During Xi Jinping’s first five-year term through 2018, markets and observers were mainly preoccupied with the slowing Chinese economy and turbulent political currents. What has flown under the radar, however, is the quiet energy transition that has unfolded since Xi came into office.

Couple years ago, when I suggested the potential for China hitting “peak coal” in terms of demand, it wasn’t clear if the trend would last. Now, it appears to have held up, even if the pace of transition has been gradual.

Of course, the economic slowdown and the end of rapid industrialization have helped to facilitate China’s energy transition. But that isn’t all of it. The Xi administration’s insistence on pursuing an “anything but coal” strategy has led to enduring changes in China’s energy profile and demonstrable reductions in pollution. Coal’s proportion in overall energy consumption has fallen to its lowest level in more than 25 years.

Many are rightly skeptical of the current administration’s record on a number of fronts—especially market reforms and political tightening—which have fallen short of US expectations. But when it comes to energy, and by implication the environment, the Xi administration has made a difference.

Let’s look at what has happened to China’s energy markets in seven charts.

Figure 1. Coal Consumption Appears to Have Peaked in 2013Source: BP Statistical Review of World Energy 2019.

Comparing Xi’s first term with his predecessor Hu Jintao’s last term, growth in coal consumption has dropped notably. Although 2017 and 2018 saw a slight uptick, likely tied to the stimulus in 2016-2017, Beijing is unlikely to allow coal consumption to return to its previous heights. That’s because there is a de facto cap on coal consumption, as this is the only way to raise the proportion of non-fossil energy sources in overall consumption, one of the binding targets in China’s 13th Five-Year Plan.

The commodity’s decline can also be seen in China’s “coal country”—namely Shanxi, Inner Mongolia, and Shaanxi, which together constitute somewhere between 65% to 70% of total coal production, depending on the year (see Figure 2). For instance, Shanxi province saw its coal production down 14% between 2015 and 2016 before rebounding slightly but not returning to 2014 levels.

Figure 2. Coal Country Sees Less Output (in 10,000 tons)Sources: NBS; China5e.

Coal capacity cuts were part and parcel of Xi’s major “supply-side structural reform” plan launched in 2015. This move could’ve triggered social instability because of job losses associated with shuttering production, but Beijing spent some 100 billion yuan ($14.5 billion) over two years to help coal miners and steel workers transition into other industries.

What has gained at coal’s expense? Natural gas and renewables. Since 2009, China’s natural gas consumption has more than tripled, while renewables (hydro, nuclear, and wind) have grown exponentially from a very low base (see Figures 3 & 4). In fact, China now consumes more renewable energy than North America and is fast approaching Europe’s level (see Figure 5).

Figure 3. Bullish on Natural Gas Consumption in ChinaSource: BP Statistical Review of World Energy 2019.

Figure 4. Renewables and Natural Gas Gaining at Expense of CoalSource: NBS.

Figure 5. Renewables Consumption Rising in the Middle KingdomSource: BP Statistical Review of World Energy 2019.

As of 2018, China’s coal consumption as a proportion of its total energy mix—which includes more than just natural gas and renewables—has already dropped to about 60% from a peak of 76% in the early 1990s.

That is still a high level by developed country standards, but there is a major silver lining. A direct outcome of clamping down on coal and accelerating the country’s post-industrial transition has been a remarkable decrease in air pollution, a leading priority of the Xi administration (see Figure 6).

Figure 6. Breathing Easier as PM2.5 Levels See Significant Decrease Notes: WHO standard = 10μg/m3; China standard = 35μg/m3. This sample includes 50 of the most populous urban prefectures.

Source: Energy Policy Institute of Chicago.

Since the “airpocalypse” of 2013, the level of PM2.5—the most harmful micro particulate matter—across urban China has seen marked improvement. PM2.5 levels have become so familiar—something that everyone habitually checks on their smart phones, like the weather—that to the Chinese public, the PM2.5 target is arguably more important than the GDP target. According to an Energy Policy Institute of Chicago study, PM2.5 concentrations in the Beijing-Tianjin-Hebei region (one of the most polluted) fell by 36% in four years, exceeding the target in the National Air Pollution Action Plan.

The effort is by no means complete. Many Chinese cities are still far from their government’s own PM2.5 standard, not to mention the World Health Organization’s much stricter standard. But progress on this front is undeniable.

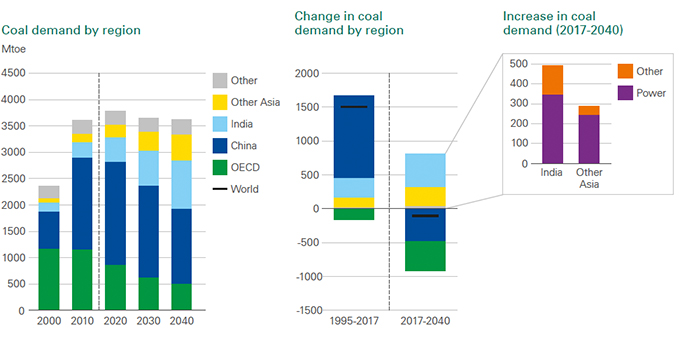

Figure 7. India Projected to Assume Coal Consumption Mantle

Source: BP Energy Outlook 2019.

Recognizing Beijing’s achievements on the energy and pollution front shouldn’t obscure new and greater challenges ahead, however. Just as China is exiting its coal-intensive phase, it appears that India will assume that mantle, as it enters a coal buildout phase (see Figure 7). The spotlight, the headlines, and the miasma of smog look to be increasingly shifting from Beijing to Delhi.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe