- January 4, 2023 Economy

Rethinking 2022: What’s Overlooked and Overhyped?

As the curtains close on 2022, the three-year pandemic continues to cast a long shadow. Yet with China moving rapidly from containment to coexistence, the last major economy to do so, 2023 may be considered the first year in which the world decided to live with Covid.

China entered the pandemic in 2020 with swift state mobilization that locked down major hubs, built makeshift clinics, and erected a sprawling testing, tracking, and quarantine operation that achieved one of the lowest case counts in the world.

The country’s exit from Zero-Covid, however, is a study in rapid state demobilization, including the dismantling of much of the Covid apparatus that has been in place for three years. It’s a process that has unfolded with the same speed as the initial mobilization.

That stark contrast is plain for all to see.

During such topsy-turvy years, it is easy to fixate on the daily noise. Just like in 2020, when much of the attention was devoted to putting the pandemic under control, 2022 ends with our collective focus on how Beijing has willfully abandoned control of the exit.

The focus on daily cycles and headlines can amplify their actual significance and obscure subtler forces and trends that may end up much more consequential. That’s why in 2020, we reflected more broadly on what we considered “Overlooked” and “Overhyped”—factors and trends that will materially affect political and economic outcomes going forward.

With 2023 knocking on the door, it seems only appropriate to revisit how those 2020 trends held up and offer our 2022 edition of Overlooked & Overhyped.

2020 Trends Revisited

Overlooked

1. Closing the Curtain on the GDP Obsession Era

2. Decoupling Is Everywhere Except in Reality

Two years since our first Overlooked & Overhyped, they appear to have aged well (full version here). If there’s still lingering doubt over Beijing’s abandonment of the growth target, the past year of Zero-Covid has put it to rest.

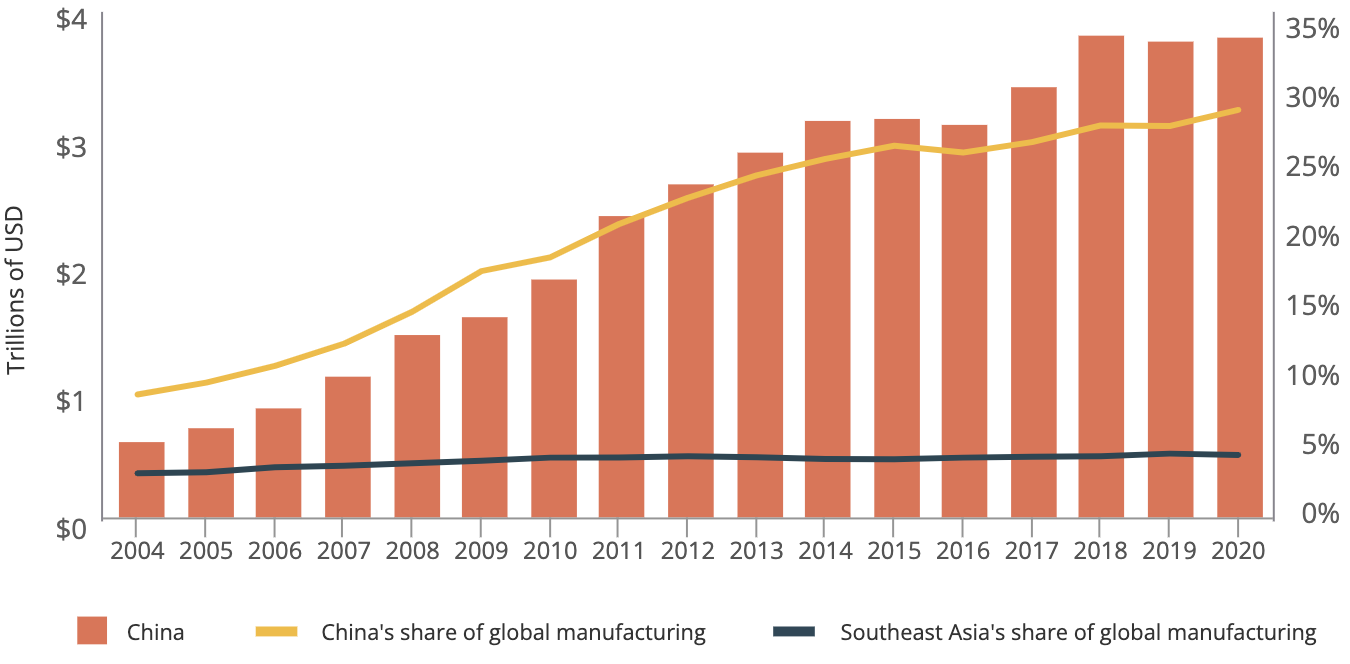

When it comes to decoupling, that vague term has gone through its share of permutations. But what hasn’t changed is the gap between expectation and reality when it comes to decoupling. While supply chain diversification is proceeding gradually, China’s strong position in global manufacturing has endured, if not strengthened, throughout the pandemic.

Even the ballyhooed anecdotes of firms fleeing to Southeast Asia contain a sizable wrinkle: a portion of those relocations are Chinese companies expanding into the market as a new export platform. In many ways, Vietnam has similar attributes to the Guangdong province of a decade ago

China’s Manufacturing Sector Held Up Through the Pandemic

Source: MacroPolo.

Overhyped

1. China Slams Door on The World

2. BRI Is Down but Not Out

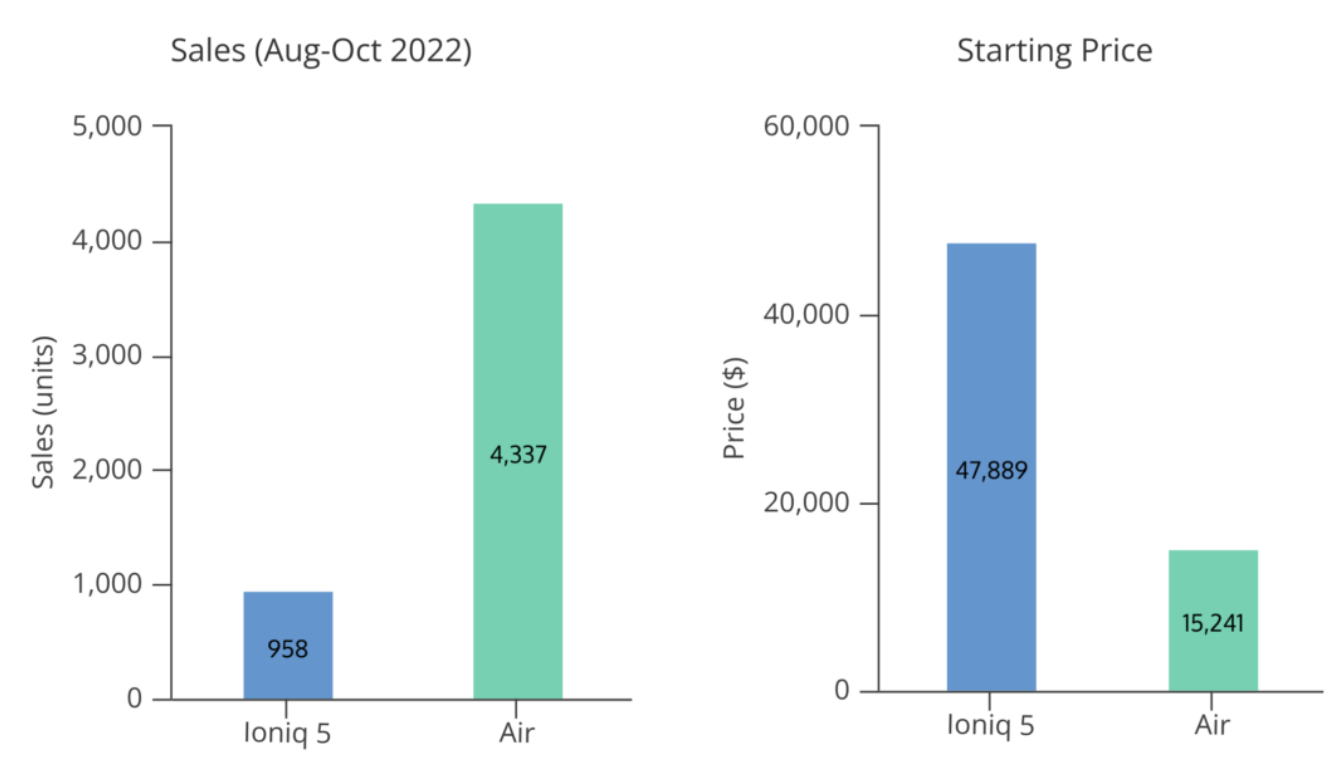

China’s borders might have been closed to people for several years, they were certainly not closed to the flow of goods. Not only has China significantly ramped up its trade with Southeast Asia to nearly $1 trillion, it is also outcompeting Japanese and Korean players in the crucial electric vehicles (EVs) market in the region. In terms of capital flows, the recent breakthrough in firm audits for listing in US markets also suggests that China’s financial outflows could pick up.

Chinese EV Brand Significantly Ahead of Korea’s Hyundai in Southeast Asia Source: MacroPolo.

Source: MacroPolo.

When it comes to the “Belt and Road” initiative, its epitaph was written prematurely. There is little doubt that BRI has become a shadow of its former self as Beijing curtails its ambition for this monumental project. But it Is unlikely to disappear completely from Beijing’s lexicon as it gets retooled as “BRI-lite” to focus on diplomatic efforts, targeted investments, and expanding export markets.

————-

Because these 2020 trends and factors are still material, the 2022 edition of Overlooked & Overhyped are both extensions and new manifestations of existing trends.

Overlooked

1. Policy Whiplash Now a Feature, Not a Bug

The political logic behind doing away with the GDP target is Xi Jinping’s marquee effort for the better part of the last decade: recentralizing China’s governance model. A decentralized governance model was, generally speaking, more optimized for growth, with the GDP target essentially serving as the organizing principle for the entire political economy. That “growth-first” prerogative required devolving investment and spending decisions to provinces to fiercely compete with each other.

The thorny problems created by that “growth-first” model are still present, but at least a singular target boiled national priorities into something concrete at all levels of government. Now that the target is gone and growth is “second,” it is no longer clear what’s first.

What is clear is that the center now decrees what is “first,” which has taken on the character of various campaigns, some short-lived, some persistent. But the center often does not clearly communicate what’s expected on the execution nor the timing.

This produces two somewhat opposing dynamics: the tendency to lurch from one vague goal to another and the rapid pivot away from such mobilization. In this new environment, policy whiplashes are likely to occur with some regularity. The risk isn’t so much that of an overcentralized system that can no longer course correct. Rather, the risk is the discombobulating overcorrections from staunchly holding the line to just giving up.

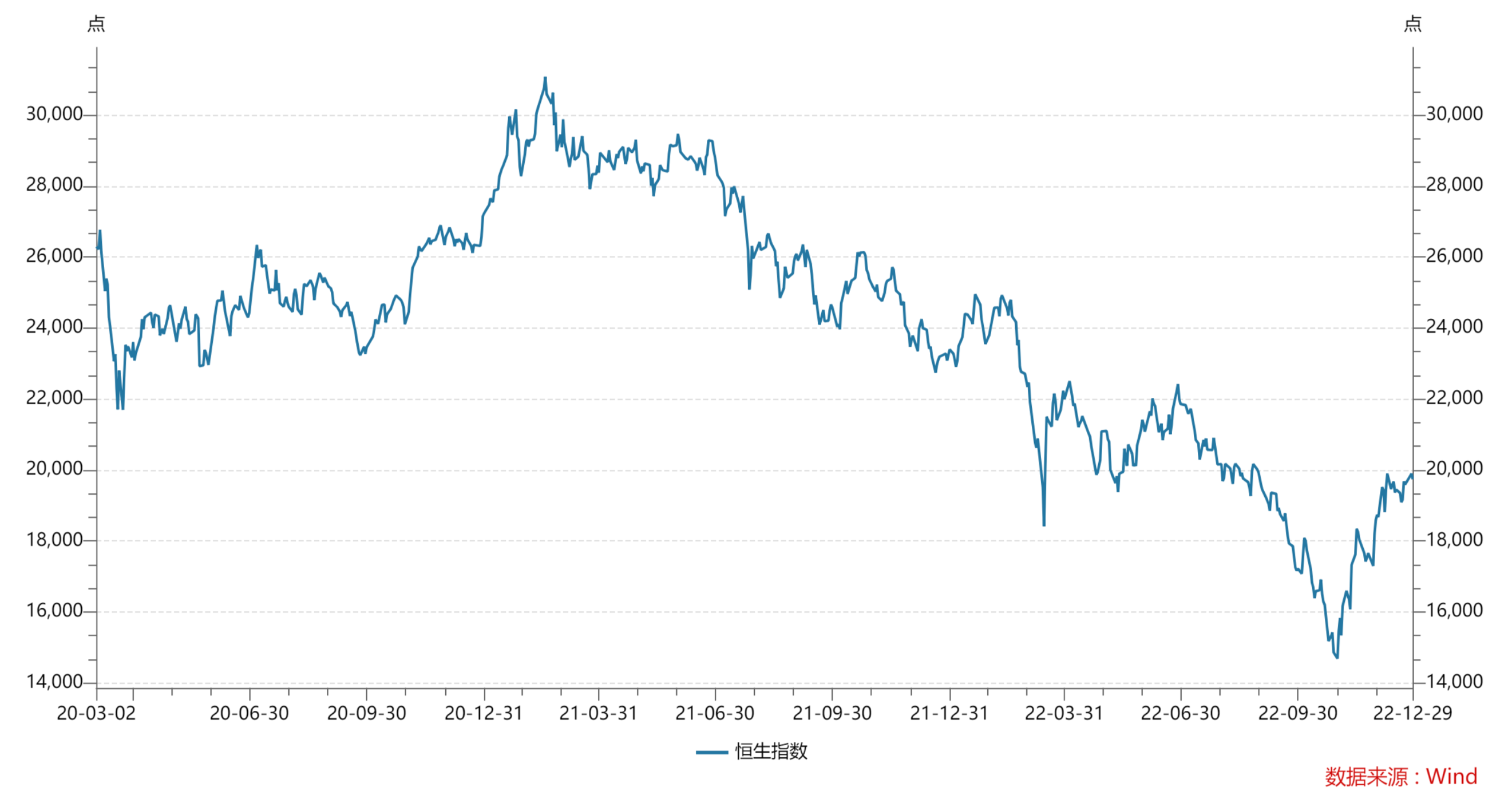

Zero-Covid is of course the most poignant example of this whiplash. So too was the tech crackdown of 2021 subject to this phenomenon. The mobilization behind that campaign blindsided many, though its intensity proved short-lived.

Hang Seng Index Responded Strongly to Tech Crackdown and Shanghai Lockdown Source: Wind.

Source: Wind.

As Xi’s governance model is still struggling to take full shape, this new feature will weigh on markets in the foreseeable future, especially given how policy-driven Chinese markets already are.

2. Industrial Policy Accelerates Regionalism

As three major pillars of the global economy—United States, China, and European Union—beef up industrial policy, it has chipped away at the current globalization edifice. One of the main foundations of this phase can be summed up as “make anything anywhere in the world that makes economic sense.”

But industrial policy by default is a form of economic nationalism that is at odds with the letter and spirit of global interdependence. Given that a chief aim of industrial policy is supply chain resilience, location matters again, particularly where things are made.

So long as all three major economies view their relationships through a more competitive rather than an interdependent lens, each will take actions to strengthen their competitive advantages in this new world.

For the United States, that advantage appears to be rallying allies to participate in its industrial policy efforts and reduce exposure to China. That is, Washington hopes enough allies combined can be an appropriate substitute for China across a host of supply chain needs. For China, its trump card is having built one of the most formidable and efficient manufacturing ecosystems in the world. It may be the only ecosystem capable of producing both “good enough” products for G77 economies and premium products for G7 markets. The European Union, meanwhile, appears to be perennially caught in the middle.

But industrial policy at home generates negative externalities abroad—namely in undermining multilateral efforts. Exhibit A is the surprisingly fierce battle over US EV subsidies in its climate bill. Rather than its intended aim of securing EV supply chains by tapping US allies like South Korea and Germany, this industrial policy bill instead riled allies and pushed them into more vigorous pursuit of their own industrial policies.

Overhyped

1. Zero-Covid Isn’t Dystopian Surveillance State

As late as mid-2022, commentary was rife that maintaining the Zero-Covid apparatus was just pretext for perpetuating the surveillance state through the ubiquitous health tracking app. These location-based apps were meant to track people having traveled to Covid risk areas but of course, any location-based app has numerous use cases, including surveillance or controlling people’s movements.

The financial and operational cost of maintaining such an app tracking system appeared to not have merited its continuation, particularly as the Chinese government has numerous other methods to monitor and surveil. In fact, the wholesale dismantling of the Zero-Covid apparatus, including health tracking, caught many off-guard.

The Chinese state’s control of information and data is a complex issue that will endure with or without Zero-Covid. But the tendency to view China as the testbed for realizing the “Minority Report” dystopian tech state can lead to a whole lot of pigeonholing every development into that framework. It seems more productive and useful to grapple with reality than perpetuate views based on confirmation bias.

2. Decoupling Is Finally Happening

Supply chains and trade have rarely enjoyed the kind of spotlight they have over the last couple of years. Every few weeks, a headline will capture the latest investment in chip fabs in the United States or Western companies’ intent to manufacture outside of China.

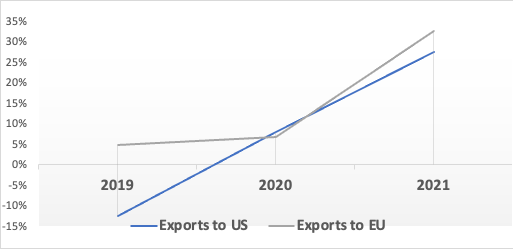

Yet looking at some of the numbers, they don’t seem to match the rhetoric. When it comes to trade, for example, China’s exports to US and EU markets increased significantly from 2019-2021 and is on course for another banner year in 2022. What could affect China’s trade is the potential global recession, not talk of decoupling.

Chinese Exports to US and EU Grew Healthily Source: Wind.

Source: Wind.

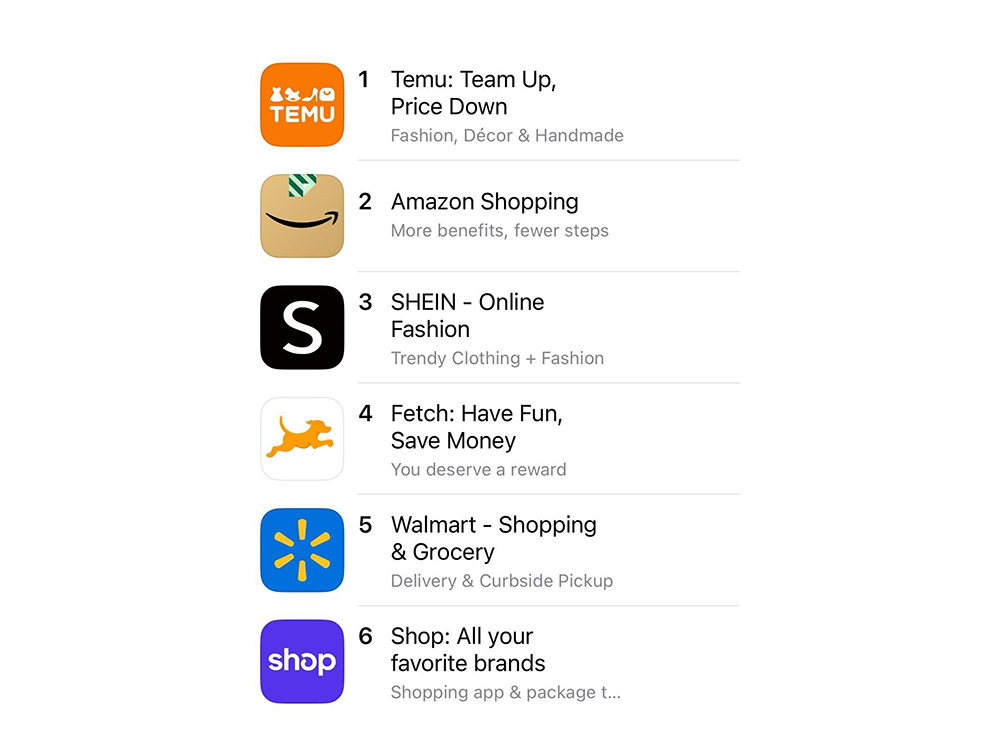

In fact, in an inflationary environment, Chinese goods remain attractive and apparently highly competitive in spite of rising labor costs. One example is that the top three downloaded apps in the App Store under “Shopping” include two Chinese e-commerce giants Temu (Pinduoduo) and Shein, the fast-fashion purveyor that is eating into the market share of Zara and H&M.

This advantage extends beyond just consumer retail, as Chinese EVs, mobile phones, solar panels, and batteries are also cheaper than their counterparts. In short, China is no longer simply just a “factory of the world,” but is increasingly becoming the “make everything country.”

That appears to be precisely Beijing’s strategy. The louder the calls for “decoupling” from Chinese manufactured goods, the harder Beijing will make it to “quit China,” further reinforcing the fact that the country isn’t about to slam its door on the world. Where China is particularly competitive is not at the cutting-edge, but rather in the everyday products that global consumers want and the mid-range tech products that supply chains need today. That is very tough to compete against without proper substitutes.

We will revisit these trends and factors at the end of 2023.

Damien Ma is the Managing Director of MacroPolo. You can find his work on energy, politics, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe