- May 30, 2023 Technology

Will the Virtual Reality Future Be Made in China?

For the last decade or so, much of consumer hardware innovation has centered on making a computer fit in your hand or pocket, and then on your wrist. But the thrill of that first revolutionary iPhone has long faded, leaving in its wake ennui and a saturated market.

Despite skepticism, serious players have decided that the next “killer” product is going to be a wearable computer on your face, or virtual reality (VR) headsets. It’s no secret that a company like Meta has bet the farm on a VR world, entailing a radical and risky overhaul of its core competence from a software to a hardware company. Meta’s shift into hardware, ironically, means that it will have to rely more on the China market for suppliers, something that Apple knows well as it aims to define the VR market with its own soon-to-launch premium device.

That’s because China, as the “make everything country,” currently stands alone as the manufacturer of high-end electronics at reasonable cost. Without Chinese suppliers in the mix, it might be impossible to make a VR product at a price point that consumers want to buy.

Making a Computer Fit on Your Face Is Hard and Expensive

The guts of a VR headset are similar to that of a smartphone because a computer is still a computer no matter which part of the body it sits on. But VR constitutes a higher order engineering challenge because of the balance between form factor and performance.

Ideally, the form factor would be a pair of sleek, lightweight eyeglasses that’s easy to take off and put on. But how does one fit the slew of high-end components—from chips and advanced displays to the battery—into a non-clunky pair of glasses you would actually want to wear? Not to mention a VR headset requires more advanced and layered displays and numerous sensors to track eye movement and surroundings because it is ultimately a visual product.

That difficult balancing act raises the unit cost of a VR headset, especially in the premium segment where Meta’s Quest Pro began retailing for $1,500 in late October 2022. At that price point, demand is already sluggish, evidenced by the fact that the Quest Pro only sold an estimated 25,000 units in its first few months, prompting Meta to drop the price to just $999 in March of this year.

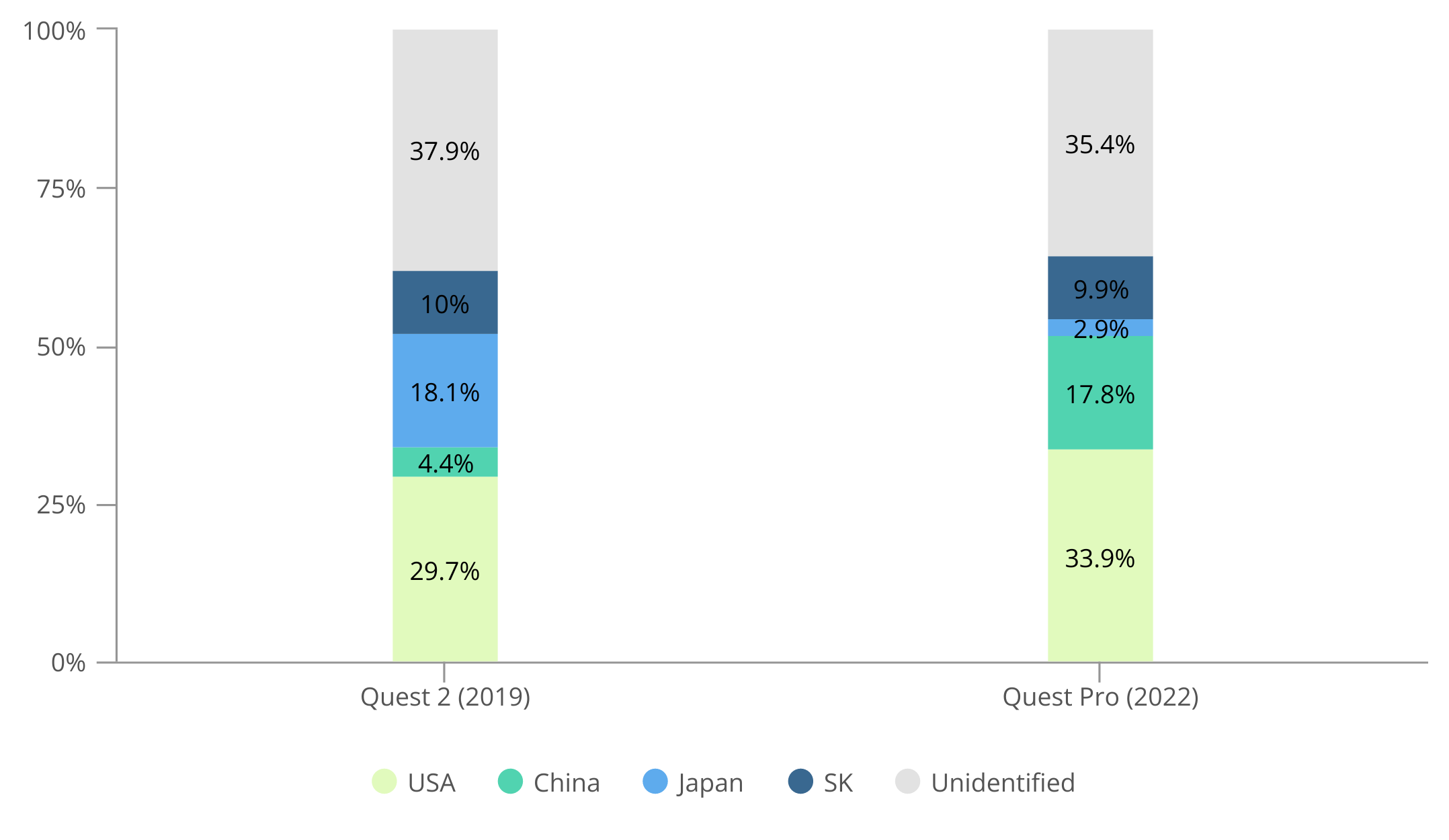

But to get to that price point, Meta significantly increased sourcing components from Chinese suppliers, at the expense of Japanese suppliers (see Figure 1). In fact, the share of Chinese components quadrupled between the launch of the Quest 2 and the Quest Pro headset. For example, China’s BOE dominates advanced displays, which are the second-most costly component of the Quest Pro after the system on a chip (SoC) set. Final assembly, just like smartphones, will still be concentrated in China by familiar original equipment manufacturers like Foxconn, Luxshare, and Goertek.

Figure 1. Meta’s Quest Pro Has Significantly More Chinese Components Source: Nikkei Asia Review; Fomalhaut Techno Solutions.

Source: Nikkei Asia Review; Fomalhaut Techno Solutions.

So when it comes to rolling out cost-competitive VR products without compromising on quality, the reality is that China has a decisive edge. But that doesn’t mean China has dominance across the board, as South Korea and the United States remain major suppliers. The former is pivotal when it comes to memory chips, whose SK Hynix chips Meta uses in its Quest 2, while US firm Qualcomm currently dominates SoC processors.

Even when it comes to advanced displays, China’s strong position isn’t guaranteed. Industry standards may shift from the Fast LCD displays that BOE makes to Micro OLED displays that a company like Apple seems to champion. If Apple goes with Micro OLEDs, that could benefit South Korean suppliers such as LG and Samsung and Japan’s Sony and JDI.

Competitive Dynamics

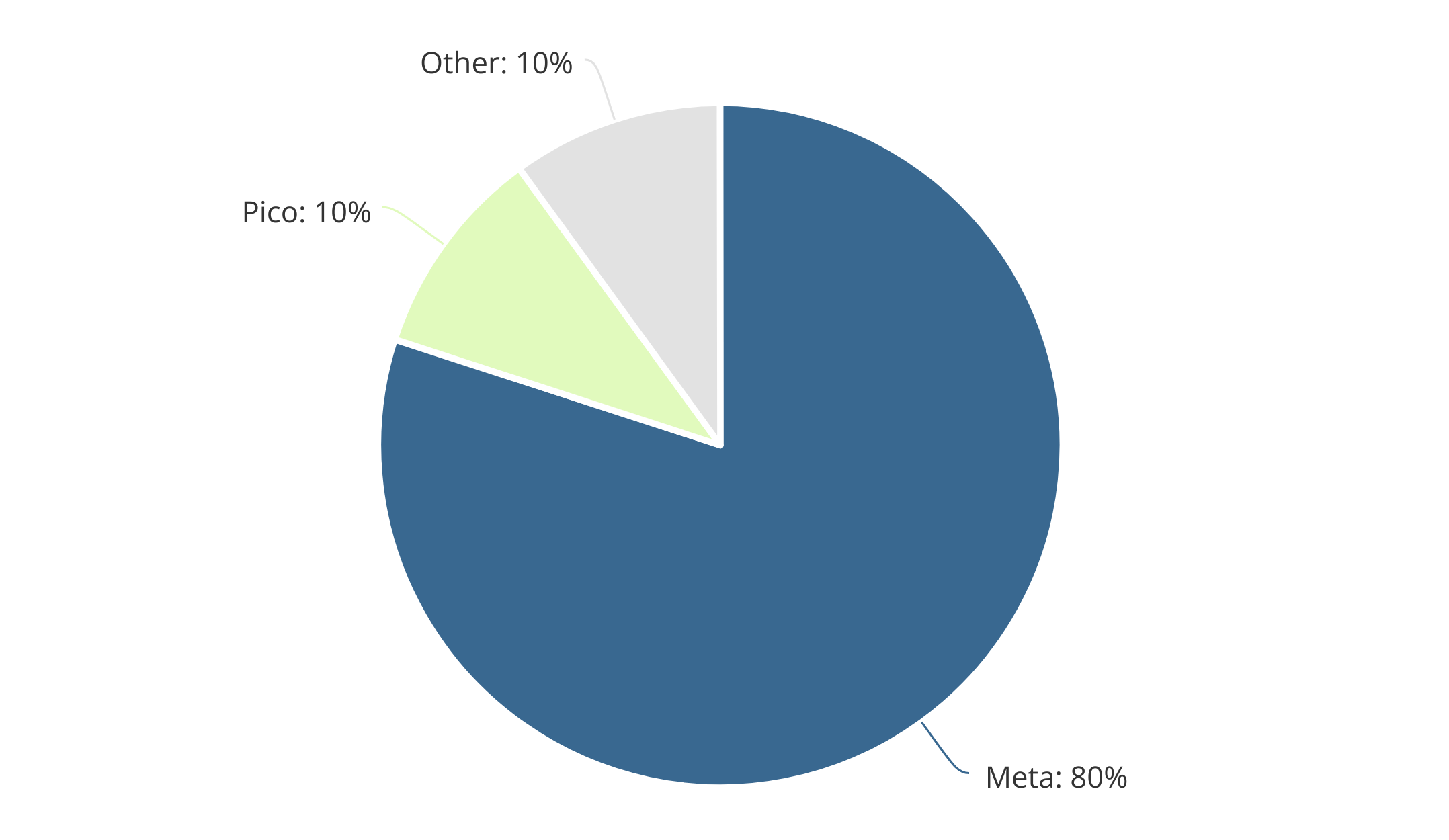

Meta and Apple of course aren’t the only big tech companies investing in VR. China’s Bytedance entered the market in 2022 with the acquisition of VR headset maker Pico for $1.3 billion. But its lower end Pico 4 headset, retailing for just $450, was met with disappointing sales, prompting the Chinese company to slash its sales guidance for 2023 by 50% to just 500,000 units. For the time being, it is Meta’s race to lose as it has already sold nearly 20 million units (see Figure 2).

Figure 2. Meta Dominates Nascent VR Market For Now

Note: Data is for shipments in 2022.

Source: IDC.

That competition is about to rachet up as Apple’s VR market entry is just around the corner, though little is confirmed about what the company will unveil. But if history is any guide, Apple has a knack for being fashionably late to the party only to wow the market with a superior, refined, and trend-setting product—and this one is rumored to come with an eye-popping $3,000 price tag.

Indeed, Apple is a company of such scale that it can set the industry’s direction in components and suppliers. In future analysis, we’ll delve deeper into the VR market’s competitive and collaborative dynamics, evolving technologies and supply chains, political risks, and the companies integral to what many are betting on as the next defining product.

AJ Cortese is a senior research associate at MacroPolo. You can find his work on industrial technology, semiconductors, the digital economy, and other topics here.

Stay Updated with MacroPolo

Get on our mailing list to keep up with our analysis and new products.

Subscribe