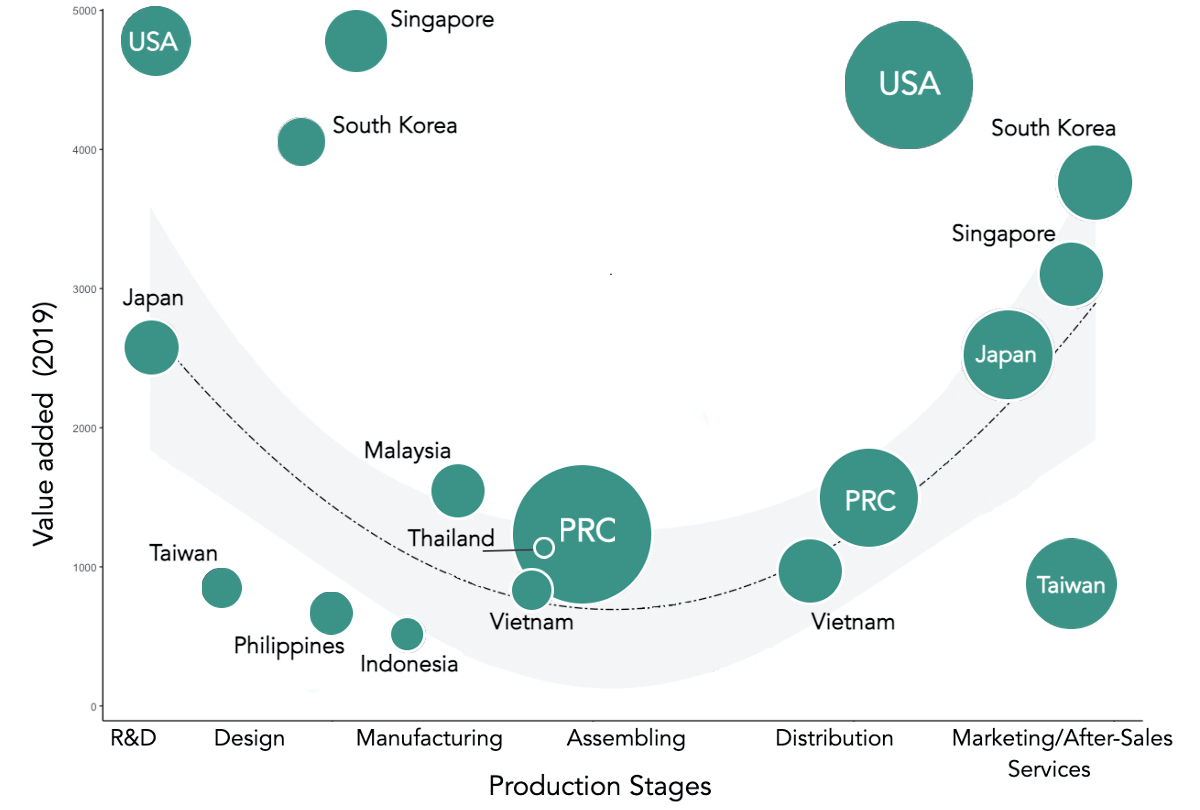

Using trade and labor cost data, countries in this analysis can be plotted along the “Smile Curve” (see Figure 10). The results show that their positions along the curve have been largely stationary over the past two decades. Advanced economies like the United States, Japan, and South Korea occupy the higher ends, while China and Southeast Asian countries have continued to hover around the bottom.

Figure 10. Positions Along Smile Curve See Little Change, 2000 vs. 2019

Notes: The x-axis represents country/industry position in the production stage based on ADB MRIO data on Average Propagation Length. The y-axis represents labor productivity using ILO data on mean nominal monthly earnings by economic activity in PPP adjusted 2017 US dollar. The size of the circles represents total value added to the global value chain by country/industry. Methodology is adapted from “Measuring Smile Curves in Global Value Chains,” Meng, B., Ye, M. and Wei, S.-J. (2020).

Notes: The x-axis represents country/industry position in the production stage based on ADB MRIO data on Average Propagation Length. The y-axis represents labor productivity using ILO data on mean nominal monthly earnings by economic activity in PPP adjusted 2017 US dollar. The size of the circles represents total value added to the global value chain by country/industry. Methodology is adapted from “Measuring Smile Curves in Global Value Chains,” Meng, B., Ye, M. and Wei, S.-J. (2020).

Source: ADB MRIO Database; UIBE GVC Index Team, “Data files structure of the UIBE GVC index system”; ILO; national statistics bureaus; author calculations.

If anything, countries like China and Vietnam are expanding in their existing positions along the curve rather than meaningfully shifting towards either of the higher ends. Despite growing larger in size, Southeast Asian countries still pale in comparison to China. Advanced economies continue to dominate the ends of the curve that are the most profitable parts of the global value chain.

Is Vietnam the New Guangdong?

This analysis shows that supply chain diversification is much easier said than done, at least when it comes to the machinery and electronics industry. Even with the modest diversification from China to Southeast Asia in the last few years, the segment of the value chain that each country occupies has remained largely the same.

Short of unpredictable cataclysmic events, supply chain composition in the foreseeable future isn’t likely to deviate from the observed trend, with China remaining by far the “factory of the world” when it comes to consumer electronics production.

Southeast Asia will continue to capture a fraction of the assembly and basic production that China is increasingly shedding in a bid to move up the Smile Curve. But within Southeast Asia, not all countries are made the same, with Vietnam being the standout in growing its production base.

In many ways, Vietnam could be thought of as Guangdong province, but 10 years ago. Indeed, 2021 Vietnam’s population size, demographics, and wages are similar to 2011 Guangdong (see Table). Vietnam has also taken a chapter out of China’s playbook in proactively attracting foreign investors through preferential taxes and a proliferation of industrial parks.

Vietnam Today Is Comparable To Guangdong a Decade Ago

Source: ILO; national statistics; author calculations.

Yet if the Guangdong analogy holds, Vietnam’s advantages may not be sustained for long. For instance, by 2024 Vietnam would be fully compliant with labor requirements in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the EU-Vietnam Free Trade Agreement, putting upward pressure on wages. That was what happened to Guangdong in 2015, when the province in one fell swoop increased its minimum wage by nearly 20% and as a result, lost some luster in the eye of foreign investors.

Vietnam will likely continue to improve its infrastructure and labor force resilience to remain as attractive a market as possible. But its role in the Asian supply chain may be limited to being a satellite of the “global factory” next door. For now, “quitting China” appears much harder than what the headlines and rhetoric may suggest.

Rita Rudnik is a Summer Associate at MacroPolo.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe