- May 23, 2024

The Permanent Magnet Supply Crunch That Wasn’t

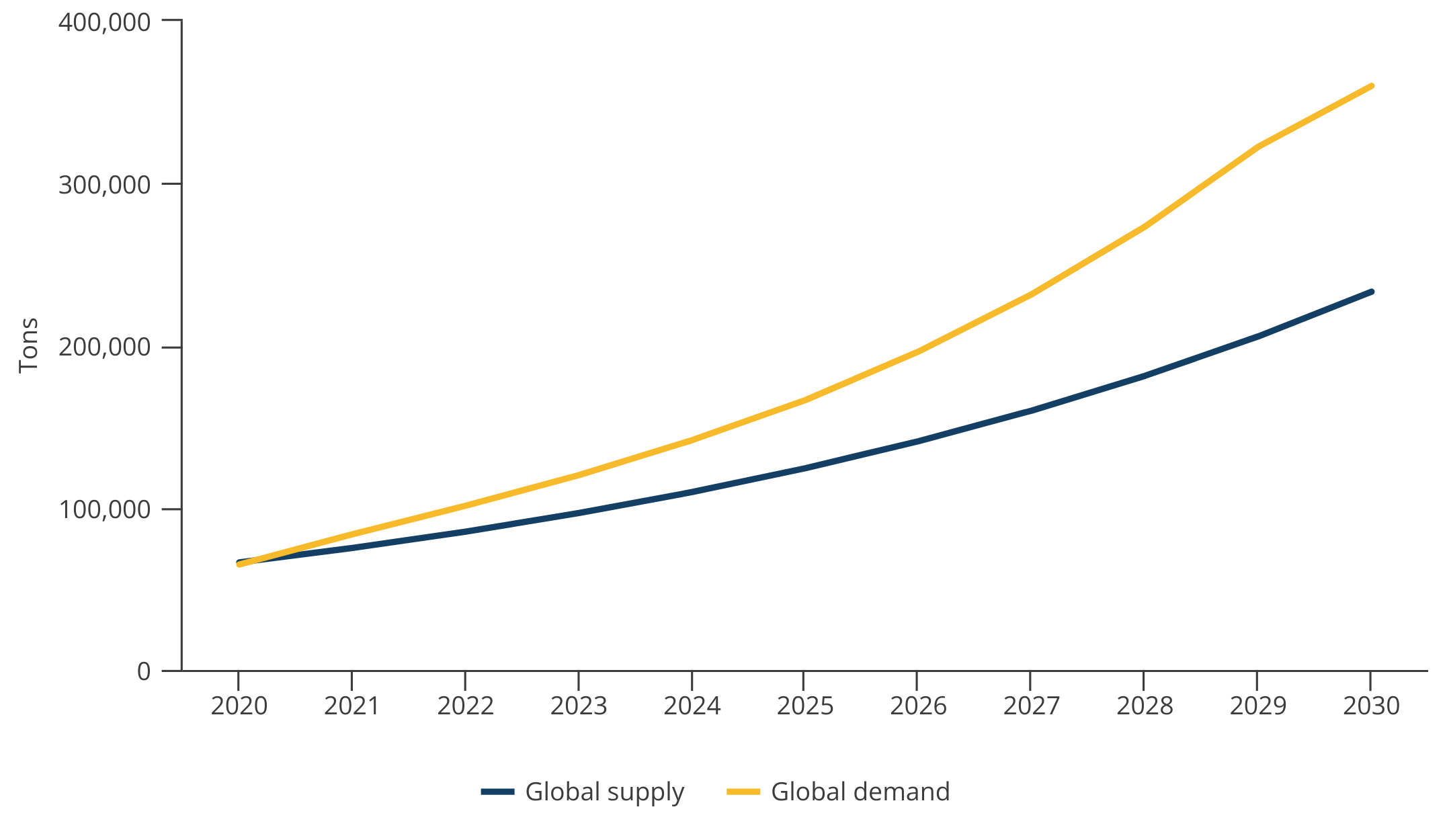

When we released our case study on permanent magnets a few years ago, it appeared a global supply shortage was imminent, as demand from electric vehicles (EVs) and wind turbines was poised to outpace the ability of suppliers to keep up (see Figure 1). These aren’t just any permanent magnets, but high-performance sintered neodymium-iron-boron (NdFeB) magnets that are integral to electric motors.

Figure 1. Permanent Magnet Supply Shortage Was Expected as Early as 2022

Note: Global demand for high-performance NdFeB magnets projected to increase at 18% CAGR, while global supply projected to grow at 13.4% CAGR. The supply deficit is estimated to grow through 2030.

Source: Huajing Industrial Research Institute; Frost & Sullivan; and authors’ calculations.

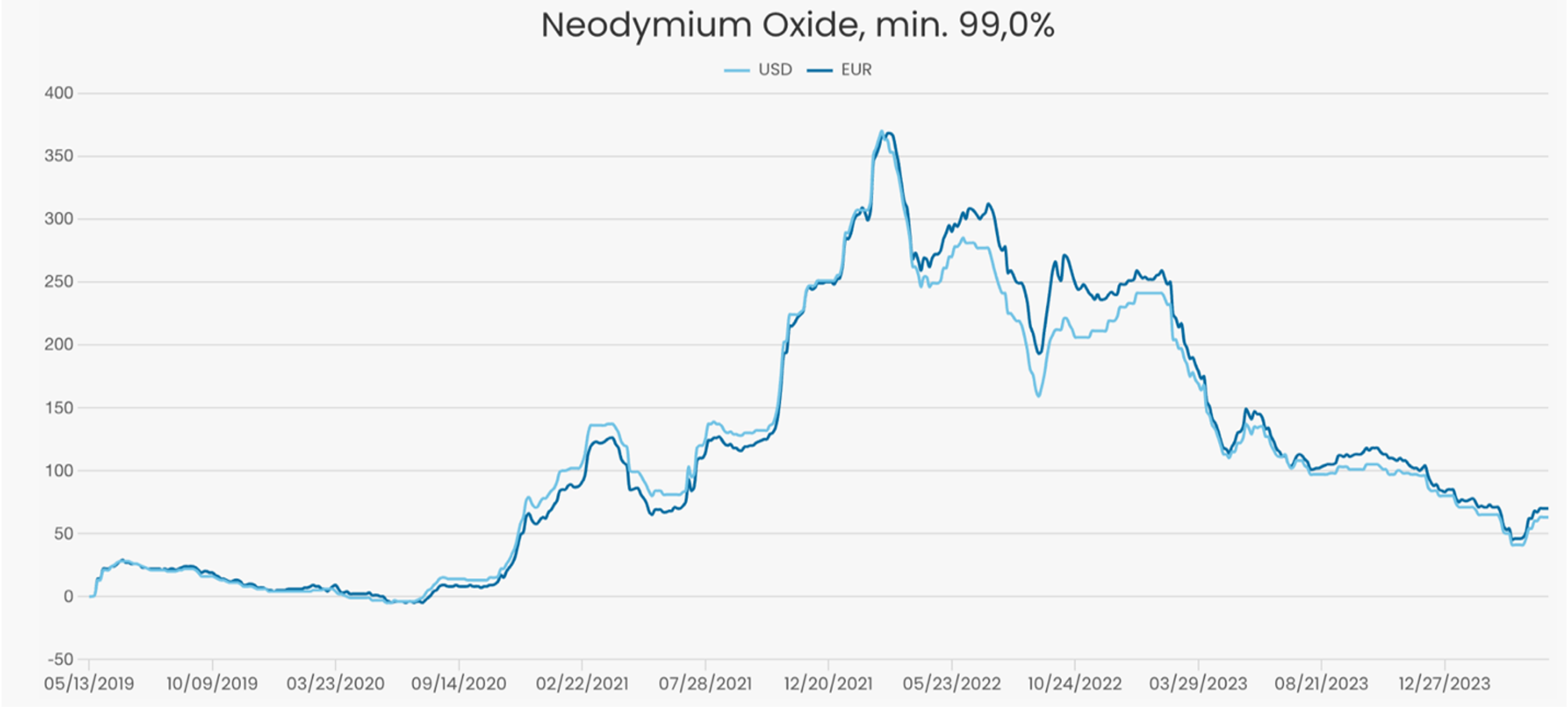

Although China was already the largest supplier of high-performance NdFeB magnets in 2021, commanding roughly 90% of global market share, there were questions about whether even Chinese capacity could keep up. But the supply crunch didn’t seem to materialize, as implied by declining neodymium oxide prices since 2021. More than three quarters of the cost of NdFeB magnets is attributed to neodymium oxide, so its price is a good proxy for supply and demand changes (see Figure 2).

Figure 2. Neodymium Oxide Prices Have Been Falling Since 2022

Source: Strategic Metals Invest.

That price decline, we believe, has more to do with significant supply ramp-up than with weakening demand for magnets. This update focuses on what appears to be Chinese suppliers’ central role in averting a supply crunch and some of its implications for the global cleantech supply chain.

Chinese Suppliers Stepped Up

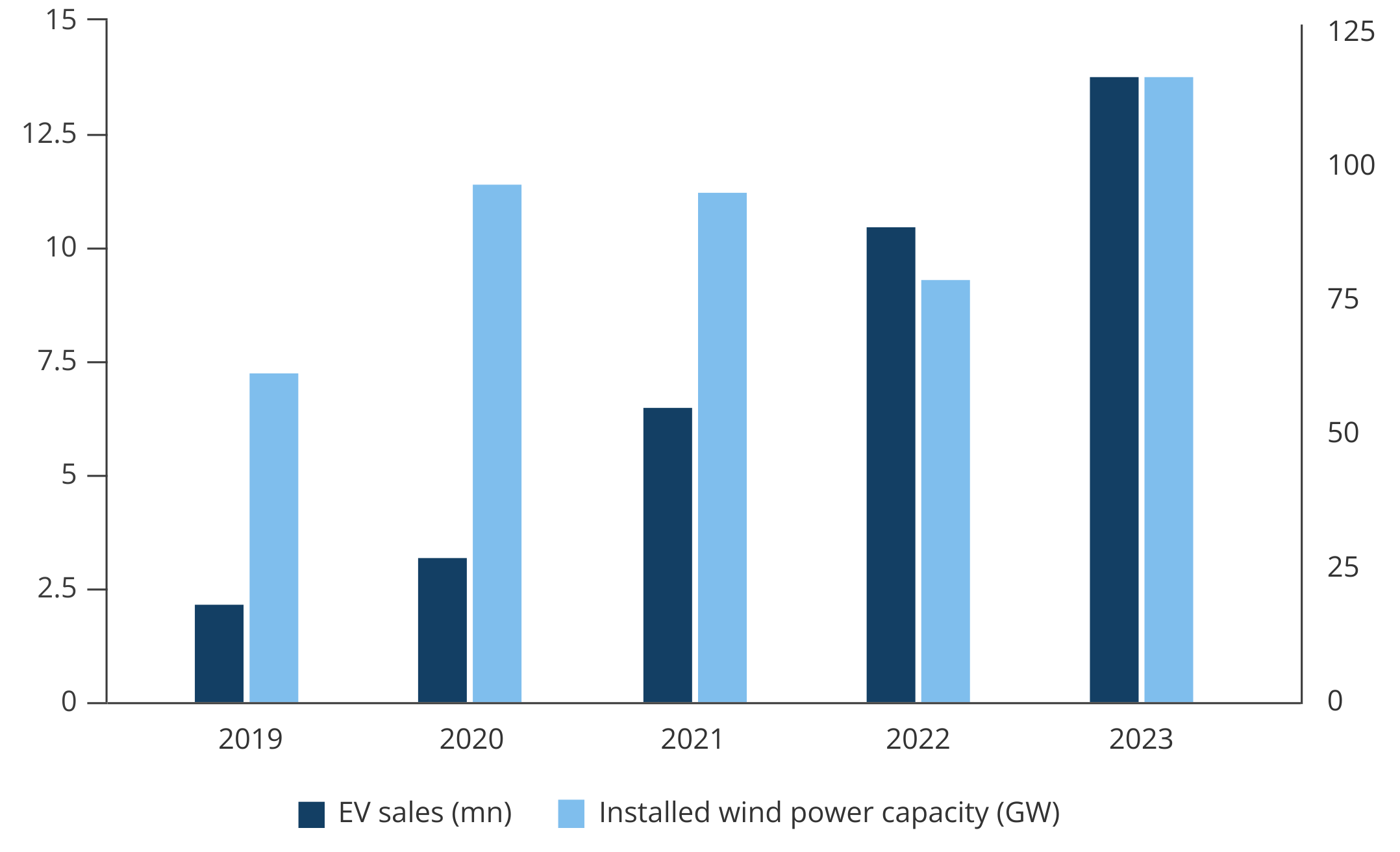

The demand drivers for NdFeB magnets boomed during the 2020-2023 period, as those years saw up to 60% growth in annual EV sales and some of the highest wind power installation rates globally (see Figure 3). Just take EVs: one EV can contain anywhere between 2.5 kg to 10 kg of NdFeB magnets. If taking the higher end of 10 kg, China would’ve needed at least 35,000 tons of those magnets for the 3.5 million EVs it produced domestically in 2021, not to mention exports.

Figure 3. Boom Times for EVs and Wind Turbines

Source: BloombergNEF; Global Wind Energy Council.

At a minimum, it looked like permanent magnet supplies were going to be very tight going forward. But behind the scenes, Chinese suppliers were already undergoing a rapid capacity expansion by 2019 in anticipation of the magnet demand boom. Take Jiangxi-based JL Mag, one of China’s six leading magnet producers, which more than doubled its high-performance magnets production from just 6,631 tons in 2019 to nearly 13,000 tons by 2022.

That same year, JL Mag began construction of its second plant in Baotou, Inner Mongolia—China’s rare earths mecca—that will add another 12,000 tons of capacity when it’s complete later this year. If all goes according to plan, by 2025, JL Mag should be able to produce 40,000 tons of permanent magnets alone, or about 75% of China’s total production in 2021. Another major supplier, Ningbo Yunsheng, is completing another plant in Baotou that should yield 15,000 tons of NdFeB magnets capacity by the end of 2024.

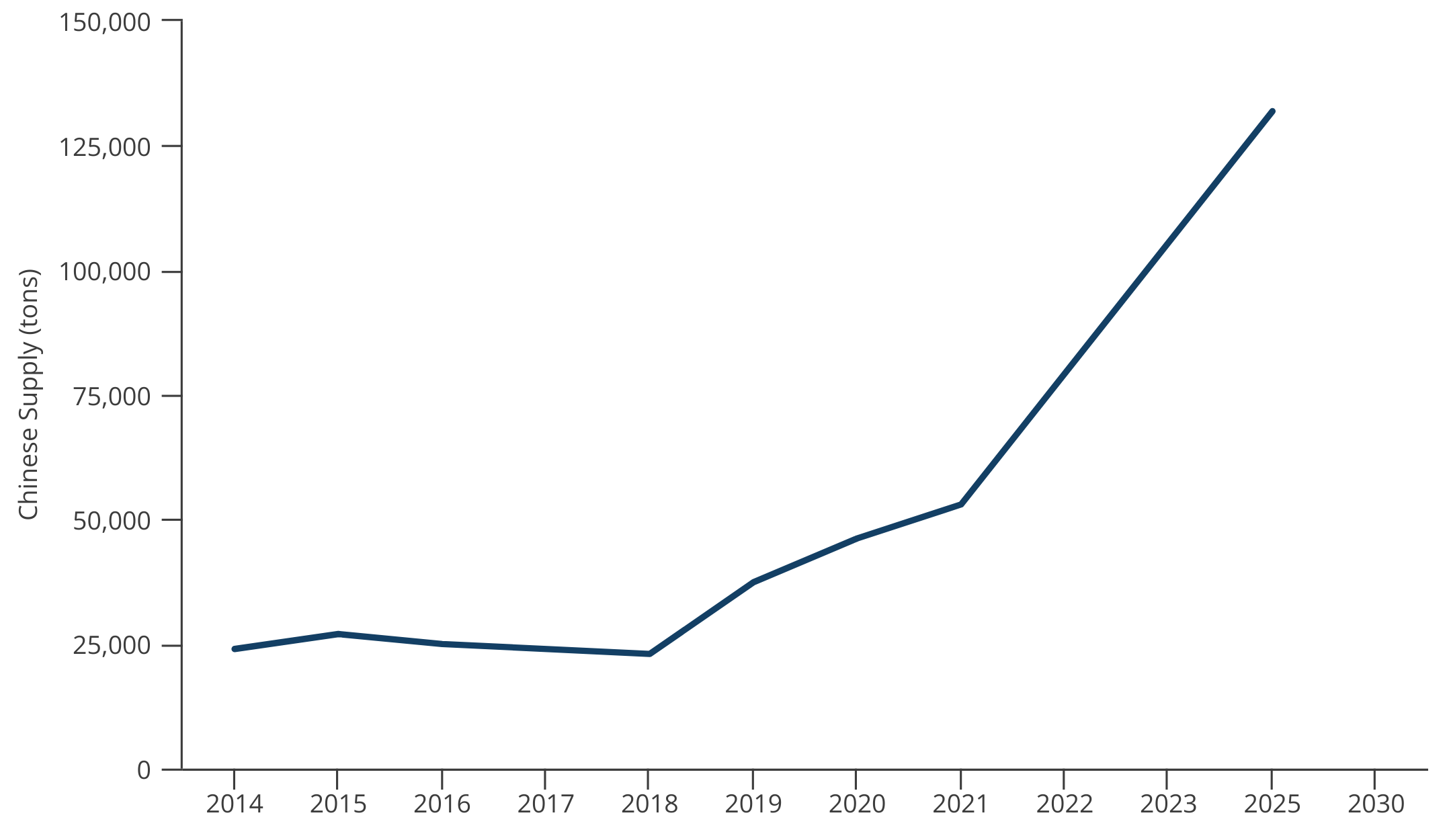

As a result, China’s NdFeB magnet supply is projected to grow at twice the global CAGR in Figure 1 from 2021-2025, reaching nearly 132,000 tons by 2025 (see Figure 4). While the preponderance of supply expansion is centered on China, additional marginal supply from Germany and Japan has also helped to avoid the anticipated supply crunch. Precise magnet production volumes for German and Japanese suppliers are unavailable, but successive revenue growth from companies like Vacuumschmelze (VAC) and Hitachi Metals suggest they also benefited from the magnet demand boom.

Figure 4. Chinese High-Performance Magnet Production Ramps Up From 2019

Note: 2017 data unavailable.

Source: China Association of Automobile Manufacturers; Association of China Rare Earth Industry; Ping An Securities; Guotai Junan Securities; and Gongyan Industrial Report.

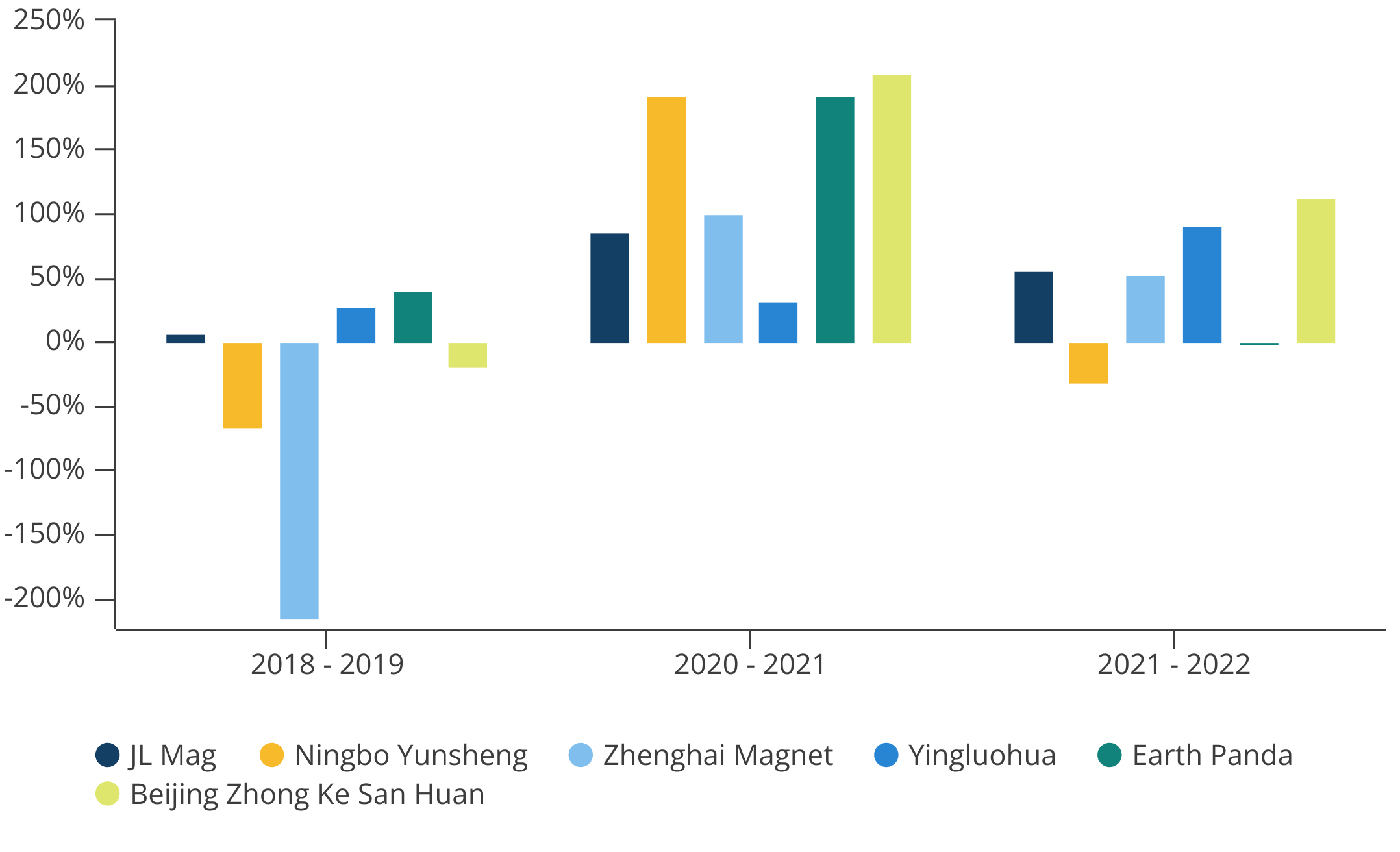

Likewise, that demand boom lifted all boats for Chinese suppliers. While investors have been fawning over the “magnificent 7” US tech companies, China’s “MAGnificent 6”—JL Mag, Ningbo Yunsheng, Zhenghai Magnet, Yingluohua, Earth Panda, and Beijing Zhongke Sanhuan—have all seen solid profit performance in recent years (see Figure 5). For instance, Ningbo Yunsheng’s profits shot up nearly twenty-fold from 26 million yuan ($3.6 million) in 2019 to 518 million yuan ($71.6 million) in 2021.

Figure 5. China’s “MAGnificent 6” Suppliers See Profit Growth Jump in 2020  Note: Chinese producers appeared to have absorbed the high neodymium oxide prices during this period as they were able to ride the demand boom for permanent magnets, thereby achieving solid profit margins in 2020-2021.

Note: Chinese producers appeared to have absorbed the high neodymium oxide prices during this period as they were able to ride the demand boom for permanent magnets, thereby achieving solid profit margins in 2020-2021.

Source: Company Annual Reports & Filings.

A Rare (Earths) Advantage

It’s no surprise that the MAGnificent 6 are congregating in Baotou, where the municipal government has long sought to build a “magnet valley.” To that end, the local industrial policy package for magnet manufacturers typically included tax breaks, preferential land leasing prices, discounts on electricity, and prioritization in the bidding process. Of course, magnet producers also benefitted from close relationships with upstream neodymium suppliers like China Northern Rare Earth and Shenghe Resources.

In other words, China has focused on developing an integrated supply chain for magnets for more than a decade, much as it had done with other cleantech products, such as solar panels. Yet there continues to be misdiagnosis of China’s key leverage as controlling the resources in the ground.

In fact, China has only about one third of global rare earth elements (REEs), meaning 66% of it can be dug up outside of China, if other countries choose to. While China does milk as much of its reserves as it possibly can, the key is that, like for many other metals, China processes over 90% of the world’s REEs. That processed neodymium oxide, the main cost of a permanent magnet, is the crucial input.

While Beijing did once fancy itself as the “Saudi Arabia” of REEs, its attempts at manipulating prices through supply basically failed. That’s when Beijing decided a better strategy was to create supply chains and make end products—hence its leverage has shifted from attempting to control resources to having low-cost, high-quality, and globally competitive industry bases that run the gamut of the cleantech supply chain.

Repelling Chinese Suppliers?

On the back of the MAGnificent 6’s supply ramp-up, China’s high-performance NdFeB magnet exports climbed to 70% of global supply, up from 48% in 2018. Whether that continues in coming years remains to seen, as countries like the United States—which currently depends on Chinese exports for three quarters of its permanent magnets—double down on industrial policy to build a parallel cleantech supply chain.

The recent US tariffs of 25% on permanent magnets from China, which kick in by 2026, seem to align with the industrial policy goal of satisfying 51% of US demand with domestically produced magnets (~14,000 tons) in two years. This has come on top of US Congress’ proposal to subsidize domestic magnet producers at $20/kg to $30/kg.

Two years is an aggressive timeline for bolstering US magnet production from essentially zero. While some projects are in the works, including nascent REE processing, all told there is perhaps 7,000 tons of “planned” magnet production capacity in the United States (this includes Germany’s VAC agreeing to supply General Motors with magnets at a new plant in South Carolina).

Assuming that capacity is reached by the end of 2025, doubling that again by 2026 will likely be quite a stretch for the United States. This may explain why some Chinese magnet executives remain bullish on their prospects in international markets, seemingly unfazed by the tariffs. Another important reason is that the China market itself constitutes the primary demand for permanent magnets because it is already a cleantech manufacturing hub. Exports make up just 20% of the magnet suppliers’ business, with most going to Germany instead of the United States. Indeed, the MAGnificent 6 appear to believe that their strengths in scale and pricing will endure in the foreseeable future.

Amy Ouyang is a research associate at MacroPolo. You can find her work on the global energy transition and its intersection with the economy, technology and industrial policy here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe