- October 26, 2023 Technology

The Curse of Success: Can China Level Up on Carbon Fiber?

Beyond money and talent, there’s an underlying tension that could hamper China’s technology pivot: the misalignment of interests between the state and the private sector. That misalignment can be aptly characterized as the state’s desire to invent the future and the private sector’s focus on scaling the here and now.

From batteries and solar panels to legacy chips and machinery, China’s private sector has excelled at executing the “digest then tweak” strategy. They deploy what already exists, scale aggressively, then rapidly iterate and innovate based on local market conditions and competition. Such an approach has yielded tremendous success for technological convergence, but it may ironically keep China running in the same place for longer than Beijing wants.

The long path to the technological frontier is usually littered with sunk costs and few results to show for it. For many private sector players, however, it is difficult enough just to run very fast to stay in place on market share, with little time and capacity to consider longer-term research and development (R&D). That also means many such companies risk getting “stuck in the mid-range” rather than catapulting to the frontier as Beijing desires. The case of carbon fiber, a material vital to making advanced commercial aircraft, is a good illustration of this dynamic.

Middling Success

Invented in the United States in the 1950s, carbon fibers are now in everything from your Wilson tennis racquet to the latest Boeing aircraft. Its properties—light but strong—make carbon fibers a great material for structural integrity, as it can withstand high pressure.

America and Japan have long dominated the manufacturing of carbon fibers, to the frustration of China. In fact, Chinese Academy of Sciences (CAS) material scientist Shi Changxu famously wrote a letter in 2001 to China’s top leaders, arguing that the country needed to reduce its dependence on carbon fiber imports.

As a result, CAS got ~$12 million for basic research on carbon fibers. Four years later in 2005, China managed to establish its first pilot production project after having jointly worked on R&D with Japan’s Toray, a leader in carbon fiber. By 2010, however, China still accounted for <1% of global carbon fiber production.

Unbeknownst at the time, carbon fiber production was about to turn a corner. That’s because in 2009, Beijing put its support behind the massive deployment of wind power, which turned out to be a boon for carbon fiber demand. Wind turbine blades, as well as its nacelle and rotor, contain several tons of carbon fibers. As China’s wind industry installed 370GW of capacity over the last decade-plus, it drove hundreds of thousand tons of carbon fiber demand, far surpassing the global annual output today.

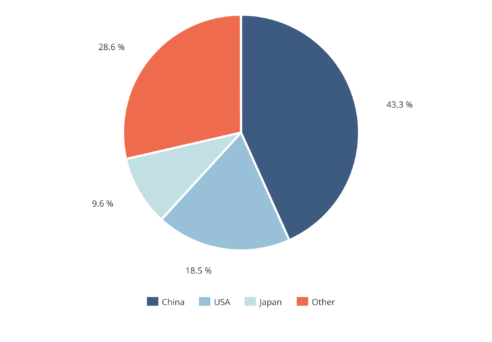

Consequently, China became the global leader in carbon fiber production, controlling over 43% of the global market share by 2022 (see Figure 1). Its strong position is largely thanks to a handful of private sector “carbon fiber” unicorns, such as Sinofibers Technology and Weihai Guangwei Composites, each valued at more than $1 billion.

Figure 1. China Is Significant Producer of Mid-Range Carbon Fiber

Source: Caitong Securities.

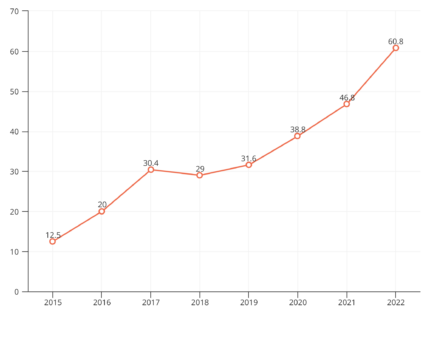

China’s wind power boom gave the incentive the private sector needed to kick carbon fiber production into high gear—a feat never achieved by the state firms that poured money into the material in the mid-2000s. But what will catch the Chinese government’s eye even more is the dramatic increase in local content (see Figure 2).

Figure 2. China’s Carbon Fiber Localization Has Soared Since 2015

Note: Localization rate represents portion of Chinese market supplied by Chinese firms.

Source: iResearch.

There’s another catch, however. Not all carbon fibers are created equal—the type that goes into the wings of a Boeing 787 Dreamliner is materially different from the kind used in wind turbines. The latter uses mid-range variants ranging from T300 to T700 (the larger number indicates greater tensile strength), while the high-end T1000 variant is used in aircraft.

But the high-end has continued to elude Chinese producers. Part of the reason is that the T1000 variant has been subject to export controls under the 1996 Wassenaar Arrangement, which prevents Japan and the United States from supplying key inputs to China.

That may have been prohibitive in the early going for China’s carbon fiber manufacturers, but more than 25 years later, China still hasn’t caught up on the high end. The larger reason seems to be that Chinese companies got so good at developing T700 that there was little incentive to deviate from the path dependence.

Counting on domestic demand for a proven product has been profitable and a safer bet for domestic suppliers, especially when bankruptcies of those that ventured into the high-end served as cautionary tales. So why risk the gambit of investing in the T1000 when there’s no assurance of near-term returns?

Purging the Curse of Success?

So if Chinese suppliers became global leaders in mid-range carbon fiber on the back of a wind industry, could Beijing’s long heralded establishment of a commercial aircraft industry be the ticket to mastering T1000?

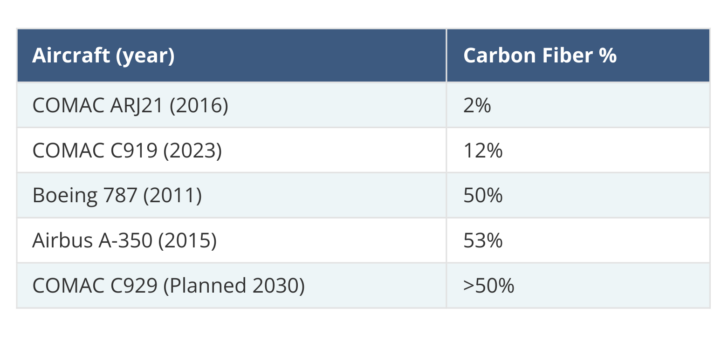

That seems to be the official plan at least. Carbon fibers are the future of aircraft bodies, one of the key innovations that Boeing launched more than a decade ago. Although China’s recently debuted C919 is at least a full generation behind Boeing and Airbus on integrating carbon fiber, Beijing hopes its next-generation C929 will be half carbon fiber (see Table 1).

Table 1. Carbon Fiber Is Crucial to Next-Generation Commercial Aircraft

Note: Year indicates date of first entering commercial service.

Source: Everbright Securities Research Institute.

Seven years is an aggressive timeline, and meeting it entails a rapid catch-up on T1000 carbon fibers that looks similar to what happened on the T700. But this is far from guaranteed, because commercial aircraft grade carbon fiber is technically more difficult, and it’s still too early to say whether China’s commercial aircraft will be a ringing success.

This presents a chicken and egg problem, as the lack of assurance of a large domestic market for T1000 means the private sector might continue to have reservations about pouring significant resources into developing it. Although some pilot projects are starting, China’s mastery of the T1000 depends on the prospect of its civil aviation industry.

In the meantime, existing suppliers will need to strike a delicate balance between the mid-range and advanced variants to protect their businesses’ competitive positions. Yet that will be at odds with Beijing’s gung-ho attitude toward reaching the frontier—a factor that may compel the Chinese leadership to increasingly lean on state resources to fill the gaps. Whether the state sector can rise to the occasion where it failed before is anyone’s guess. But at a minimum, Beijing won’t need to second-guess their alignment of interest.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe