The China Footprint

Did the US-China economic relationship peak in the 2010s? At the start of the decade Chinese students, tourists, homebuyers, and investors flocked to the United States, pushing bilateral relations beyond goods trade into a new era of business, cultural, and social engagement. But rising US-China tensions—particularly since 2016—are now undermining such connections.

Whether political forces in both countries undo these ties remains to be seen, but the China Footprint measures this evolving dynamic by tracking the full picture of Chinese consumption and investment on American soil over the past ten years. The data show this “footprint” of more direct and tangible economic linkages has faded far faster than bilateral goods trade and portfolio investments between the United States and China.

To explore individual dimensions of the China Footprint, use the buttons below the graph. For an overview, or to explore our methodology, please click here.

Venture Capital

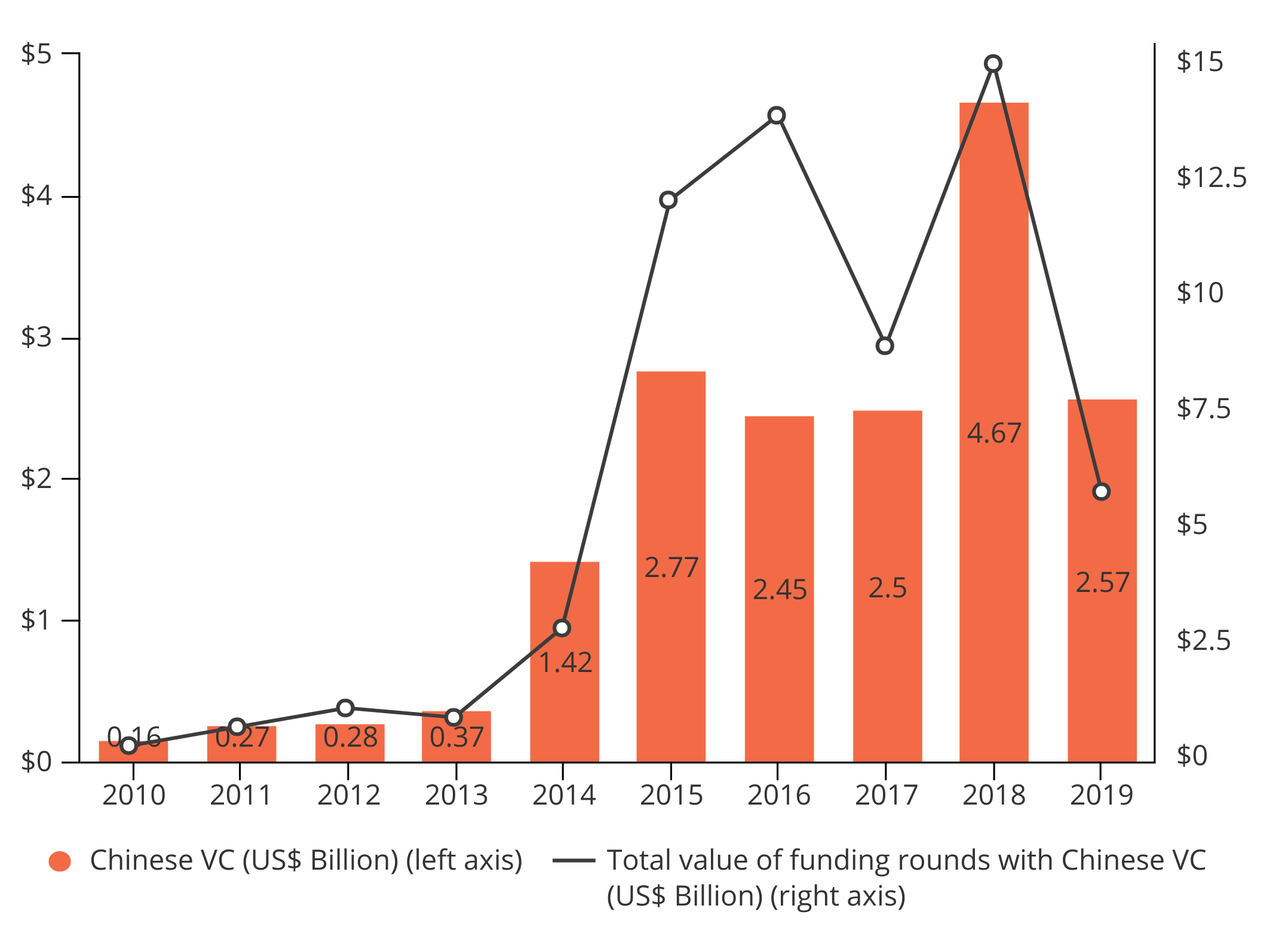

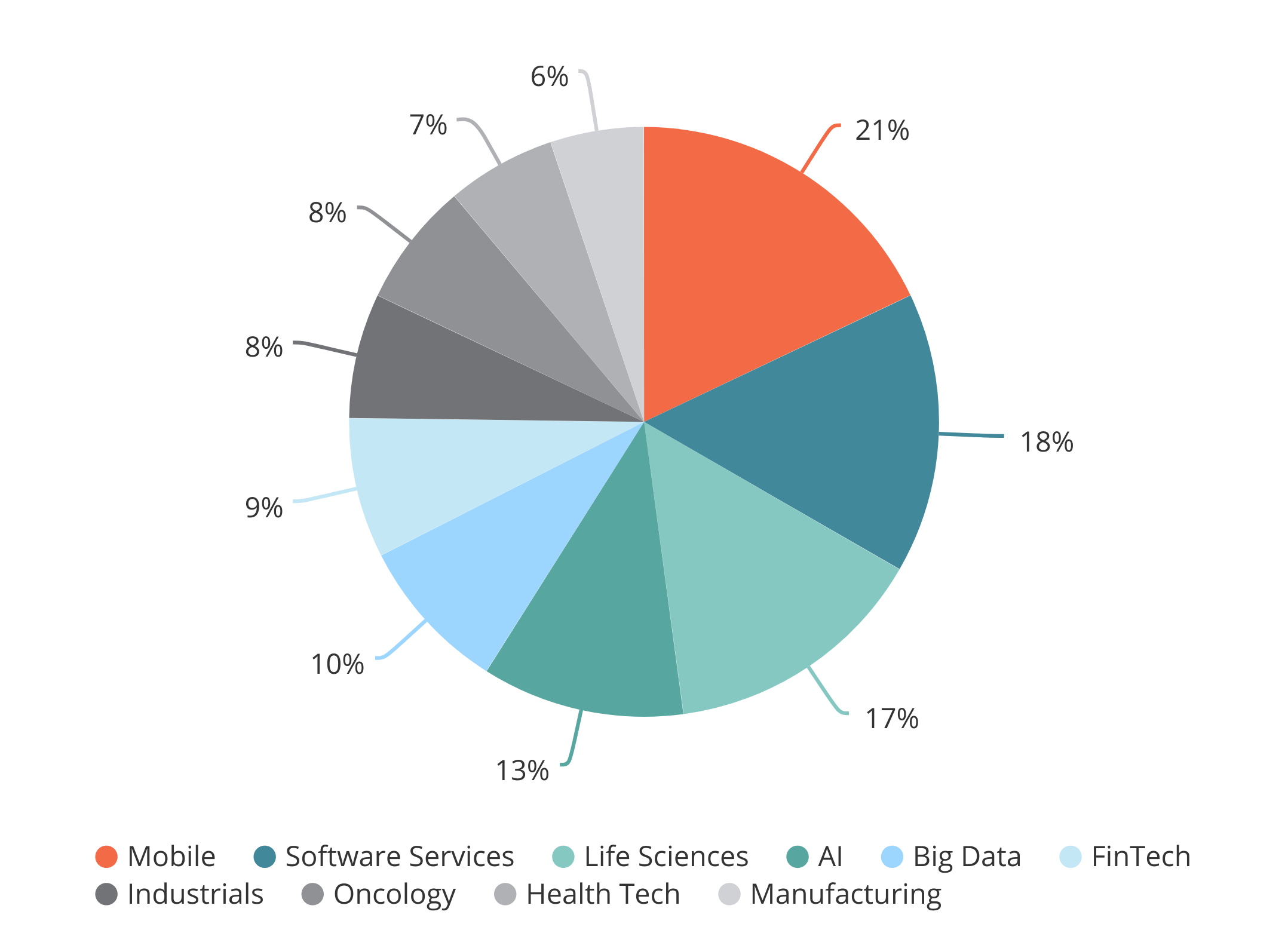

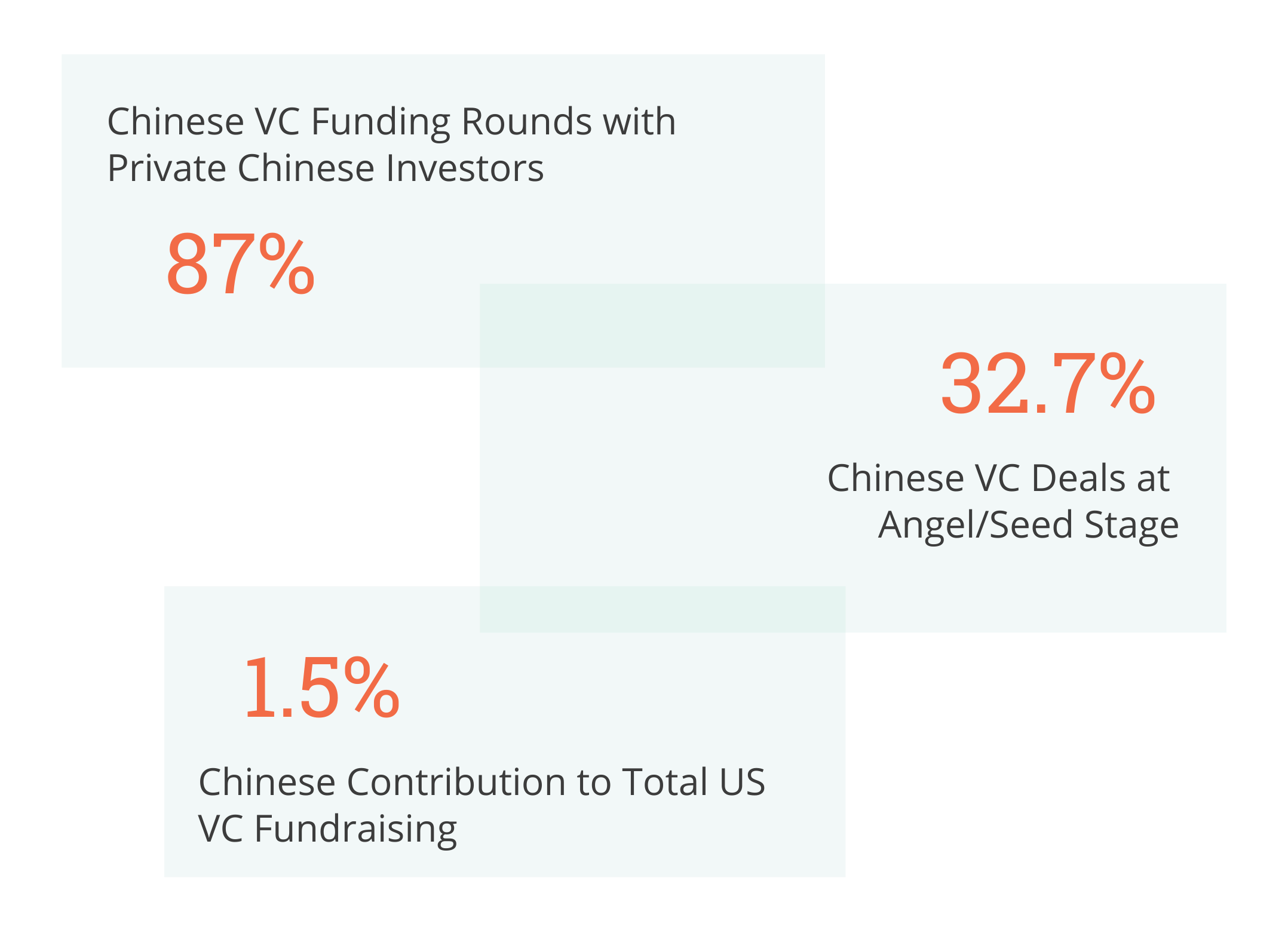

Venture capital (VC) is a form of portfolio investment (as distinct from FDI) provided to startups with high long-term growth potential. While there has long been significant American VC investment in Chinese startups, Chinese VC investments in the United States only passed $1 billion in 2014, before spiking to $4.7 billion in 2018.

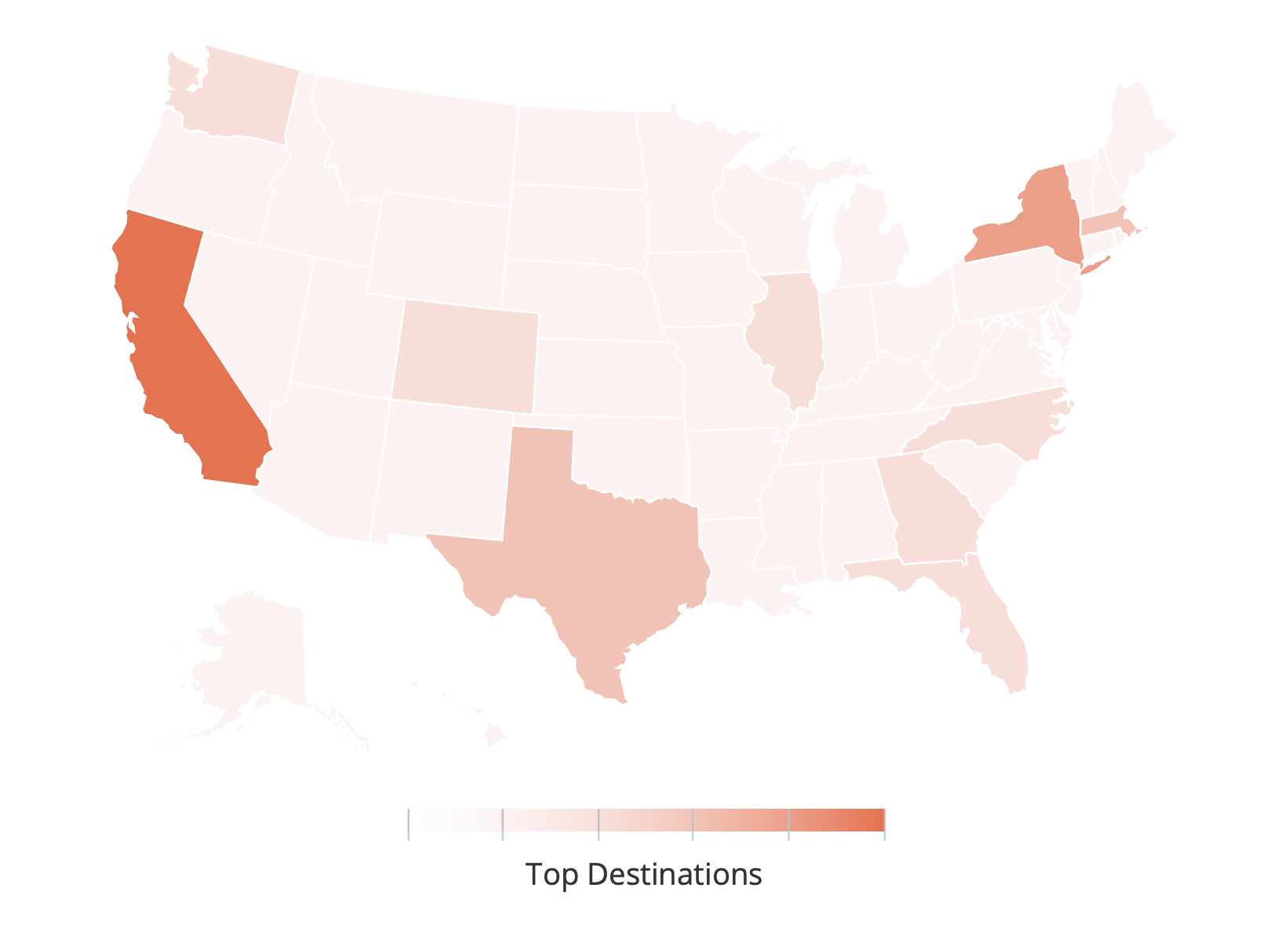

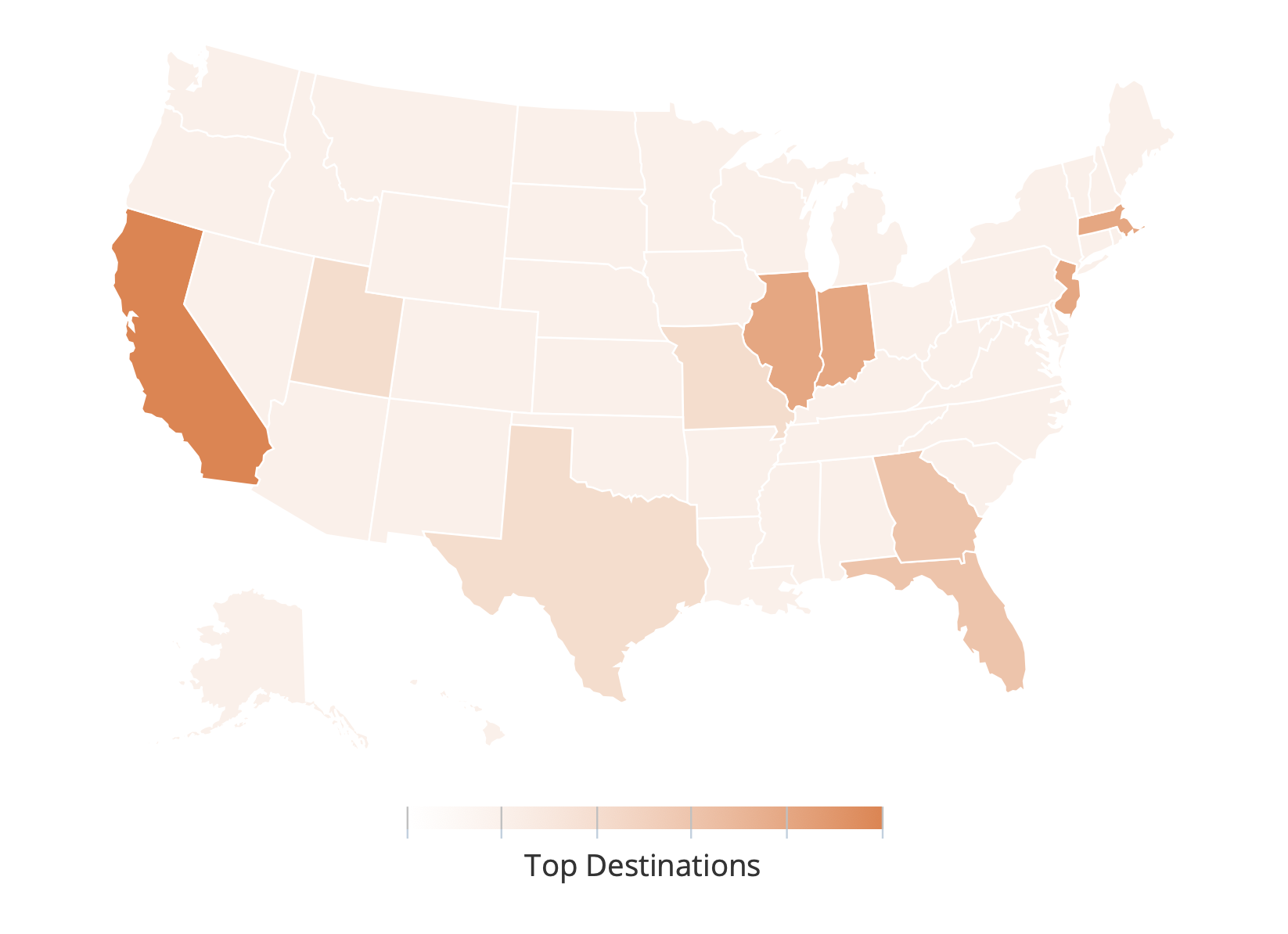

This capital is overwhelmingly from private VCs and directed at high-tech startups in Silicon Valley, with some activity in other tech hubs like New York, Boston, and Austin. But recent moves to tighten national security screening of Chinese investment in American tech means the future of such investments is increasingly cloudy.

Travel

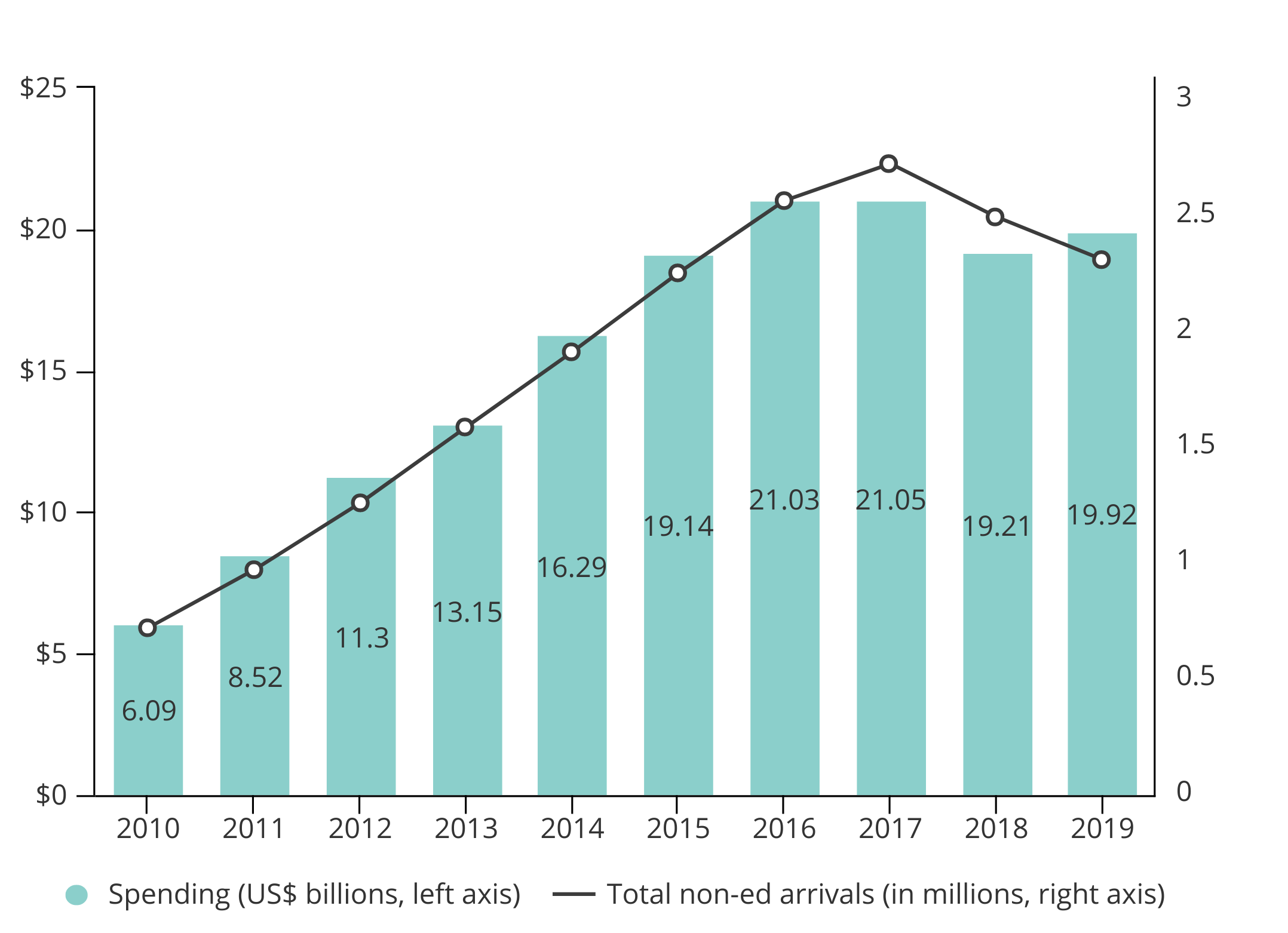

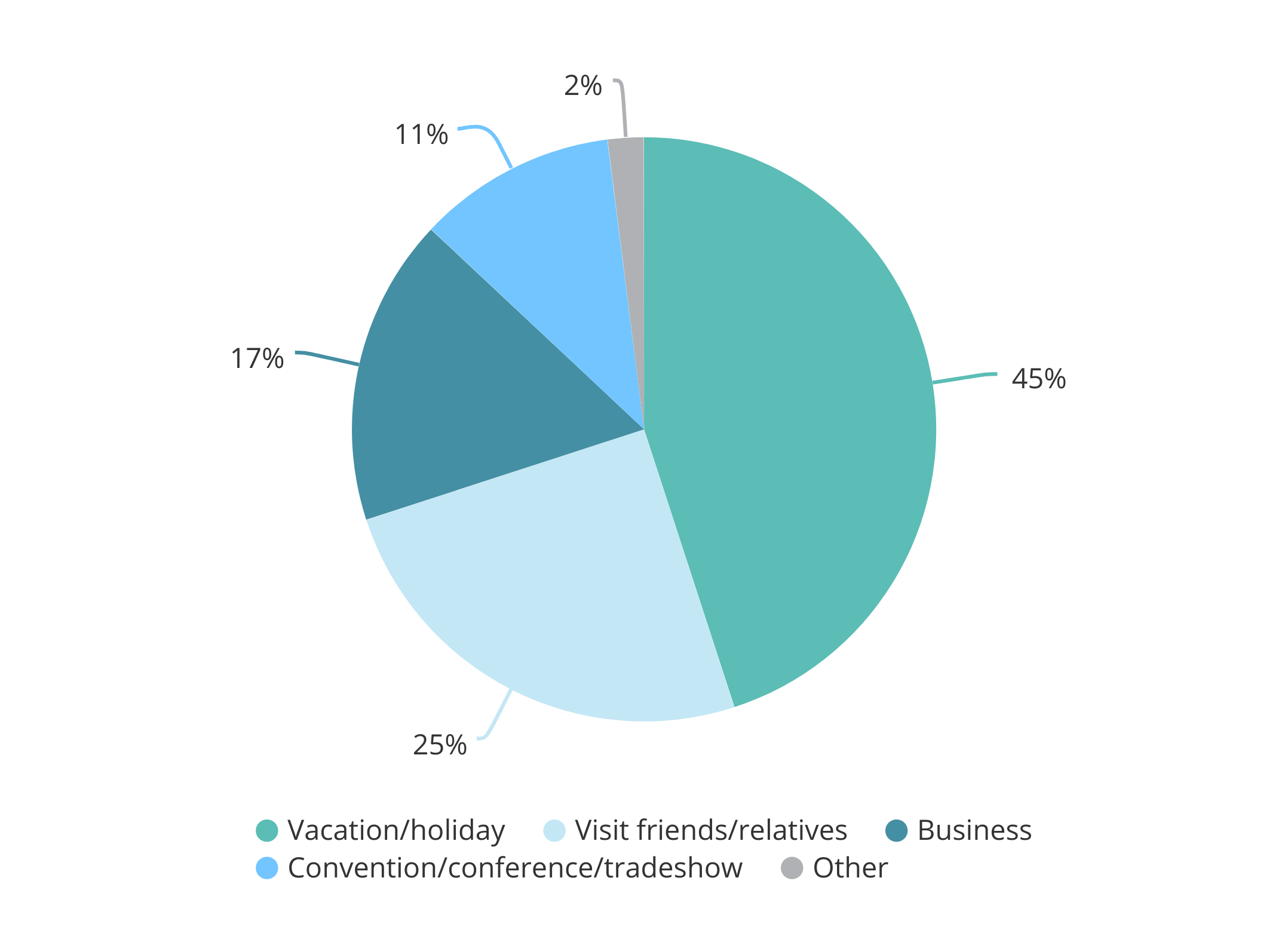

Spending by Chinese travelers in the United States more than tripled between 2010 and 2015, driven by rising incomes in China and a move in 2014 to bolster two-way travel by offering ten-year tourist visas to citizens of both countries. Since 2015, however, that growth has levelled off and spending by Chinese tourists and businesspeople visiting the United States has, with some small dips and bumps, held steady at around $20 billion annually.

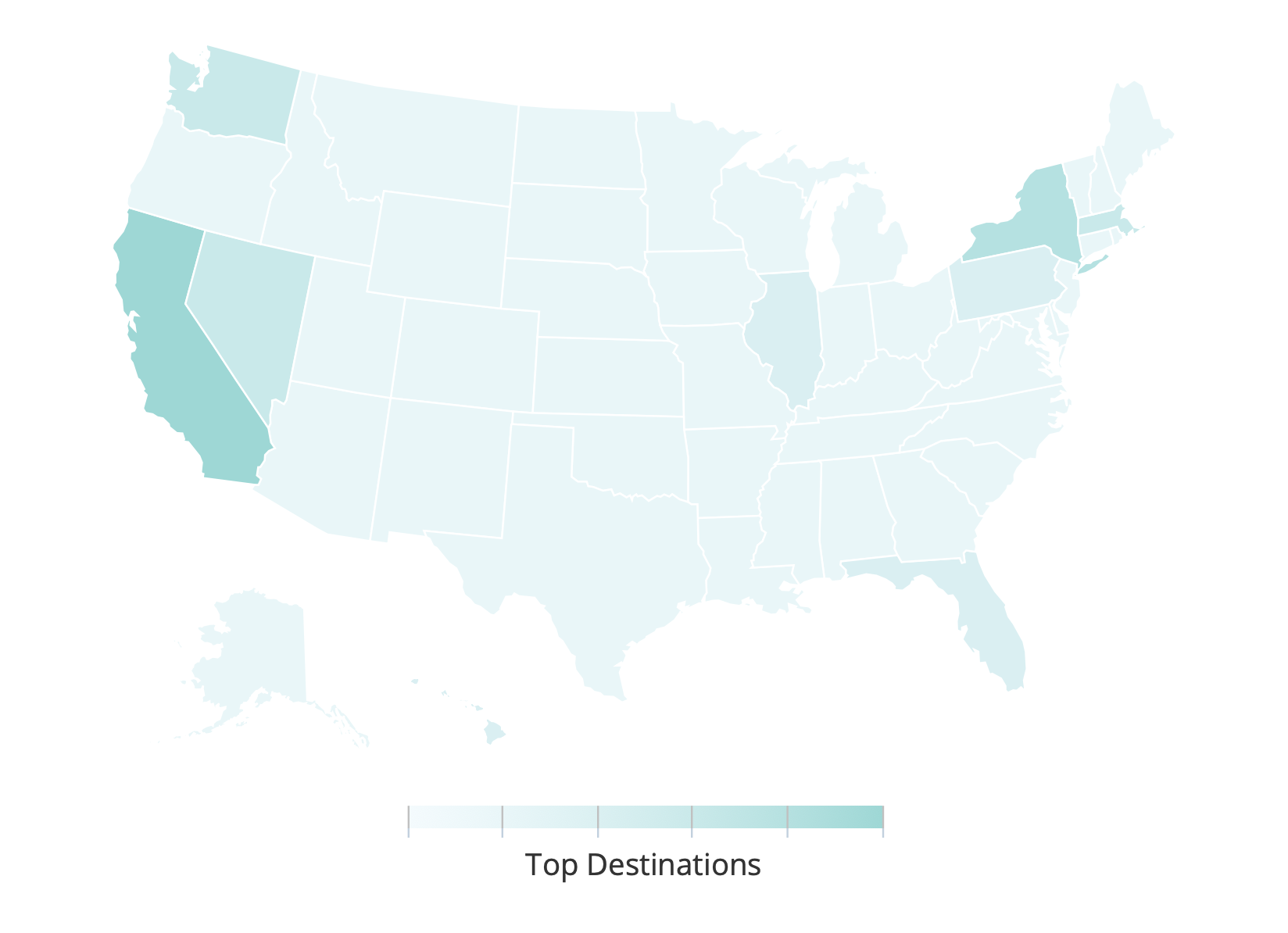

Most visitors go to the West Coast or the Northeast region of the United States, but US National Parks have seen a boom in Chinese visitors on the back of major promotional campaigns.

Sources: Department of Commerce, National Travel and Tourism Office.

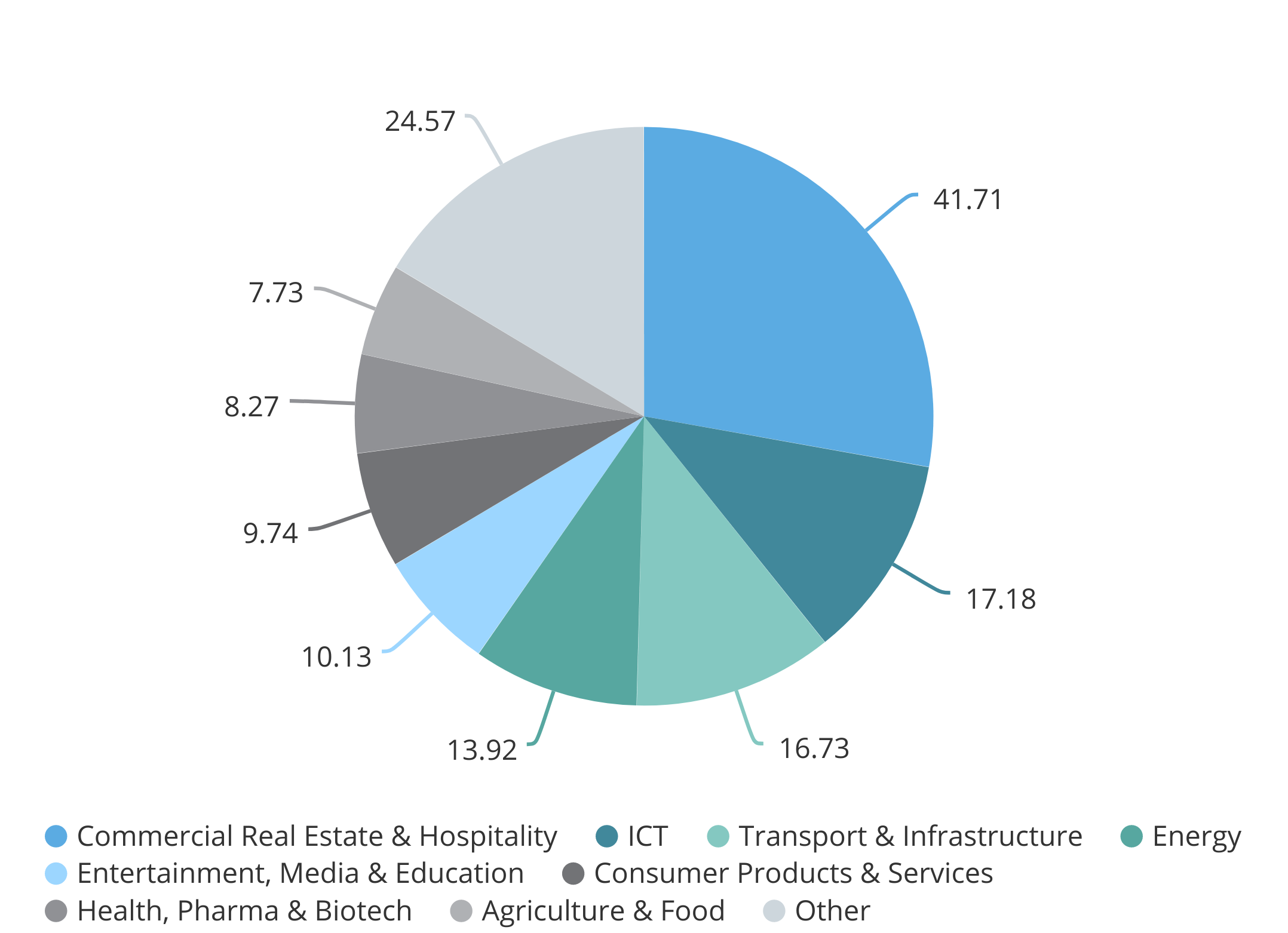

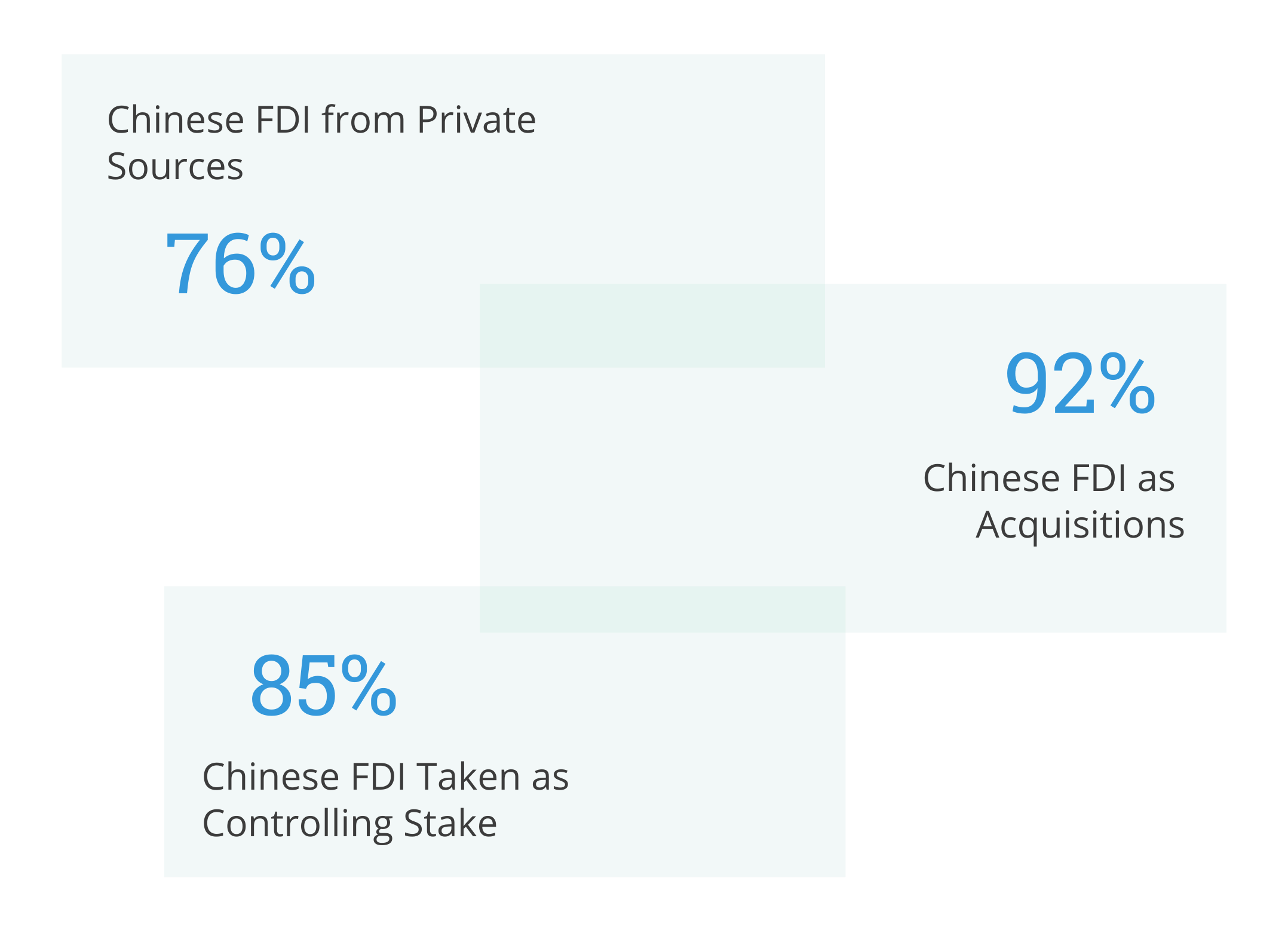

Foreign Direct Investment

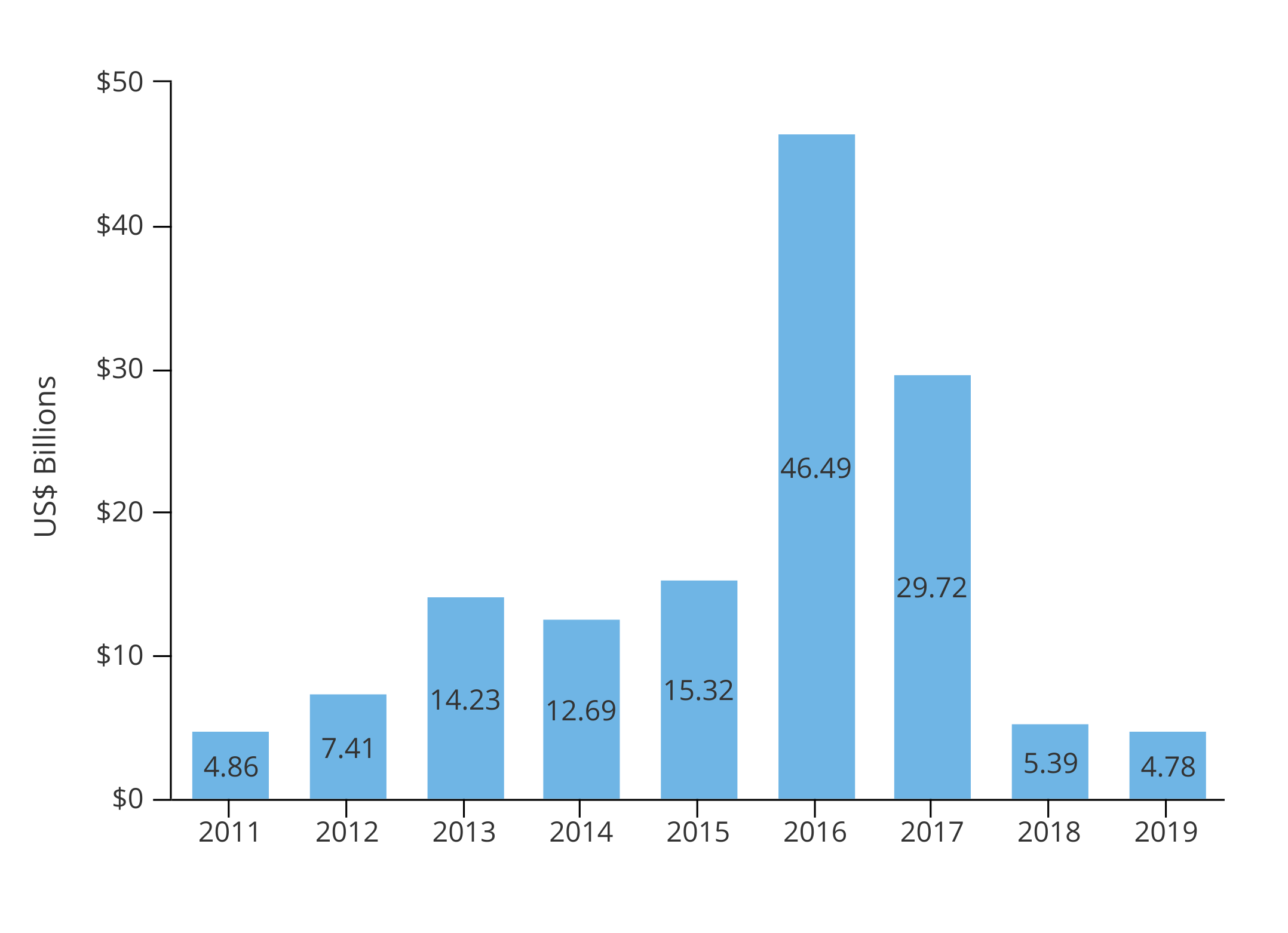

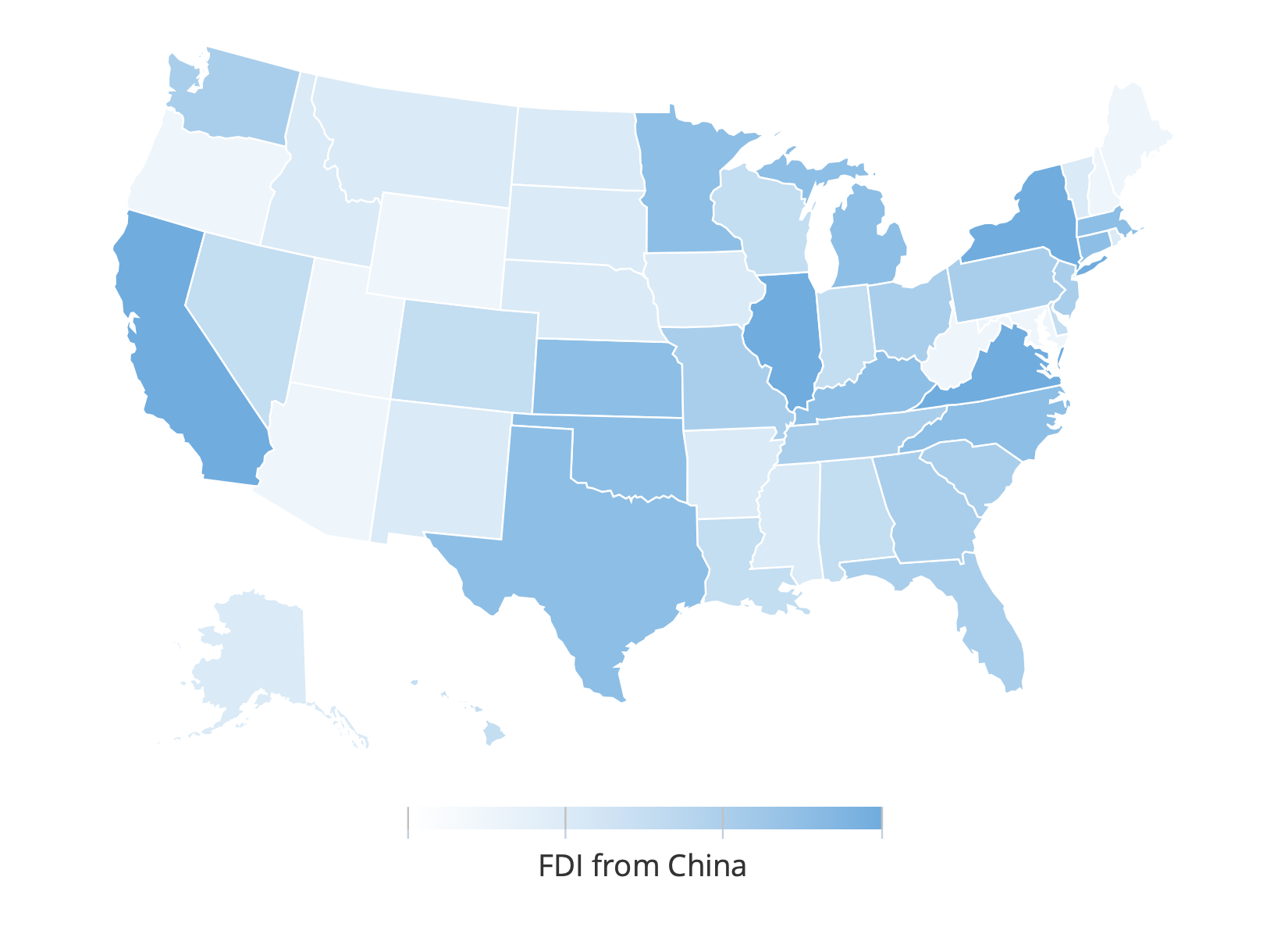

After several years of modest increases, Chinese foreign direct investment (FDI) into the United States ballooned to a mammoth $46.5 billion in 2016, before declining dramatically to pre-2011 levels due to capital controls from Beijing and heightened regulatory scrutiny in Washington. Chinese capital has supported American growth and jobs in projects from financial centers on the East Coast and manufacturing hubs in the Midwest to high-tech and entertainment industries on the West Coast.

But this FDI also created political controversy, especially over acquisitions of sensitive technologies. All investors are sensitive to political risks and, whether considered an opportunity or a risk, Chinese FDI seems unlikely to return to its previous heights.

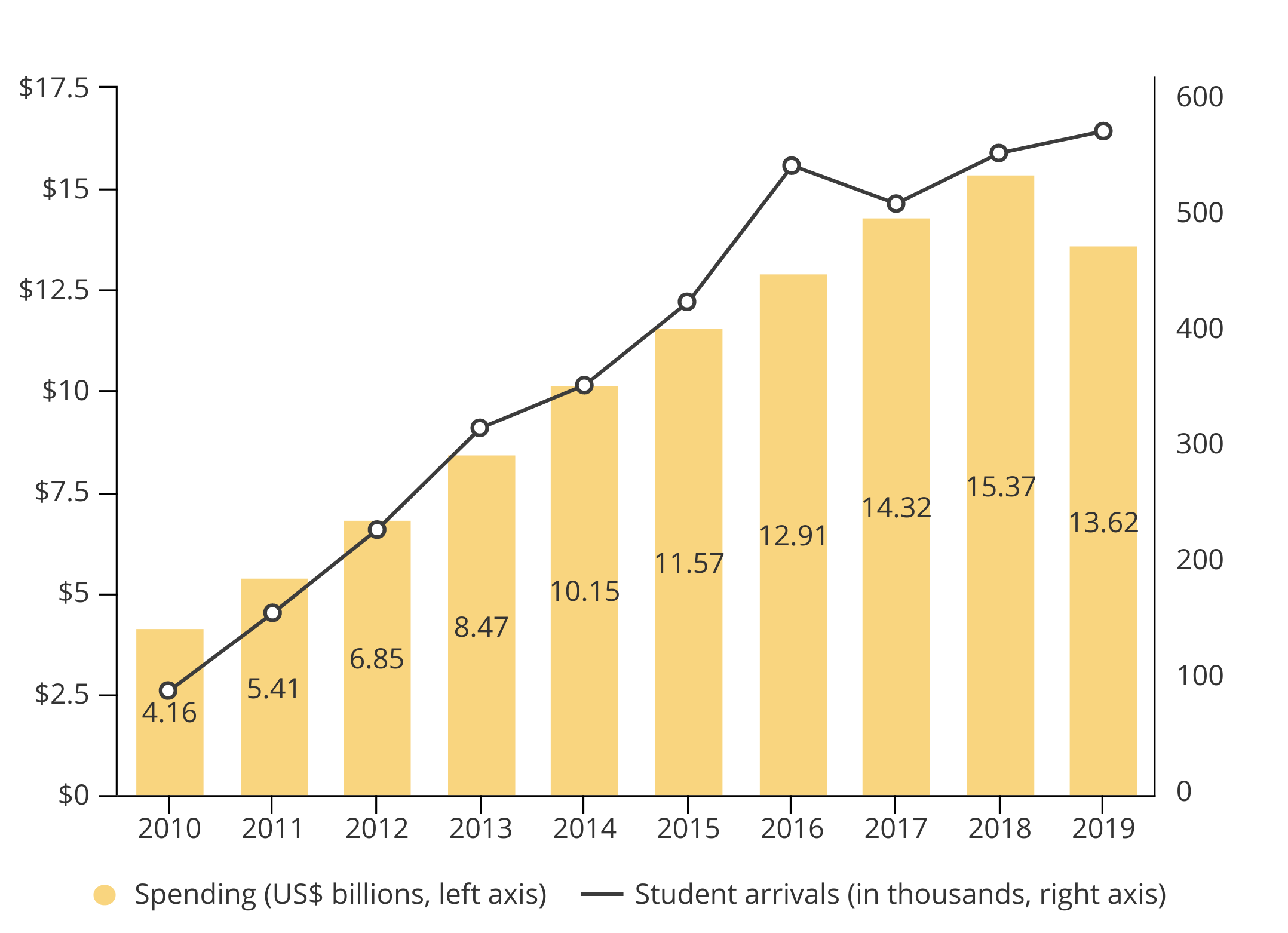

Education

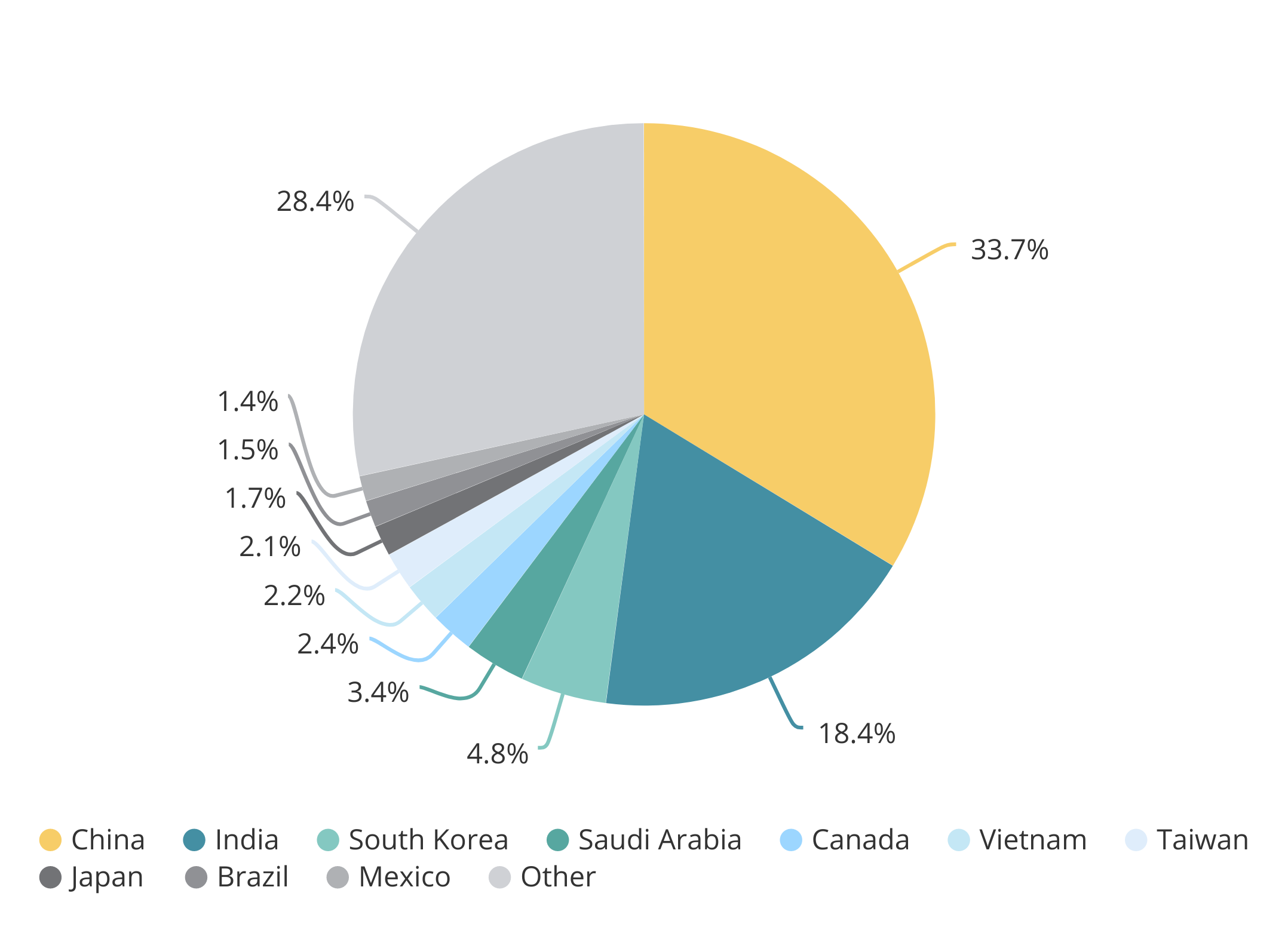

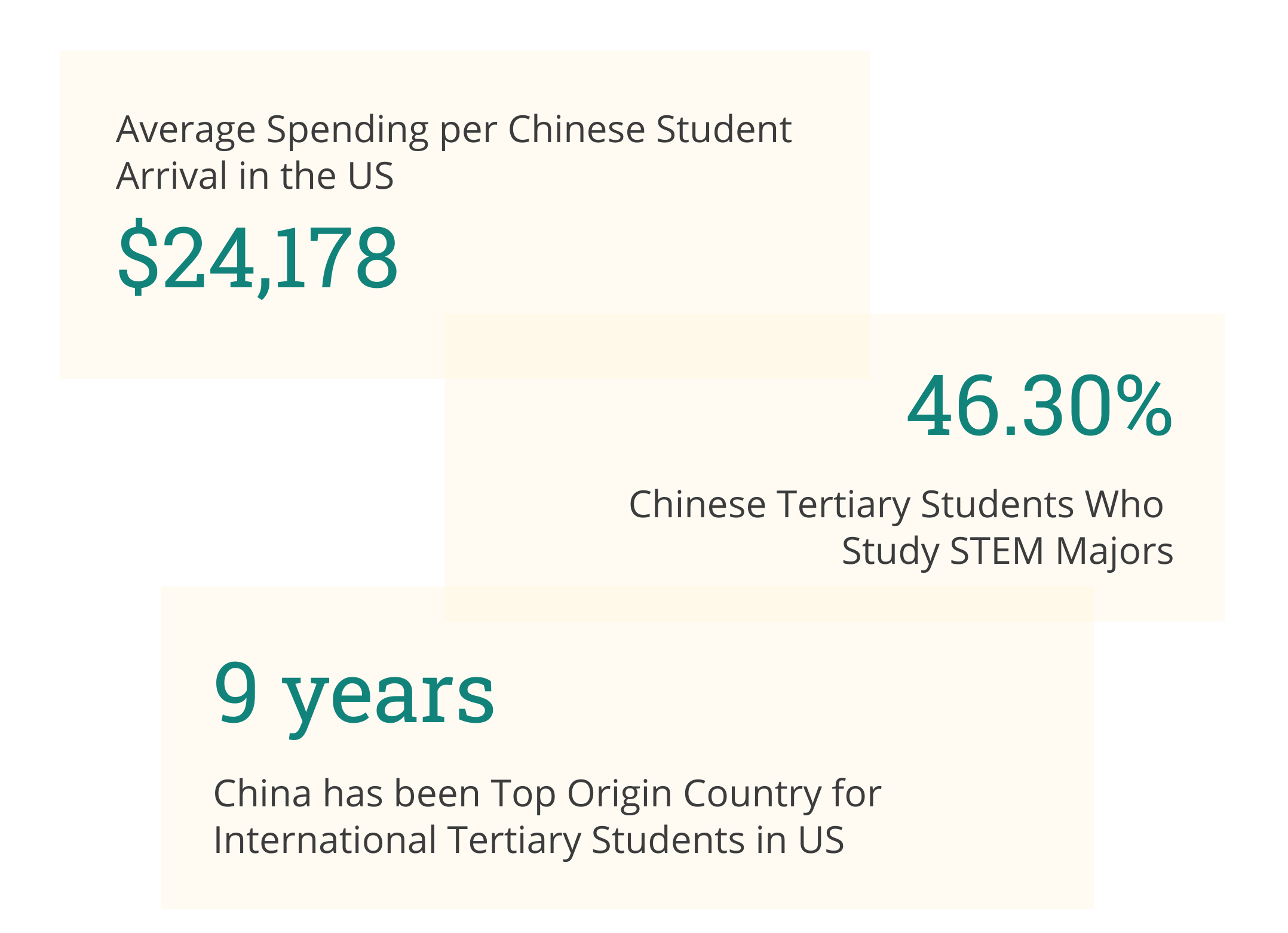

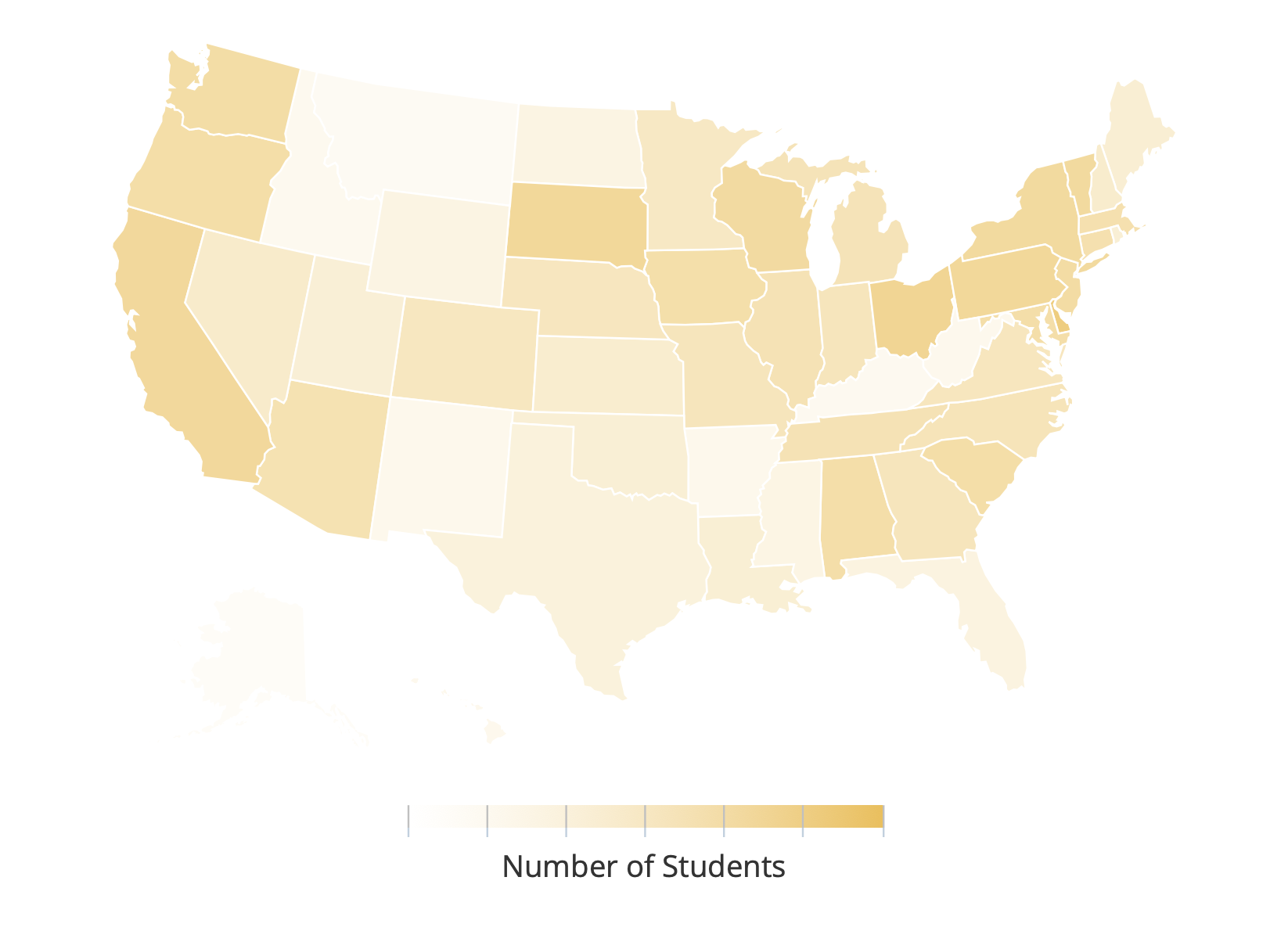

After the Global Financial Crisis many American universities sought to offset declining revenues by enrolling more Chinese students, particularly undergraduates, most of whom pay full tuition. As a result, China became by far the largest source of international students in the United States. Chinese students’ spending—including tuition, airfare, and living expenses—more than tripled between 2010 and 2018, before dropping 11% in 2019.

Annual enrollment growth declined from a peak of nearly 30% to just 1.7% for the 2018-2019 academic year. These arrivals have also created frictions, as some American politicians accuse Chinese students, especially those in STEM fields, of stealing intellectual property or serving as conduits for political influence.

Dig Deeper:

- Who Loses from Restricting Chinese Student Visas?

- Heartland Mainland – Episode 1: Freshman Orientation

Sources: Department of Commerce, National Travel and Tourism Office; Institute of International Education, Open Doors 2019

EB-5 Investment

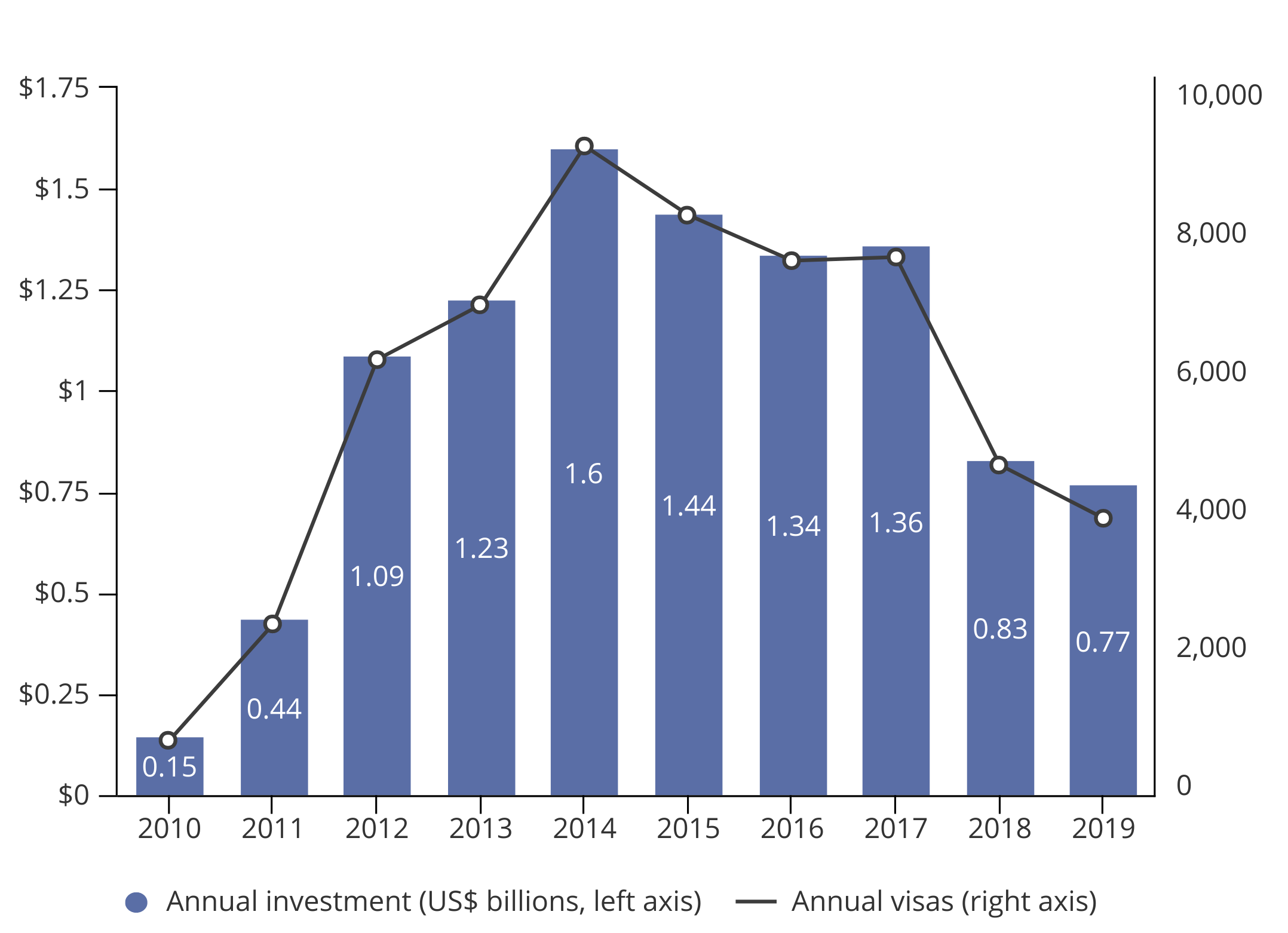

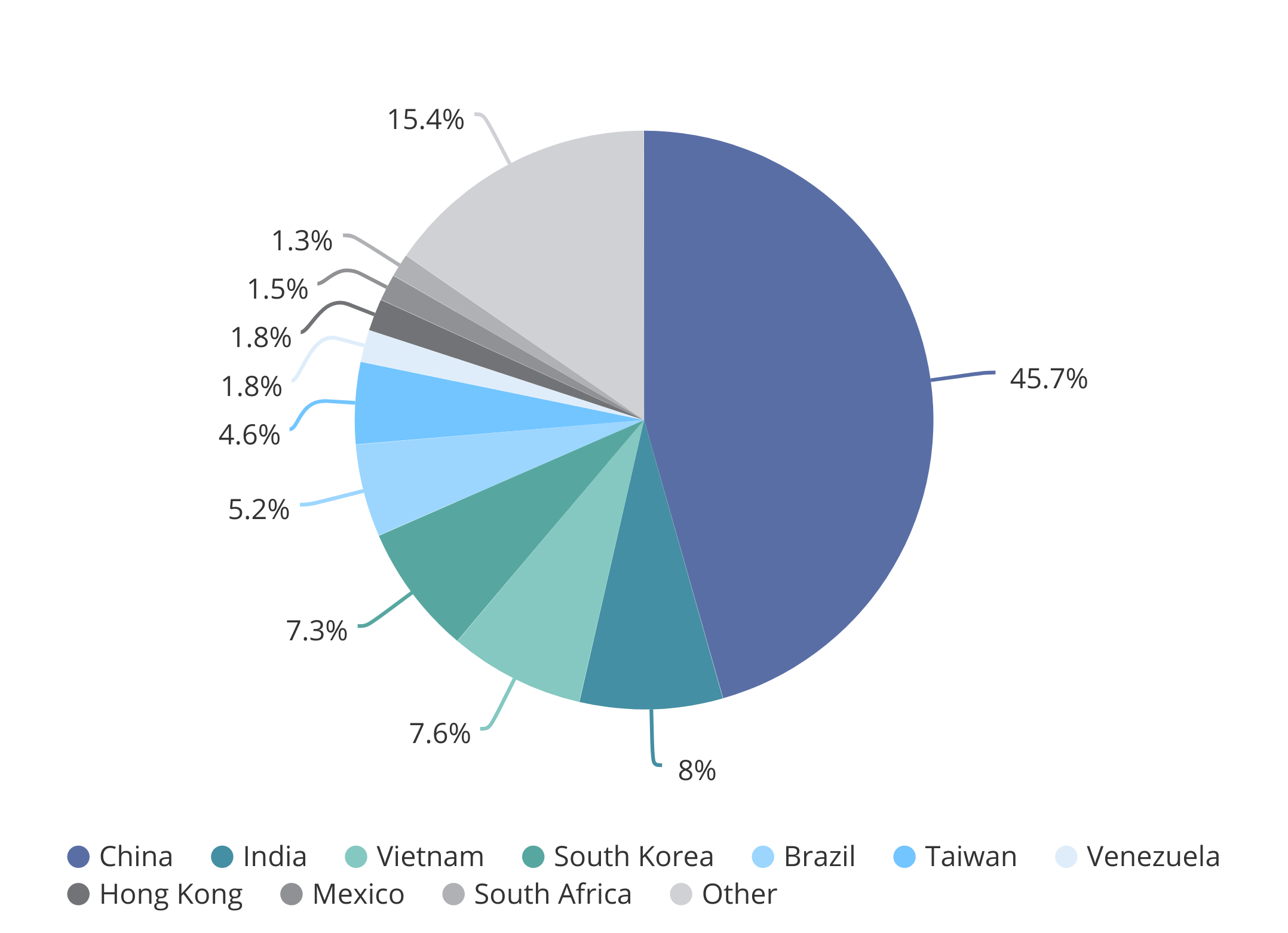

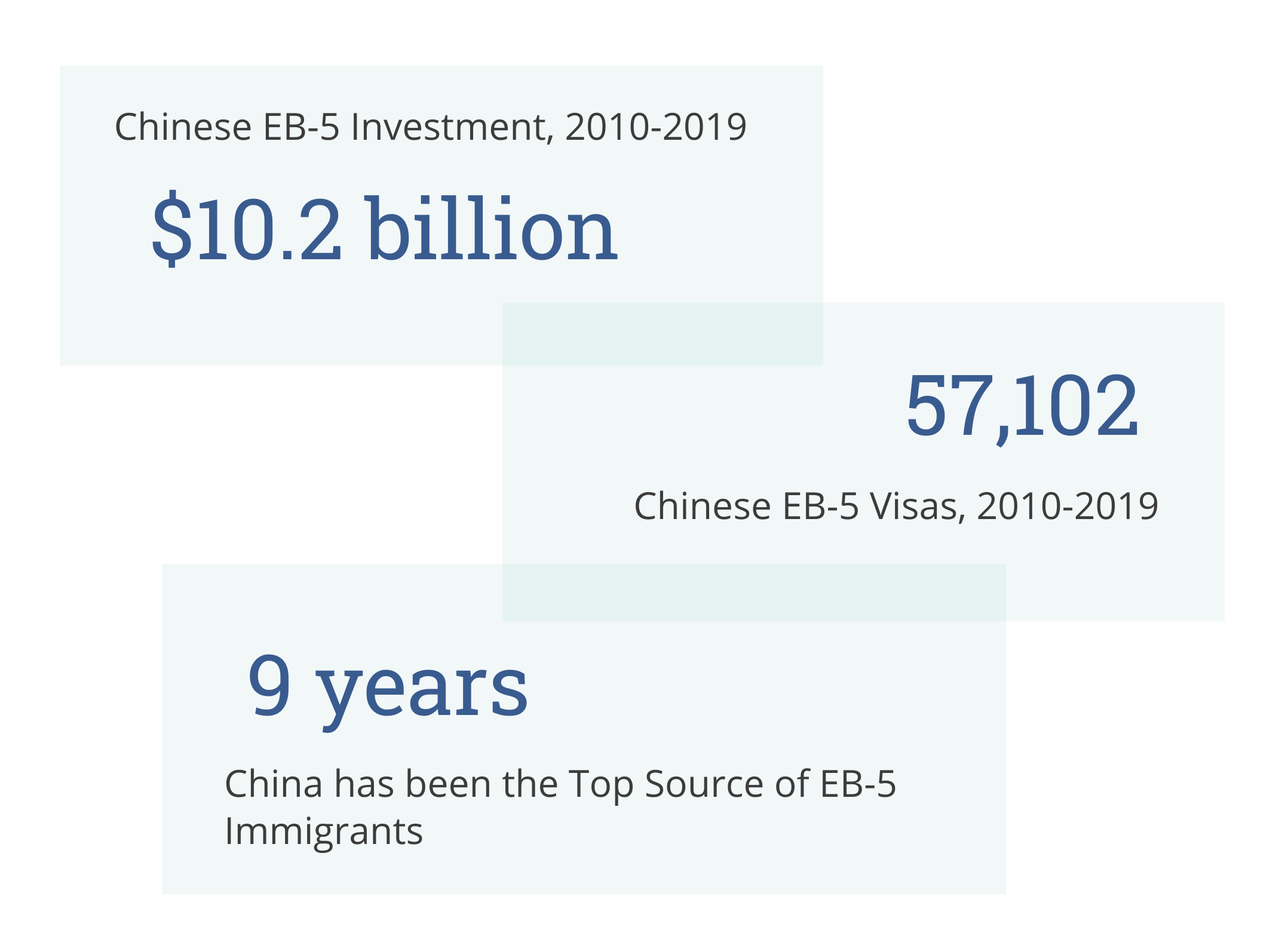

The EB-5 program offers green cards to foreign citizens (and their families) who invest $500,000 or more in an American project—often a real estate development—that creates at least 10 jobs in the United States. From 2008-2014, Chinese “immigrant investors” dominated the program, receiving up to 80% of the 10,000 visas allocated each year.

But a cap on the EB-5 visas granted to any single country has caused both the number and dollar-value of Chinese EB-5 investments to fall by more than half since 2014. While EB-5 visas attracted much attention, the program is small—averaging just over $1 billion annually from China—compared with Chinese FDI, education spending, home purchases, and travel.

Dig Deeper:

Sources: US Department of State, Bureau of Consular Affairs, Visa Office; The Associated Press; United States Citizenship and Immigration Services.

Home Purchases

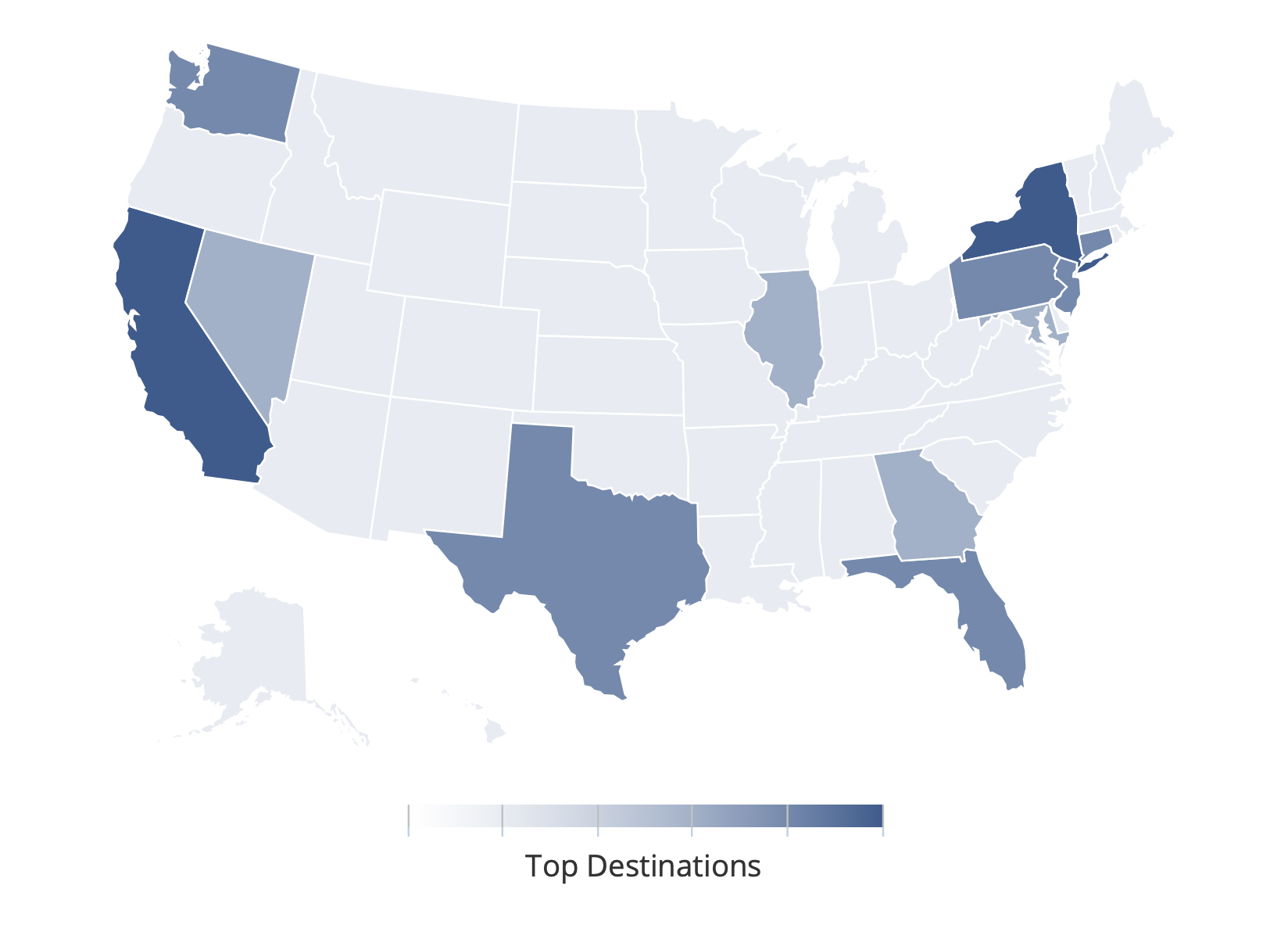

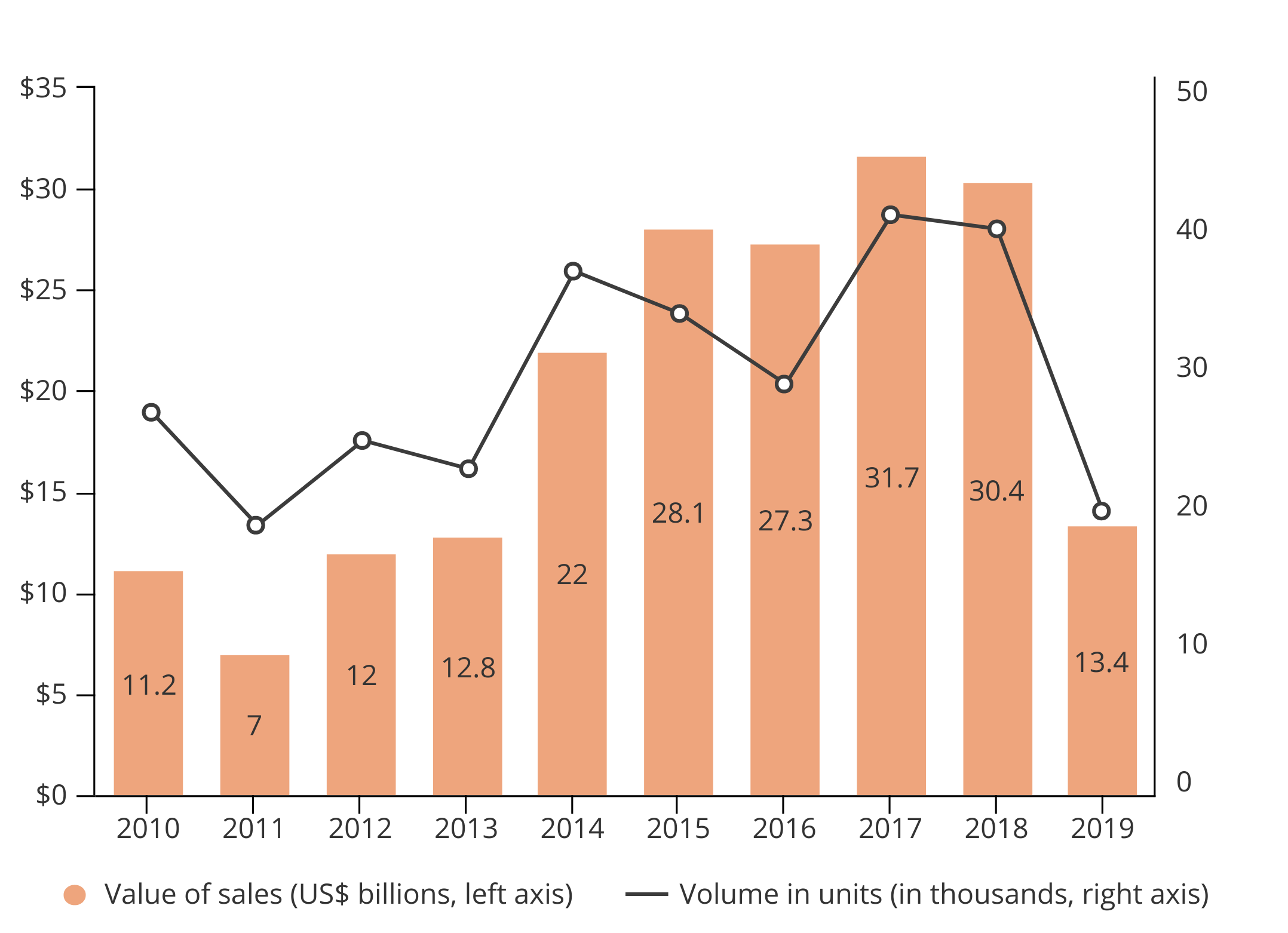

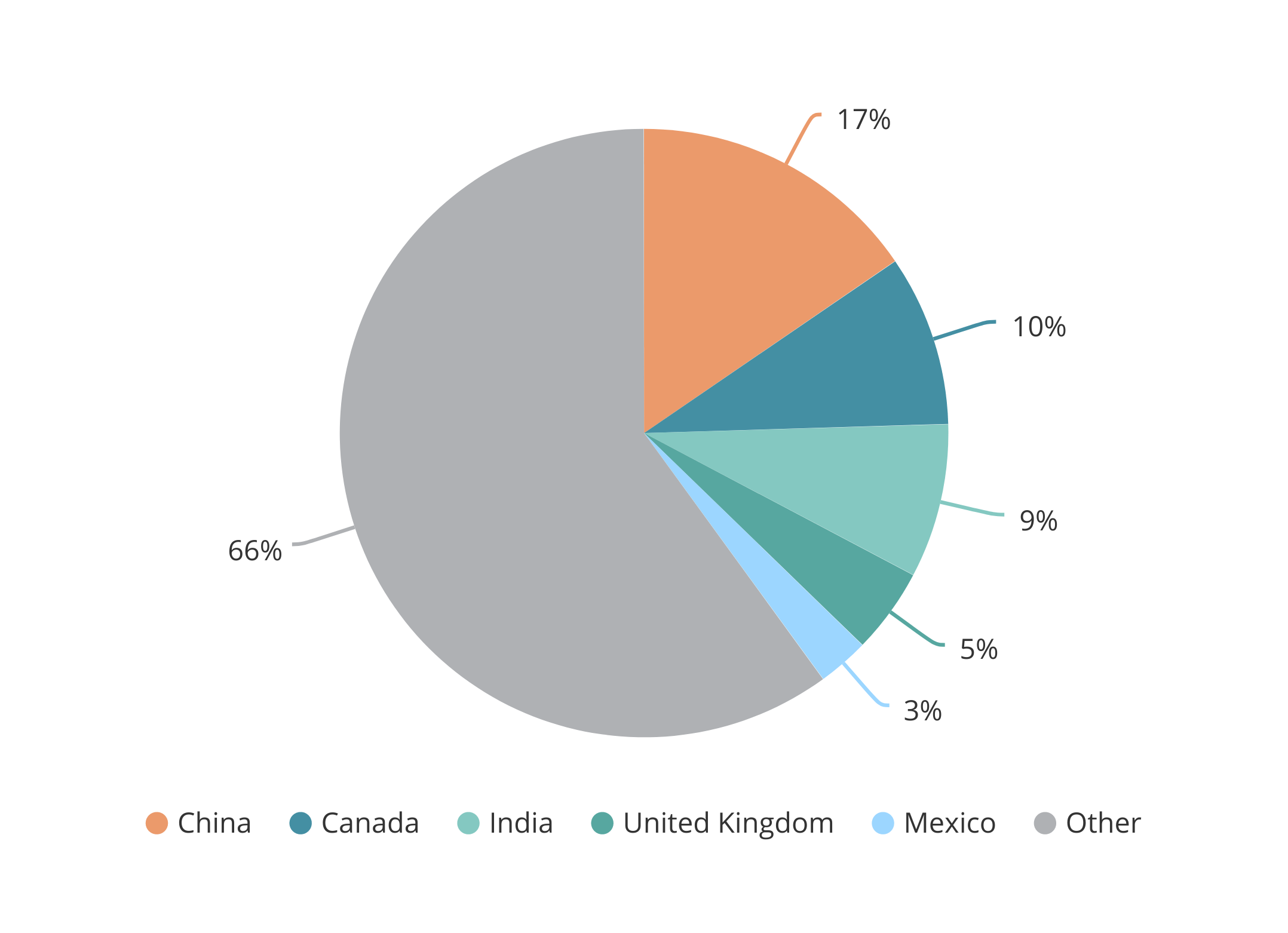

In 2013, China passed Canada to become the top source of foreign home purchases in the United States. The value of Chinese purchases nearly doubled between 2013 and 2014, a surge that attended increasing quality-of-life concerns in China and political uncertainty around Xi Jinping’s anti-corruption campaign.

Home-buying then stabilized at around $30 billion a year until 2019, when total spending and unit volume both fell by over 50%. Beijing’s tightening capital controls mean that wealthy Chinese find it harder to move large sums of money abroad, but it’s likely this sudden drop in purchases also reflects sharply deteriorating perceptions of how welcome Chinese are in America.

Dig Deeper:

Source: Copyright ©2019 “2019 Profile of International Activity in US Residential Real Estate.” National Association of Realtors. All rights reserved. Reprinted with permission. July 2019.