- March 1, 2019 Economy

GDP Target and Beyond: Things to Watch at This Year’s NPC

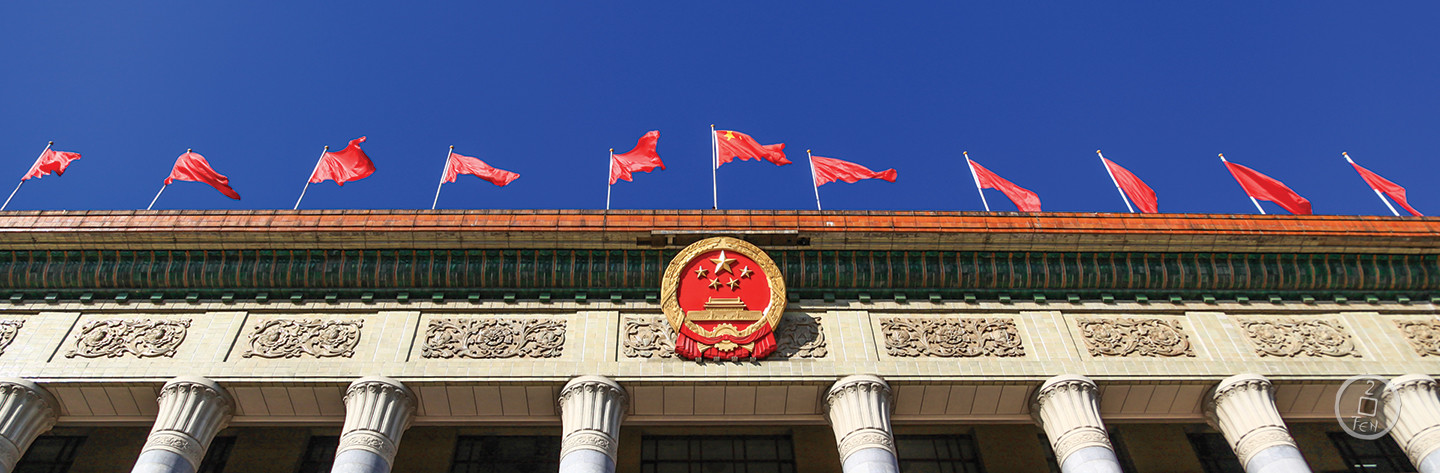

China’s annual legislative confab, the National People’s Congress (NPC), starts March 5. Many foreign observers will be paying attention to the passage of the new Foreign Investment Law, which will likely adopt a “pre-establishment national treatment” approach to foreign investment that is meant to give equal access and treatment to both foreign and domestic firms. But there are a few equally important issues that bear watching—namely the GDP target, social security contribution, and the property tax.

Why the GDP Target Shouldn’t be Dismissed Outright

The most widely anticipated announcement at the NPC will be the GDP target, which will be revealed during Premier Li Keqiang’s Annual Work Report, the equivalent of a “State of the Union.”

As I have written previously, China’s 2019 GDP target is likely to be set as a range between 6% to 6.5%. But which end of the range will real GDP growth fall closer to? The work report should offer some clues. For instance, the report typically provides the annual fiscal deficit target both in the form of percentage of GDP and total value. These two pieces of data allow us to infer Beijing’s projected nominal GDP value. For example, in 2018, Beijing’s fiscal deficit target was 2.38 trillion yuan ($350 billion), or 2.6% of GDP, suggesting Beijing projected total GDP of 91.5 trillion yuan ($13.7 trillion). Actual 2018 GDP turned out to be 90 trillion yuan ($13.4 trillion), about 2% lower than the projection (see Figure 1).

Once the nominal GDP projection for 2019 is determined, we can compute Beijing’s 2019 nominal GDP growth rate projection, which is the closest proxy of an acceptable growth rate for Beijing. Comparing Beijing’s nominal growth rate projection with actual growth rates last quarter can help infer the Chinese government’s attitude toward supporting growth.

Put differently, if actual growth rate is in line with Beijing’s projection, then there will be less need for stimulus. In the most recent quarter, 4Q2018, the nominal growth rate (annualized q-o-q) was around 8%. A 2019 nominal growth rate projection below 9% suggests Beijing is fine with real growth moderating closer to 6% without much policy support. On the other hand, an above 9% nominal growth projection suggests Beijing wants real growth to be closer to 6.5% and will likely rely on more pro-growth measures.

Figure 1. Difference between Actual Nominal GDP and Projected GDP (as % of Projected GDP)

Note: Positive reading means actual growth was above the GDP target.

Source: Wind.

Social Welfare Redistribution

For China’s business community, they will be most attuned to whether the NPC will decide on cutting employers’ contribution to entitlements. One of the main reasons that China’s private entrepreneurs have been grumbling lately is in response to President Xi Jinping’s policy of stricter enforcement of employers’ contribution to social welfare, which currently sits at 40% of payroll. This is quite high by international standards, but businesses have been relatively muted on this issue because enforcement has been weak. That is, many private businesses have found loopholes to pay lower rates than the mandate or even evade the payments altogether.

Beijing’s recent reform to streamline and strengthen tax and entitlement collection makes evasion less feasible for private business owners. For the first time, not only do firms have to pay the contribution in full, many have been asked to retroactively pay their previously unpaid contributions. This enforcement policy could not have come at a worse time for China’s entrepreneurs, as they are already suffering from the growth slowdown and credit tightening.

Beijing has at least recognized that stricter enforcement has come at the wrong time. In September 2018, the Chinese government ordered a temporary suspension on collecting unpaid contributions. But that hasn’t calmed sentiments, as business owners remain concerned about future contribution payments. To further appease China’s distressed private sector, in November 2018 Xi promised that entitlement contributions would be lowered.

But cutting entitlement contributions won’t be easy. That’s because the current high rate is necessary given China’s rapidly aging population and relatively low retirement age (60 for men and 55 for women). Without first raising the retirement age, any cut to entitlements will be limited.

Of course, raising the retirement age is unpopular in any country and can even trigger social unrest. Given the Chinese public is already complaining that slower growth is affecting their lives, it seems unlikely that Beijing will announce a higher retirement age anytime soon. Amid the current economic slowdown, delaying retirement, which benefits China’s long-run fiscal sustainability, will turn into a headwind for the labor market in the near term because the longer people stay in their jobs, the more jobs will have to be created.

Therefore, the most likely outcome will be an unsatisfying compromise that temporarily cuts entitlement contributions while kicking down the road the difficult decision on retirement age.

Whither Property Tax?

Perhaps equally as unpopular as raising the retirement age is the imposition of the long-discussed property tax. However, last December’s Central Economic Work Conference signaled that Beijing is determined to reform China’s real estate sector, of which the property tax is an indispensable element. So it is possible that more progress on a property tax will be revealed at the NPC.

This is in part because back in 2013, the property tax was one of the many reform initiatives that Beijing pledged to complete by 2020. In fact, drafting the property tax has been on the NPC’s agenda and was also included in the 2018 work report. However, given the importance of the property sector to the Chinese economy, Beijing will be cautious in pushing forward a property tax, especially during the current slowdown. Any implementation of such a tax, even if announced, will likely be punted into the future when economic growth stabilizes again.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe